Values

Values

Values

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

114<br />

Group Financial Statements<br />

Notes<br />

In accordance with IAS 39, available-for-sale investments and<br />

securities are measured at fair value or, if the fair value cannot<br />

be determined, at amortized cost or at amounts based on estimated<br />

discounted cash fl ows. Impairment losses on availablefor-sale<br />

investments come to €-16 million in the year under<br />

review.<br />

Securities initially recognized at fair value through profi t<br />

or loss are carried at fair value in accordance with IAS 39. Th e<br />

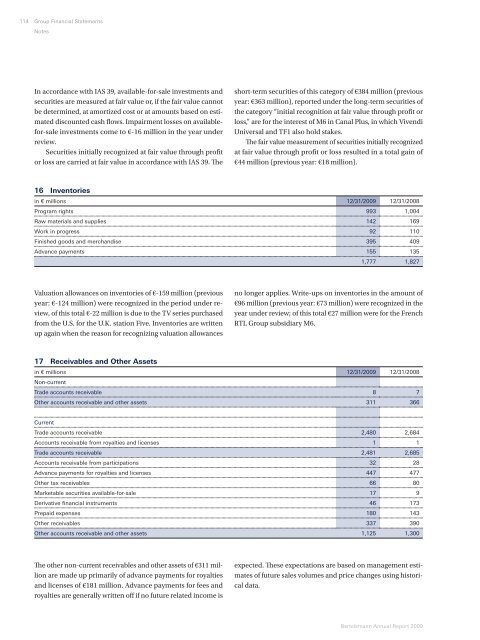

16 Inventories<br />

in € millions 12/31/2009 12/31/2008<br />

Program rights 993 1,004<br />

Raw materials and supplies 142 169<br />

Work in progress 92 110<br />

Finished goods and merchandise 395 409<br />

Advance payments 155 135<br />

1,777 1,827<br />

Valuation allowances on inventories of €-159 million (previous<br />

year: €-124 million) were recognized in the period under review,<br />

of this total €-22 million is due to the TV series purchased<br />

from the U.S. for the U.K. station Five. Inventories are written<br />

up again when the reason for recognizing valuation allowances<br />

17 Receivables and Other Assets<br />

Th e other non-current receivables and other assets of €311 million<br />

are made up primarily of advance payments for royalties<br />

and licenses of €181 million. Advance payments for fees and<br />

royalties are generally written off if no future related income is<br />

short-term securities of this category of €384 million (previous<br />

year: €363 million), reported under the long-term securities of<br />

the category “initial recognition at fair value through profi t or<br />

loss,” are for the interest of M6 in Canal Plus, in which Vivendi<br />

Universal and TF1 also hold stakes.<br />

Th e fair value measurement of securities initially recognized<br />

at fair value through profi t or loss resulted in a total gain of<br />

€44 million (previous year: €18 million).<br />

no longer applies. Write-ups on inventories in the amount of<br />

€96 million (previous year: €73 million) were recognized in the<br />

year under review; of this total €27 million were for the French<br />

RTL Group subsidiary M6.<br />

in € millions 12/31/2009 12/31/2008<br />

Non-current<br />

Trade accounts receivable 8 7<br />

Other accounts receivable and other assets 311 366<br />

Current<br />

Trade accounts receivable 2,480 2,684<br />

Accounts receivable from royalties and licenses 1 1<br />

Trade accounts receivable 2,481 2,685<br />

Accounts receivable from participations 32 28<br />

Advance payments for royalties and licenses 447 477<br />

Other tax receivables 66 80<br />

Marketable securities available-for-sale 17 9<br />

Derivative fi nancial instruments 46 173<br />

Prepaid expenses 180 143<br />

Other receivables 337 390<br />

Other accounts receivable and other assets 1,125 1,300<br />

expected. Th ese expectations are based on management estimates<br />

of future sales volumes and price changes using historical<br />

data.<br />

Bertelsmann Annual Report 2009