Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management | Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

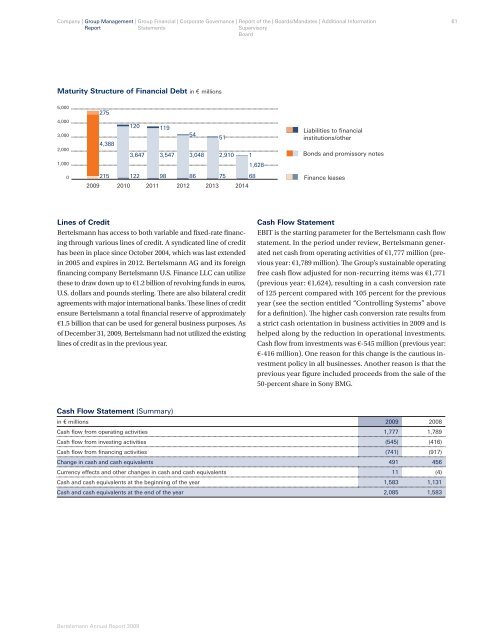

Maturity Structure of Financial Debt in € millions<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

2009<br />

275<br />

4,388<br />

215<br />

120<br />

3,647<br />

122<br />

2010 2011<br />

Lines of Credit<br />

Bertelsmann has access to both variable and fi xed-rate fi nancing<br />

through various lines of credit. A syndicated line of credit<br />

has been in place since October 2004, which was last extended<br />

in 2005 and expires in 2012. Bertelsmann AG and its foreign<br />

fi nancing company Bertelsmann U.S. Finance LLC can utilize<br />

these to draw down up to €1.2 billion of revolving funds in euros,<br />

U.S. dollars and pounds sterling. Th ere are also bilateral credit<br />

agreements with major international banks. Th ese lines of credit<br />

ensure Bertelsmann a total fi nancial reserve of approximately<br />

€1.5 billion that can be used for general business purposes. As<br />

of December 31, 2009, Bertelsmann had not utilized the existing<br />

lines of credit as in the previous year.<br />

Bertelsmann Annual Report 2009<br />

119<br />

3,547<br />

98<br />

54<br />

3,048<br />

86<br />

51<br />

2,910<br />

75<br />

2012 2013 2014<br />

1<br />

1,628<br />

68<br />

Liabilities to financial<br />

institutions/other<br />

Bonds and promissory notes<br />

Finance leases<br />

Cash Flow Statement<br />

EBIT is the starting parameter for the Bertelsmann cash fl ow<br />

statement. In the period under review, Bertelsmann generated<br />

net cash from operating activities of €1,777 million (previous<br />

year: €1,789 million). Th e Group’s sustainable operating<br />

free cash fl ow adjusted for non-recurring items was €1,771<br />

(previous year: €1,624), resulting in a cash conversion rate<br />

of 125 percent compared with 105 percent for the previous<br />

year (see the section entitled “Controlling Systems” above<br />

for a defi nition). Th e higher cash conversion rate results from<br />

a strict cash orientation in business activities in 2009 and is<br />

helped along by the reduction in operational investments.<br />

Cash fl ow from investments was €-545 million (previous year:<br />

€-416 million). One reason for this change is the cautious investment<br />

policy in all businesses. Another reason is that the<br />

previous year fi gure included proceeds from the sale of the<br />

50-percent share in Sony BMG.<br />

Cash Flow Statement (Summary)<br />

in € millions 2009 2008<br />

Cash fl ow from operating activities 1,777 1,789<br />

Cash fl ow from investing activities (545) (416)<br />

Cash fl ow from fi nancing activities (741) (917)<br />

Change in cash and cash equivalents 491 456<br />

Currency effects and other changes in cash and cash equivalents 11 (4)<br />

Cash and cash equivalents at the beginning of the year 1,583 1,131<br />

Cash and cash equivalents at the end of the year 2,085 1,583<br />

61