Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company | Group Management Group Financial | Corporate Governance | Report of the | Boards/Mandates | Additional Information<br />

Report Statements Supervisory<br />

Board<br />

Income Statement<br />

Statement of Comprehensive Income<br />

Balance Sheet<br />

Cash Flow Statement<br />

Statement of Changes in Equity<br />

Notes<br />

Th e Bertelsmann Group operates various pension plans for<br />

current and former employees and their surviving dependents.<br />

Th e model of such plans varies according to the legal, fi scal<br />

and economic environment of the country concerned. Th ese<br />

company pension plans include both defi ned contribution and<br />

defi ned benefi t plans.<br />

In the case of defi ned contribution plans, the company<br />

makes payments into an external pension fund or another welfare<br />

fund through a statutory, contractual or voluntary model.<br />

Th e company has no obligation to provide further benefi ts once<br />

it has made these payments, so no provisions are recognized.<br />

Expenses for defi ned contribution plans in the amount of<br />

€23 million were recognized in the year under review (previous<br />

year: €33 million).<br />

All other pension plans are defi ned benefi t plans. Some are<br />

fi nanced through an external investment fund (plan assets),<br />

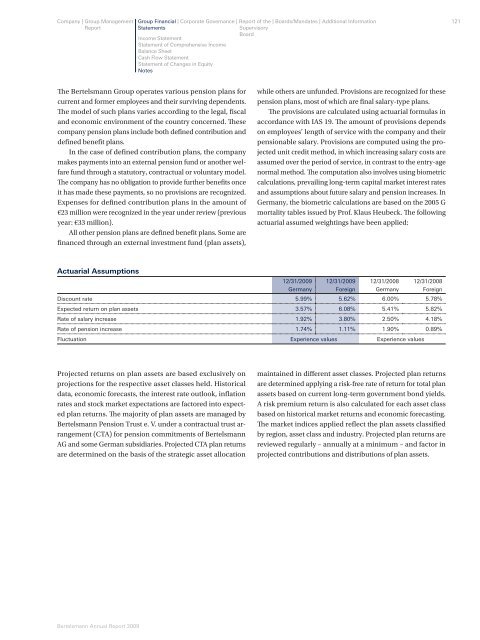

Actuarial Assumptions<br />

Bertelsmann Annual Report 2009<br />

while others are unfunded. Provisions are recognized for these<br />

pension plans, most of which are fi nal salary-type plans.<br />

Th e provisions are calculated using actuarial formulas in<br />

accordance with IAS 19. Th e amount of provisions depends<br />

on employees’ length of service with the company and their<br />

pensionable salary. Provisions are computed using the projected<br />

unit credit method, in which increasing salary costs are<br />

assumed over the period of service, in contrast to the entry-age<br />

normal method. Th e computation also involves using biometric<br />

calculations, prevailing long-term capital market interest rates<br />

and assumptions about future salary and pension increases. In<br />

Germany, the biometric calculations are based on the 2005 G<br />

mortality tables issued by Prof. Klaus Heubeck. Th e following<br />

actuarial assumed weightings have been applied:<br />

12/31/2009<br />

Germany<br />

12/31/2009<br />

Foreign<br />

12/31/2008<br />

Germany<br />

12/31/2008<br />

Foreign<br />

Discount rate 5.99% 5.62% 6.00% 5.78%<br />

Expected return on plan assets 3.57% 6.08% 5.41% 5.82%<br />

Rate of salary increase 1.92% 3.80% 2.50% 4.18%<br />

Rate of pension increase 1.74% 1.11% 1.90% 0.89%<br />

Fluctuation Experience values Experience values<br />

Projected returns on plan assets are based exclusively on<br />

projections for the respective asset classes held. Historical<br />

data, economic forecasts, the interest rate outlook, infl ation<br />

rates and stock market expectations are factored into expected<br />

plan returns. Th e majority of plan assets are managed by<br />

Bertelsmann Pension Trust e. V. under a contractual trust arrangement<br />

(CTA) for pension commitments of Bertelsmann<br />

AG and some German subsidiaries. Projected CTA plan returns<br />

are determined on the basis of the strategic asset allocation<br />

maintained in diff erent asset classes. Projected plan returns<br />

are determined applying a risk-free rate of return for total plan<br />

assets based on current long-term government bond yields.<br />

A risk premium return is also calculated for each asset class<br />

based on historical market returns and economic forecasting.<br />

Th e market indices applied refl ect the plan assets classifi ed<br />

by region, asset class and industry. Projected plan returns are<br />

reviewed regularly – annually at a minimum – and factor in<br />

projected contributions and distributions of plan assets.<br />

121