- Page 2 and 3:

PINELLASSUNCOASTTRANSITAUTHORITYTra

- Page 6 and 7:

Map 3-9 Dwelling Unit Density by TA

- Page 8 and 9:

SECTION 1INTRODUCTIONThe Ten-Year T

- Page 10 and 11:

ORGANIZATION OF REPORTIn addition t

- Page 12 and 13:

Improve the project delivery proces

- Page 14 and 15:

Goal: Enrich quality of life and re

- Page 16 and 17:

High-Speed Rail (HSR)In April 2009,

- Page 18 and 19:

ooooPolicy 1.4.8: The MPO shall con

- Page 20 and 21:

According to the Transportation Ele

- Page 23 and 24:

were appointed to the PAC by the PS

- Page 25:

SECTION 3STUDY AREA CONDITIONS AND

- Page 29 and 30:

ANCLOTE RDUS 19ABELCHER RDPASS A GR

- Page 31 and 32:

Auto OwnershipBased on the 2000 Cen

- Page 33 and 34:

Table 3-4Major Private and Public E

- Page 35 and 36:

ANCLOTE RDUS 19ABELCHER RDPASS A GR

- Page 37 and 38:

Transportation Disadvantaged Popula

- Page 39 and 40:

ANCLOTE RDUS 19ABELCHER RDPASS A GR

- Page 41 and 42:

EAST LAKE DRBELCHER RDUS 19ACR 39SR

- Page 43 and 44:

Major Trip GeneratorsThe major trip

- Page 45 and 46:

Developments of Regional ImpactDeve

- Page 47 and 48:

DRI # Project Name Local Govt.15715

- Page 49 and 50:

COMMUTING PATTERNSThe 2000 Census p

- Page 51 and 52:

Figure 3-6 Figure 3-7% Roadways Abo

- Page 53 and 54:

PopulationPinellas County populatio

- Page 55 and 56:

SECTION 4EXISTING PSTA SERVICE LEVE

- Page 57 and 58:

BELCHER RDUS 19ACR 39SR 58062ND ST

- Page 59 and 60:

PSTA FacilitiesIn 2005, PSTA moved

- Page 61 and 62:

Table 4-3PSTA Bus Fleet InventoryMa

- Page 63 and 64:

Table 4-4 (continued)Inventory of T

- Page 65 and 66:

OPERATING STATISTICSThe current ope

- Page 67 and 68:

Tables 4-8 and 4-9 include the PSTA

- Page 69 and 70:

Table 4-8 (Cont’d)Ridership Analy

- Page 71 and 72:

Table 4-9 (Cont’d)Ridership Analy

- Page 73 and 74:

Table 4-10 (Cont’d)Service Profil

- Page 75 and 76:

Demand-Response Transportation Oper

- Page 77 and 78:

Table 4-13PSTA Cost per Passenger T

- Page 79 and 80:

PERFORMANCE EVALUATION AND TRENDSA

- Page 81 and 82:

The following is a summary of the t

- Page 83 and 84:

Cost Efficiency - This is indicated

- Page 85 and 86:

Transit SystemJacksonvilleTransport

- Page 87 and 88:

Table 4-21Peer Review Analysis (Eff

- Page 89 and 90:

Figure 4-15 Figure 4-16Operating Ex

- Page 91 and 92:

SECTION 5MARKET RESEARCH AND PUBLIC

- Page 93 and 94:

10. Travel Training/Travel Aids Pro

- Page 95 and 96:

improvements, and PSTA Board meetin

- Page 97 and 98:

on-board survey research in conjunc

- Page 99 and 100:

Pasco CountyEAST LAKE RDGulfofMexic

- Page 101 and 102:

Figure 5-1Reason for Using Medicaid

- Page 103 and 104: Figure 5-3How would you travel if y

- Page 105 and 106: Figure 5-6PSTA Service Satisfaction

- Page 107 and 108: Questions 9 through 13 asked respon

- Page 109 and 110: COMMITTEES AND WORKSHOPSA number of

- Page 111 and 112: think about the issue at hand. Peop

- Page 113 and 114: Figure 5-10Sample Index Card Illust

- Page 115 and 116: Analysis of TAC PrioritiesPriority

- Page 117 and 118: PSTA works closely with the TAC on

- Page 119 and 120: SECTION 6SITUATION APPRAISAL AND NE

- Page 121 and 122: Regional Maintenance Training Facil

- Page 123 and 124: Other areas considered as viable lo

- Page 125 and 126: Transit Security GrantsPSTA has bee

- Page 127 and 128: Regional Transportation IssuesOn Ma

- Page 129 and 130: Land UseAlthough much of the curren

- Page 131 and 132: Implications - PSTA should prioriti

- Page 133 and 134: Transit Network - The transit route

- Page 135 and 136: increase 5.33 percent (from 44,413

- Page 137 and 138: EAST LAKE DRBELCHER RDUS 19ACR 39SR

- Page 139 and 140: Table 7-1Revenue-Constrained Plan -

- Page 141 and 142: Figure 7-1Revenue-Constrained Plan

- Page 143 and 144: Table 7-3Vision Plan - Operating Bu

- Page 145 and 146: Table 7-4Vision Plan - Capital Budg

- Page 147 and 148: Figure 7-6Vision Plan - Combined Op

- Page 149 and 150: C.R. 77 (ROWAN)N.SUNCOASTTROUBLE CR

- Page 151 and 152: C.R. 77 (ROWAN)N.SUNCOASTTROUBLE CR

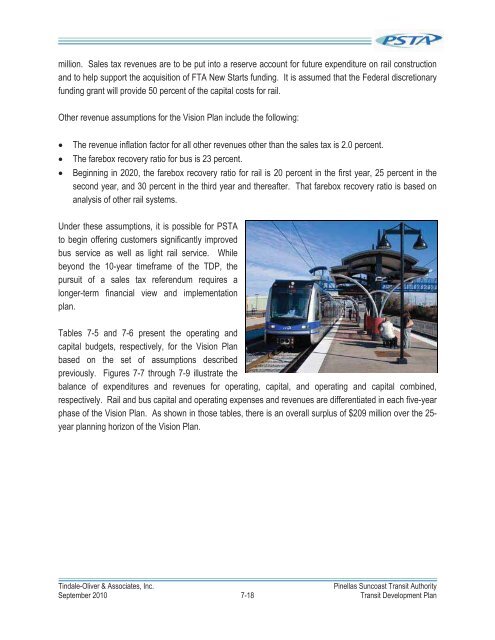

- Page 153: Fixed-Guideway Transit (Rail)As ind

- Page 157 and 158: Table 7-625-Year Vision Plan - Capi

- Page 159 and 160: Millions$2,500$2,000Figure 7-925-Ye

- Page 161 and 162: PSTA REVENUE FLEET INVENTORYPSTA BU

- Page 163 and 164: PSTA SUPERVISOR AND SERVICE VEHICLE

- Page 165 and 166: 12 YEAR SUPPORT VEHICLE REPLACEMENT

- Page 167 and 168: SECTION 5307 FORMULA FUNDSFY 2010 P

- Page 169 and 170: ADOPTED FY 2009 AMERICAN RECOVERY A

- Page 171 and 172: THREE-YEAR OPERATING BUDGET PROJECT

- Page 173 and 174: APPENDIX EFAREBOX RECOVERY REPORTTi

- Page 175 and 176: EFFECTIVE FARE CHANGESThe following

- Page 177 and 178: ApprovedFareModificationstobeeffect

- Page 179 and 180: Route58Route59Route74Route75Route79

- Page 181 and 182: HISTORY OF PSTASPECIAL LEGISLATIVE

- Page 183 and 184: APPENDIX HVision Plan Selected Capi

- Page 185 and 186: Table H-4Light Rail Station Costs*L

- Page 187 and 188: Third Penny for Pinellas, Local Inf