COMMISSION

4FcEkUnlA

4FcEkUnlA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fuel Taxes<br />

Fuel taxes represent approximately 65 percent of annual income to the OHV Trust Fund.<br />

Fuel tax transfers were once calculated based on statewide studies that estimated the<br />

total gallons of gasoline burned in the course of OHV recreation. Legislation passed in<br />

2007 (SB 742) established that future transfers would be based on the percentage of fuel<br />

taxes transferred in 2007. In 2011, legislation was passed that reduced these transfers by<br />

$10 million annually. (Revenue and Taxation Code § 8352.6)<br />

The amount of fuel tax transferred to the OHV Trust Fund is directly proportionate to the<br />

amount of fuel purchased in California; the more gasoline that is purchased by Californians,<br />

the more gas tax revenue that is transferred to the OHV Trust Fund. According to the<br />

California Board of Equalization over the last few years, the amount of gasoline sold has<br />

steadily increased suggesting the amount of gasoline purchased in California is dependent<br />

on the price of gasoline and larger economic factors.<br />

Fiscal Year Gallons of Gasoline Sold<br />

2012/2013 14,475,836,000<br />

2013/2014 14,599,336,000<br />

2014/2015 14,921,441,859<br />

OHV Registration Fees<br />

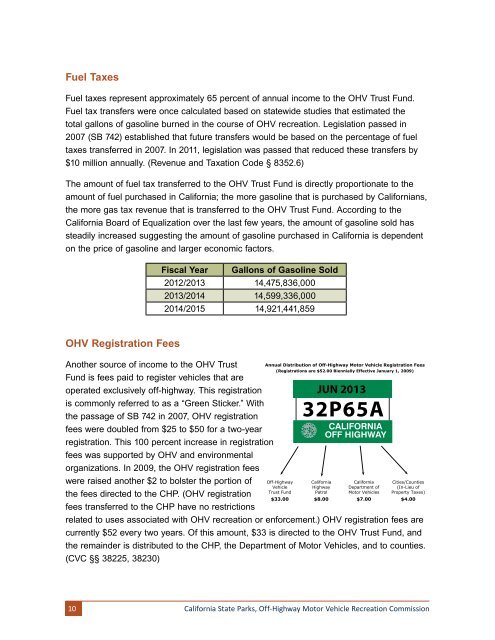

Another source of income to the OHV Trust<br />

Fund is fees paid to register vehicles that are<br />

operated exclusively off-highway. This registration<br />

is commonly referred to as a “Green Sticker.” With<br />

the passage of SB 742 in 2007, OHV registration<br />

fees were doubled from $25 to $50 for a two-year<br />

registration. This 100 percent increase in registration<br />

fees was supported by OHV and environmental<br />

organizations. In 2009, the OHV registration fees<br />

were raised another $2 to bolster the portion of<br />

the fees directed to the CHP. (OHV registration<br />

fees transferred to the CHP have no restrictions<br />

related to uses associated with OHV recreation or enforcement.) OHV registration fees are<br />

currently $52 every two years. Of this amount, $33 is directed to the OHV Trust Fund, and<br />

the remainder is distributed to the CHP, the Department of Motor Vehicles, and to counties.<br />

(CVC §§ 38225, 38230)<br />

Annual Distribution of Off-Highway Motor Vehicle Registration Fees<br />

(Registrations are $52.00 Biennially Effective January 1, 2009)<br />

Off-Highway<br />

Vehicle<br />

Trust Fund<br />

$33.00<br />

JUN 2013<br />

32P65A<br />

California<br />

Highway<br />

Patrol<br />

$8.00<br />

California<br />

Department of<br />

Motor Vehicles<br />

$7.00<br />

Cities/Counties<br />

(In-Lieu of<br />

Property Taxes)<br />

$4.00<br />

10<br />

California State Parks, Off-Highway Motor Vehicle Recreation Commission