Values

Values

Values

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62<br />

Group Management Report<br />

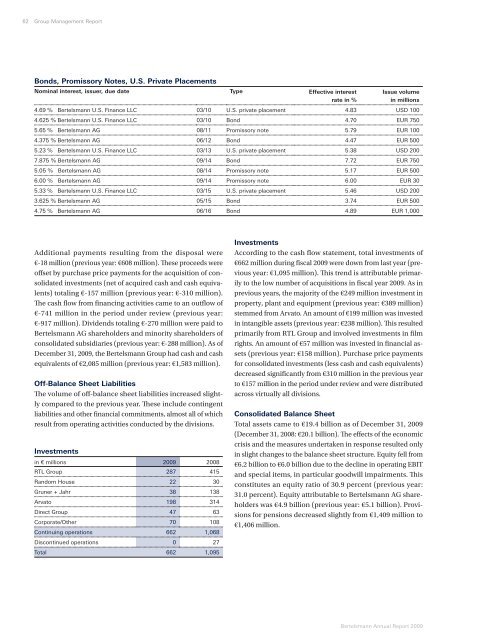

Bonds, Promissory Notes, U.S. Private Placements<br />

Nominal interest, issuer, due date Type Effective interest Issue volume<br />

rate in %<br />

in millions<br />

4.69 % Bertelsmann U.S. Finance LLC 03/10 U.S. private placement 4.83 USD 100<br />

4.625 % Bertelsmann U.S. Finance LLC 03/10 Bond 4.70 EUR 750<br />

5.65 % Bertelsmann AG 08/11 Promissory note 5.79 EUR 100<br />

4.375 % Bertelsmann AG 06/12 Bond 4.47 EUR 500<br />

5.23 % Bertelsmann U.S. Finance LLC 03/13 U.S. private placement 5.38 USD 200<br />

7.875 % Bertelsmann AG 09/14 Bond 7.72 EUR 750<br />

5.05 % Bertelsmann AG 08/14 Promissory note 5.17 EUR 500<br />

6.00 % Bertelsmann AG 09/14 Promissory note 6.00 EUR 30<br />

5.33 % Bertelsmann U.S. Finance LLC 03/15 U.S. private placement 5.46 USD 200<br />

3.625 % Bertelsmann AG 05/15 Bond 3.74 EUR 500<br />

4.75 % Bertelsmann AG 06/16 Bond 4.89 EUR 1,000<br />

Additional payments resulting from the disposal were<br />

€-18 million (previous year: €608 million). Th ese proceeds were<br />

off set by purchase price payments for the acquisition of consolidated<br />

investments (net of acquired cash and cash equivalents)<br />

totaling €-157 million (previous year: €-310 million).<br />

Th e cash fl ow from fi nancing activities came to an outfl ow of<br />

€-741 million in the period under review (previous year:<br />

€-917 million). Dividends totaling €-270 million were paid to<br />

Bertelsmann AG shareholders and minority shareholders of<br />

consolidated subsidiaries (previous year: €-288 million). As of<br />

December 31, 2009, the Bertelsmann Group had cash and cash<br />

equivalents of €2,085 million (previous year: €1,583 million).<br />

Off-Balance Sheet Liabilities<br />

Th e volume of off -balance sheet liabilities increased slightly<br />

compared to the previous year. Th ese include contingent<br />

liabilities and other fi nancial commitments, almost all of which<br />

result from operating activities conducted by the divisions.<br />

Investments<br />

in € millions 2009 2008<br />

RTL Group 287 415<br />

Random House 22 30<br />

Gruner + Jahr 38 138<br />

Arvato 198 314<br />

Direct Group 47 63<br />

Corporate/Other 70 108<br />

Continuing operations 662 1,068<br />

Discontinued operations 0 27<br />

Total 662 1,095<br />

Investments<br />

According to the cash fl ow statement, total investments of<br />

€662 million during fi scal 2009 were down from last year (previous<br />

year: €1,095 million). Th is trend is attributable primarily<br />

to the low number of acquisitions in fi scal year 2009. As in<br />

previous years, the majority of the €249 million investment in<br />

property, plant and equipment (previous year: €389 million)<br />

stemmed from Arvato. An amount of €199 million was invested<br />

in intangible assets (previous year: €238 million). Th is resulted<br />

primarily from RTL Group and involved investments in fi lm<br />

rights. An amount of €57 million was invested in fi nancial assets<br />

(previous year: €158 million). Purchase price payments<br />

for consolidated investments (less cash and cash equivalents)<br />

decreased signifi cantly from €310 million in the previous year<br />

to €157 million in the period under review and were distributed<br />

across virtually all divisions.<br />

Consolidated Balance Sheet<br />

Total assets came to €19.4 billion as of December 31, 2009<br />

(December 31, 2008: €20.1 billion). Th e eff ects of the economic<br />

crisis and the measures undertaken in response resulted only<br />

in slight changes to the balance sheet structure. Equity fell from<br />

€6.2 billion to €6.0 billion due to the decline in operating EBIT<br />

and special items, in particular goodwill impairments. Th is<br />

constitutes an equity ratio of 30.9 percent (previous year:<br />

31.0 percent). Equity attributable to Bertelsmann AG shareholders<br />

was €4.9 billion (previous year: €5.1 billion). Provisions<br />

for pensions decreased slightly from €1,409 million to<br />

€1,406 million.<br />

Bertelsmann Annual Report 2009