AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

Erfolgreiche ePaper selbst erstellen

Machen Sie aus Ihren PDF Publikationen ein blätterbares Flipbook mit unserer einzigartigen Google optimierten e-Paper Software.

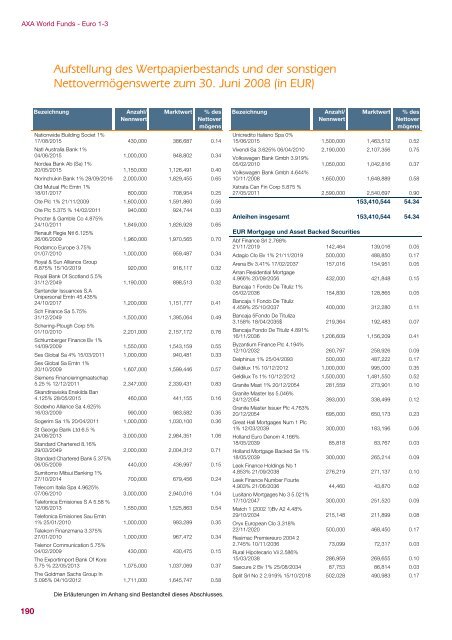

<strong>AXA</strong> World Funds - Euro 1-3<br />

190<br />

Aufstellung des Wertpapierbestands und der sonstigen<br />

Nettovermögenswerte zum 30. Juni 2008 (in EUR)<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Nationwide Building Societ 1%<br />

17/08/2015<br />

Natl Australia Bank 1%<br />

430,000 386,687 0.14<br />

04/06/2015<br />

Nordea Bank Ab (Se) 1%<br />

1,000,000 948,802 0.34<br />

20/05/2015 1,150,000 1,126,491 0.40<br />

Norinchukin Bank 1% 28/09/2016<br />

Old Mutual Plc Emtn 1%<br />

2,000,000 1,829,455 0.65<br />

18/01/2017 800,000 708,954 0.25<br />

Ote Plc 1% 21/11/2009 1,600,000 1,591,860 0.56<br />

Ote Plc 5.375 % 14/02/2011<br />

Procter & Gamble Co 4.875%<br />

940,000 924,744 0.33<br />

24/10/2011<br />

Renault Regie Ntl 6.125%<br />

1,849,000 1,826,928 0.65<br />

26/06/2009<br />

Rodamco Europe 3.75%<br />

1,960,000 1,970,565 0.70<br />

01/07/2010<br />

Royal & Sun Alliance Group<br />

1,000,000 959,487 0.34<br />

6.875% 15/10/2019<br />

Royal Bank Of Scotland 5.5%<br />

920,000 916,117 0.32<br />

31/12/2049<br />

Santander Issuances S.A<br />

Unipersonal Emtn 45.435%<br />

1,190,000 898,513 0.32<br />

24/10/2017<br />

Sch Finance Sa 5.75%<br />

1,200,000 1,151,777 0.41<br />

31/12/2049<br />

Schering-Plough Corp 5%<br />

1,500,000 1,395,064 0.49<br />

01/10/2010<br />

Schlumberger Finance Bv 1%<br />

2,201,000 2,157,172 0.76<br />

14/09/2009 1,550,000 1,543,159 0.55<br />

Ses Global Sa 4% 15/03/2011<br />

Ses Global Sa Emtn 1%<br />

1,000,000 940,481 0.33<br />

20/10/2009<br />

Siemens Financieringmaatschap<br />

1,607,000 1,599,446 0.57<br />

5.25 % 12/12/2011<br />

Skandinaviska Enskilda Ban<br />

2,347,000 2,339,431 0.83<br />

4.125% 28/05/2015<br />

Sodexho Alliance Sa 4.625%<br />

460,000 441,155 0.16<br />

16/03/2009 990,000 983,582 0.35<br />

Sogerim Sa 1% 20/04/2011<br />

St George Bank Ltd 6.5 %<br />

1,000,000 1,030,100 0.36<br />

24/06/2013<br />

Standard Chartered 8.16%<br />

3,000,000 2,984,351 1.06<br />

29/03/2049<br />

Standard Chartered Bank 5.375%<br />

2,000,000 2,004,312 0.71<br />

06/05/2009<br />

Sumitomo Mitsui Banking 1%<br />

440,000 436,997 0.15<br />

27/10/2014<br />

Telecom Italia Spa 4.9625%<br />

700,000 679,456 0.24<br />

07/06/2010<br />

Telefonica Emisiones S A 5.58 %<br />

3,000,000 2,940,016 1.04<br />

12/06/2013<br />

Telefonica Emisiones Sau Emtn<br />

1,550,000 1,525,863 0.54<br />

1% 25/01/2010<br />

Telekom Finanzmana 3.375%<br />

1,000,000 993,289 0.35<br />

27/01/2010<br />

Telenor Communication 5.75%<br />

1,000,000 967,472 0.34<br />

04/02/2009<br />

The Exportimport Bank Of Kore<br />

430,000 430,475 0.15<br />

5.75 % 22/05/2013<br />

The Goldman Sachs Group In<br />

1,075,000 1,037,069 0.37<br />

5.095% 04/10/2012 1,711,000 1,645,747 0.58<br />

Die Erläuterungen im Anhang sind Bestandteil dieses Abschlusses.<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Unicredito Italiano Spa 0%<br />

15/06/2015 1,500,000 1,463,512 0.52<br />

Vivendi Sa 3.625% 06/04/2010<br />

Volkswagen Bank Gmbh 3.919%<br />

2,190,000 2,107,356 0.75<br />

05/02/2010<br />

Volkswagen Bank Gmbh 4.644%<br />

1,050,000 1,042,816 0.37<br />

10/11/2008<br />

Xstrata Can Fin Corp 5.875 %<br />

1,650,000 1,648,889 0.58<br />

27/05/2011 2,590,000 2,540,697 0.90<br />

153,410,544 54.34<br />

Anleihen insgesamt 153,410,544 54.34<br />

EUR Mortgage und Asset Backed Securities<br />

Abf Finance Srl 2.768%<br />

21/11/2019 142,464 139,016 0.05<br />

Adagio Clo Bv 1% 21/11/2019 500,000 488,850 0.17<br />

Arena Bv 3.41% 17/02/2037<br />

Arran Residential Mortgage<br />

157,016 154,951 0.05<br />

4.966% 20/09/2056<br />

Bancaja 1 Fondo De Tituliz 1%<br />

432,000 421,848 0.15<br />

05/02/2036<br />

Bancaja 1 Fondo De Tituliz<br />

154,830 128,865 0.05<br />

4.459% 25/10/2037<br />

Bancaja 5Fondo De Tituliza<br />

400,000 312,280 0.11<br />

3.158% 18/04/2035$<br />

Bancaja Fondo De Tituliz 4.891%<br />

219,364 192,483 0.07<br />

16/11/2036<br />

Byzantium Finance Plc 4.194%<br />

1,206,609 1,156,209 0.41<br />

12/10/2032 260,797 258,926 0.09<br />

Delphinus 1% 25/04/2093 500,000 487,222 0.17<br />

Geldilux 1% 10/12/2012 1,000,000 995,000 0.35<br />

Geldilux Ts 1% 10/12/2012 1,500,000 1,481,550 0.52<br />

Granite Mast 1% 20/12/2054<br />

Granite Master Iss 5.046%<br />

281,559 273,901 0.10<br />

24/12/2054<br />

Granite Master Issuer Plc 4.763%<br />

393,000 338,499 0.12<br />

20/12/2054<br />

Great Hall Mortgages Num 1 Plc<br />

695,000 650,173 0.23<br />

1% 12/03/2039<br />

Holland Euro Denom 4.166%<br />

300,000 183,196 0.06<br />

18/05/2039<br />

Holland Mortgage Backed Se 1%<br />

85,818 83,767 0.03<br />

18/05/2039<br />

Leek Finance Holdings No 1<br />

300,000 265,214 0.09<br />

4.853% 21/09/2038<br />

Leek Finance Number Fourte<br />

276,219 271,137 0.10<br />

4.903% 21/06/2036<br />

Lusitano Mortgages No 3 5.021%<br />

44,460 43,870 0.02<br />

17/10/2047<br />

Match 1 (2002 1)Bv A2 4.48%<br />

300,000 251,520 0.09<br />

29/10/2034<br />

Oryx European Clo 3.318%<br />

215,148 211,899 0.08<br />

22/11/2020<br />

Resimac Premiereuro 2004 2<br />

500,000 468,450 0.17<br />

2.745% 10/11/2036<br />

Rural Hipotecario Vii 2.586%<br />

73,099 72,317 0.03<br />

15/03/2038 286,959 269,655 0.10<br />

Saecure 2 Bv 1% 25/08/2034 87,753 86,814 0.03<br />

Split Srl No 2 2.919% 15/10/2018 502,028 490,983 0.17