AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

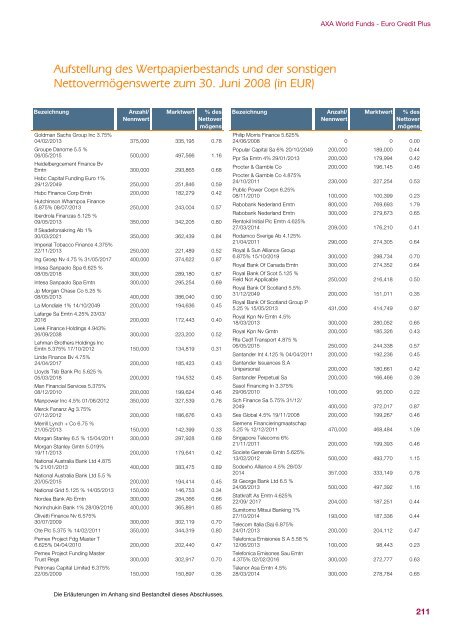

Aufstellung des Wertpapierbestands und der sonstigen<br />

Nettovermögenswerte zum 30. Juni 2008 (in EUR)<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Goldman Sachs Group Inc 3.75%<br />

04/02/2013<br />

Groupe Danome 5.5 %<br />

375,000 335,195 0.78<br />

06/05/2015<br />

Heidelbergcement Finance Bv<br />

500,000 497,566 1.16<br />

Emtn<br />

Hsbc Capital Funding Euro 1%<br />

300,000 293,865 0.68<br />

29/12/2049 250,000 251,846 0.59<br />

Hsbc Finance Corp Emtn<br />

Hutchinson Whampoa Finance<br />

200,000 182,279 0.42<br />

5.875% 08/07/2013<br />

Iberdrola Finanzas 5.125 %<br />

250,000 243,004 0.57<br />

09/05/2013<br />

If Skadeforsakring Ab 1%<br />

350,000 342,205 0.80<br />

30/03/2021<br />

Imperial Tobacco Finance 4.375%<br />

350,000 362,439 0.84<br />

22/11/2013 250,000 221,489 0.52<br />

Ing Groep Nv 4.75 % 31/05/2017<br />

Intesa Sanpaolo Spa 6.625 %<br />

400,000 374,622 0.87<br />

08/05/2018 300,000 289,180 0.67<br />

Intesa Sanpaolo Spa Emtn<br />

Jp Morgan Chase Co 5.25 %<br />

300,000 295,254 0.69<br />

08/05/2013 400,000 386,040 0.90<br />

La Mondiale 1% 14/10/2049<br />

Lafarge Sa Emtn 4.25% 23/03/<br />

200,000 194,636 0.45<br />

2016<br />

Leek Finance Holdings 4.943%<br />

200,000 172,443 0.40<br />

26/09/2038<br />

Lehman Brothers Holdings Inc<br />

300,000 223,200 0.52<br />

Emtn 5.375% 17/10/2012<br />

Linde Finance Bv 4.75%<br />

150,000 134,819 0.31<br />

24/04/2017<br />

Lloyds Tsb Bank Plc 5.625 %<br />

200,000 185,423 0.43<br />

05/03/2018<br />

Man Financial Services 5.375%<br />

200,000 194,532 0.45<br />

08/12/2010 200,000 199,624 0.46<br />

Manpower Inc 4.5% 01/06/2012<br />

Merck Fananz Ag 3.75%<br />

350,000 327,539 0.76<br />

07/12/2012<br />

Merrill Lynch + Co 6.75 %<br />

200,000 186,676 0.43<br />

21/05/2013 150,000 142,399 0.33<br />

Morgan Stanley 6.5 % 15/04/2011<br />

Morgan Stanley Gmtn 5.019%<br />

300,000 297,928 0.69<br />

19/11/2013<br />

National Australia Bank Ltd 4.875<br />

200,000 179,641 0.42<br />

% 21/01/2013<br />

National Australia Bank Ltd 5.5 %<br />

400,000 383,475 0.89<br />

20/05/2015 200,000 194,414 0.45<br />

National Grid 5.125 % 14/05/2013 150,000 146,753 0.34<br />

Nordea Bank Ab Emtn 300,000 284,366 0.66<br />

Norinchukin Bank 1% 28/09/2016<br />

Olivetti Finance Nv 6.575%<br />

400,000 365,891 0.85<br />

30/07/2009 300,000 302,119 0.70<br />

Ote Plc 5.375 % 14/02/2011<br />

Pemex Project Fdg Master T<br />

350,000 344,319 0.80<br />

6.625% 04/04/2010<br />

Pemex Project Funding Master<br />

200,000 202,440 0.47<br />

Trust Regs<br />

Petronas Capital Limited 6.375%<br />

300,000 302,917 0.70<br />

22/05/2009 150,000 150,897 0.35<br />

Die Erläuterungen im Anhang sind Bestandteil dieses Abschlusses.<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

<strong>AXA</strong> World Funds - Euro Credit Plus<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Philip Morris Finance 5.625%<br />

24/06/2008 0 0 0.00<br />

Popular Capital Sa 6% 20/10/2049 200,000 189,000 0.44<br />

Ppr Sa Emtn 4% 29/01/2013 200,000 179,994 0.42<br />

Procter & Gamble Co<br />

Procter & Gamble Co 4.875%<br />

200,000 196,145 0.46<br />

24/10/2011<br />

Public Power Corpn 6.25%<br />

230,000 227,254 0.53<br />

08/11/2010 100,000 100,399 0.23<br />

Rabobank Nederland Emtn 800,000 769,693 1.79<br />

Rabobank Nederland Emtn<br />

Rentokil Initial Plc Emtn 4.625%<br />

300,000 279,673 0.65<br />

27/03/2014<br />

Rodamco Sverige Ab 4.125%<br />

209,000 176,210 0.41<br />

21/04/2011<br />

Royal & Sun Alliance Group<br />

290,000 274,305 0.64<br />

6.875% 15/10/2019 300,000 298,734 0.70<br />

Royal Bank Of Canada Emtn<br />

Royal Bank Of Scot 5.125 %<br />

300,000 274,352 0.64<br />

Field Not Applicable<br />

Royal Bank Of Scotland 5.5%<br />

250,000 216,418 0.50<br />

31/12/2049<br />

Royal Bank Of Scotland Group P<br />

200,000 151,011 0.35<br />

5.25 % 15/05/2013<br />

Royal Kpn Nv Emtn 4.5%<br />

431,000 414,749 0.97<br />

18/03/2013 300,000 280,052 0.65<br />

Royal Kpn Nv Gmtn<br />

Rte Cedf Transport 4.875 %<br />

200,000 185,326 0.43<br />

06/05/2015 250,000 244,338 0.57<br />

Santander Int 4.125 % 04/04/2011<br />

Santander Issuances S.A<br />

200,000 192,236 0.45<br />

Unipersonal 200,000 180,661 0.42<br />

Santander Perpetual Sa<br />

Sasol Financing In 3.375%<br />

200,000 166,466 0.39<br />

29/06/2010<br />

Sch Finance Sa 5.75% 31/12/<br />

100,000 95,000 0.22<br />

2049 400,000 372,017 0.87<br />

Ses Global 4.5% 19/11/2008<br />

Siemens Financieringmaatschap<br />

200,000 199,267 0.46<br />

5.25 % 12/12/2011<br />

Singapore Telecoms 6%<br />

470,000 468,484 1.09<br />

21/11/2011<br />

Societe Generale Emtn 5.625%<br />

200,000 199,393 0.46<br />

13/02/2012<br />

Sodexho Alliance 4.5% 28/03/<br />

500,000 493,770 1.15<br />

2014<br />

St George Bank Ltd 6.5 %<br />

357,000 333,149 0.78<br />

24/06/2013<br />

Statkraft As Emtn 4.625%<br />

500,000 497,392 1.16<br />

22/09/ 2017<br />

Sumitomo Mitsui Banking 1%<br />

204,000 187,251 0.44<br />

27/10/2014<br />

Telecom Italia (Sa) 6.875%<br />

193,000 187,336 0.44<br />

24/01/2013<br />

Telefonica Emisiones S A 5.58 %<br />

200,000 204,112 0.47<br />

12/06/2013<br />

Telefonica Emisones Sau Emtn<br />

100,000 98,443 0.23<br />

4.375% 02/02/2016<br />

Telenor Asa Emtn 4.5%<br />

300,000 272,777 0.63<br />

28/03/2014 300,000 278,784 0.65<br />

211