AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

Erfolgreiche ePaper selbst erstellen

Machen Sie aus Ihren PDF Publikationen ein blätterbares Flipbook mit unserer einzigartigen Google optimierten e-Paper Software.

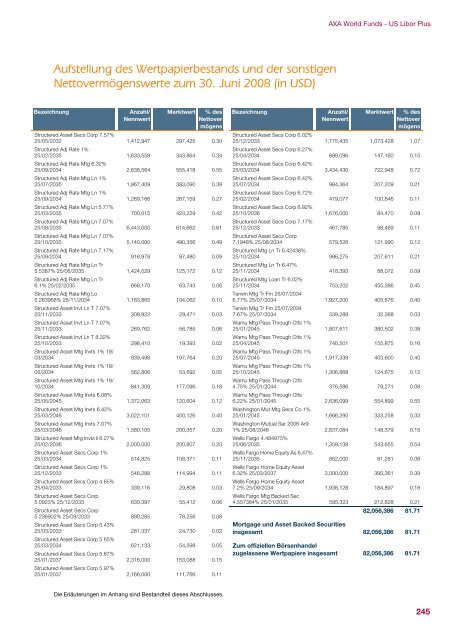

Aufstellung des Wertpapierbestands und der sonstigen<br />

Nettovermögenswerte zum 30. Juni 2008 (in USD)<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Structered Asset Secs Corp 7.57%<br />

25/05/2032<br />

Structured Adj Rate 1%<br />

1,412,947 297,425 0.30<br />

25/02/2035<br />

Structured Adj Rate Mtg 6.32%<br />

1,633,558 343,864 0.34<br />

25/09/2034<br />

Structured Adj Rate Mtg Ln 1%<br />

2,638,564 555,418 0.55<br />

25/07/2035<br />

Structured Adj Rate Mtg Ln 1%<br />

1,867,409 393,090 0.39<br />

25/09/2034<br />

Structured Adj Rate Mtg Ln 5.77%<br />

1,269,166 267,159 0.27<br />

25/03/2035<br />

Structured Adj Rate Mtg Ln 7.07%<br />

700,015 423,229 0.42<br />

25/08/2035<br />

Structured Adj Rate Mtg Ln 7.07%<br />

6,443,000 614,662 0.61<br />

25/10/2035<br />

Structured Adj Rate Mtg Ln 7.17%<br />

5,140,000 490,356 0.49<br />

25/09/2034<br />

Structured Adj Rate Mtg Ln Tr<br />

916,978 87,480 0.09<br />

5.5387% 25/06/2035<br />

Structured Adj Rate Mtg Ln Tr<br />

1,424,029 125,172 0.12<br />

6.1% 25/02/2035<br />

Structured Adj Rate Mtg Lo<br />

668,170 63,743 0.06<br />

5.263968% 25/11/2034<br />

Structured Asset Invt Ln T 7.07%<br />

1,183,865 104,062 0.10<br />

25/11/2033<br />

Structured Asset Invt Ln T 7.07%<br />

308,922 29,471 0.03<br />

25/11/2033<br />

Structured Asset Invt Ln T 8.32%<br />

269,762 56,785 0.06<br />

25/10/2033<br />

Structured Asset Mtg Invts 1% 19/<br />

298,410 19,393 0.02<br />

03/2034<br />

Structured Asset Mtg Invts 1% 19/<br />

939,498 197,764 0.20<br />

05/2034<br />

Structured Asset Mtg Invts 1% 19/<br />

562,806 53,692 0.05<br />

10/2034<br />

Structured Asset Mtg Invts 6.08%<br />

841,309 177,096 0.18<br />

25/05/2045<br />

Structured Asset Mtg Invts 6.42%<br />

1,372,063 120,604 0.12<br />

25/03/2046<br />

Structured Asset Mtg Invts 7.07%<br />

3,022,101 400,126 0.40<br />

25/03/2046<br />

Structured Asset Mtg Invts Ii 6.27%<br />

1,580,105 200,357 0.20<br />

25/02/2036<br />

Structured Asset Secs Corp 1%<br />

2,000,000 200,807 0.20<br />

25/03/2034<br />

Structured Asset Secs Corp 1%<br />

514,825 108,371 0.11<br />

25/12/2033<br />

Structured Asset Secs Corp 4.65%<br />

546,288 114,994 0.11<br />

25/04/2033<br />

Structured Asset Secs Corp<br />

339,116 29,808 0.03<br />

5.0923% 25/12/2033<br />

Structured Asset Secs Corp<br />

630,397 55,412 0.06<br />

5.236902% 25/09/2033<br />

Structured Asset Secs Corp 5.43%<br />

890,285 78,256 0.08<br />

25/03/2033<br />

Structured Asset Secs Corp 5.65%<br />

281,337 24,730 0.02<br />

25/03/2034<br />

Structured Asset Secs Corp 5.87%<br />

621,133 54,598 0.05<br />

25/01/2037<br />

Structured Asset Secs Corp 5.97%<br />

2,316,000 153,088 0.15<br />

25/01/2037 2,166,000 111,766 0.11<br />

Die Erläuterungen im Anhang sind Bestandteil dieses Abschlusses.<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

<strong>AXA</strong> World Funds - US Libor Plus<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Structured Asset Secs Corp 6.02%<br />

25/12/2033<br />

Structured Asset Secs Corp 6.27%<br />

1,775,435 1,073,428 1.07<br />

25/04/2034<br />

Structured Asset Secs Corp 6.42%<br />

699,096 147,160 0.15<br />

25/03/2034<br />

Structured Asset Secs Corp 6.42%<br />

3,434,430 722,948 0.72<br />

25/07/2034<br />

Structured Asset Secs Corp 6.72%<br />

984,364 207,209 0.21<br />

25/02/2034<br />

Structured Asset Secs Corp 6.92%<br />

479,077 100,846 0.11<br />

25/10/2036<br />

Structured Asset Secs Corp 7.17%<br />

1,676,000 84,470 0.09<br />

25/12/2033<br />

Structured Asset Secs Corp<br />

467,785 98,469 0.11<br />

7.1948% 25/08/2034<br />

Structured Mtg Ln Tr 6.42438%<br />

579,526 121,990 0.12<br />

25/10/2034<br />

Structured Mtg Ln Tr 6.47%<br />

986,275 207,611 0.21<br />

25/11/2034<br />

Structured Mtg Loan Tr 6.02%<br />

418,393 88,072 0.09<br />

25/11/2034<br />

Terwin Mtg Tr Frn 25/07/2034<br />

753,202 455,386 0.45<br />

6.77% 25/07/2034<br />

Terwin Mtg Tr Frn 25/07/2034<br />

1,927,200 405,676 0.40<br />

7.67% 25/07/2034<br />

Wamu Mtg Pass Through Ctfs 1%<br />

339,288 32,368 0.03<br />

25/01/2045<br />

Wamu Mtg Pass Through Ctfs 1%<br />

1,807,611 380,502 0.38<br />

25/04/2045<br />

Wamu Mtg Pass Through Ctfs 1%<br />

740,501 155,875 0.16<br />

25/07/2045<br />

Wamu Mtg Pass Through Ctfs 1%<br />

1,917,338 403,600 0.40<br />

25/10/2045<br />

Wamu Mtg Pass Through Ctfs<br />

1,306,868 124,675 0.12<br />

4.75% 25/01/2044<br />

Wamu Mtg Pass Through Ctfs<br />

376,586 79,271 0.08<br />

6.22% 25/01/2045<br />

Washington Mut Mtg Secs Co 1%<br />

2,636,099 554,899 0.55<br />

25/01/2045<br />

Washington Mutual Ser 2006 Ar9<br />

1,666,290 333,258 0.33<br />

1% 25/08/2046<br />

Wells Fargo 4.484975%<br />

2,837,084 148,379 0.15<br />

25/06/2035<br />

Wells Fargo Home Equity As 6.47%<br />

1,359,138 543,655 0.54<br />

25/11/2035<br />

Wells Fargo Home Equity Asset<br />

852,000 81,281 0.08<br />

6.32% 25/03/2037<br />

Wells Fargo Home Equity Asset<br />

3,000,000 395,361 0.39<br />

7.2% 25/09/2034<br />

Wells Fargo Mtg Backed Sec<br />

1,938,128 184,897 0.18<br />

4.557384% 25/01/2035 595,323 212,828 0.21<br />

82,056,386 81.71<br />

Mortgage und Asset Backed Securities<br />

insgesamt 82,056,386 81.71<br />

Zum offiziellen Börsenhandel<br />

zugelassene Wertpapiere insgesamt 82,056,386 81.71<br />

245