AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

AXA WORLD FUNDS - Samuel Begasse

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

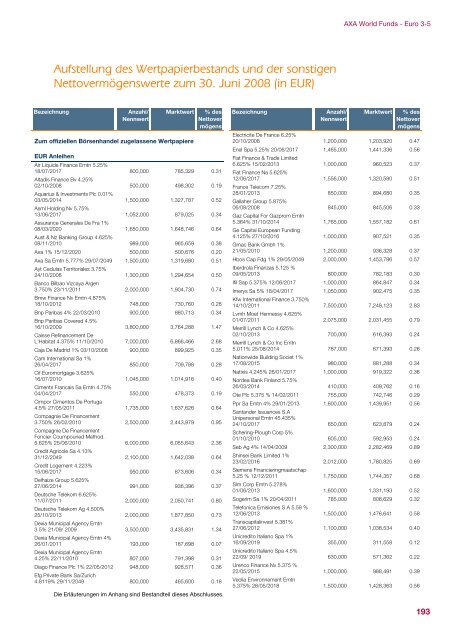

Aufstellung des Wertpapierbestands und der sonstigen<br />

Nettovermögenswerte zum 30. Juni 2008 (in EUR)<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

Zum offiziellen Börsenhandel zugelassene Wertpapiere<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

EUR Anleihen<br />

Air Liquide Finance Emtn 5.25%<br />

18/07/2017<br />

Altadis Finance Bv 4.25%<br />

800,000 785,329 0.31<br />

02/10/2008<br />

Aquarius & Investments Plc 0.01%<br />

500,000 498,302 0.19<br />

03/05/2014<br />

Asml Holding Nv 5.75%<br />

1,500,000 1,327,787 0.52<br />

13/06/2017<br />

Assurance Generales De Fra 1%<br />

1,052,000 879,025 0.34<br />

08/03/2020<br />

Aust & Nz Banking Group 4.625%<br />

1,650,000 1,648,746 0.64<br />

08/11/2010 989,000 965,659 0.38<br />

Axa 1% 15/12/2020 500,000 500,676 0.20<br />

Axa Sa Emtn 5.777% 29/07/2049<br />

Ayt Cedulas Territoriales 3.75%<br />

1,500,000 1,319,680 0.51<br />

24/10/2008<br />

Banco Bilbao Vizcaya Argen<br />

1,300,000 1,294,654 0.50<br />

3.750% 23/11/2011<br />

Bmw Finance Nv Emtn 4.875%<br />

2,000,000 1,904,730 0.74<br />

18/10/2012 748,000 730,760 0.28<br />

Bnp Paribas 4% 22/03/2010<br />

Bnp Paribas Covered 4.5%<br />

900,000 880,713 0.34<br />

16/10/2009<br />

Caisse Refinancement De<br />

3,800,000 3,764,288 1.47<br />

L’Habitat 4.375% 11/10/2010 7,000,000 6,866,466 2.68<br />

Caja De Madrid 1% 03/10/2008<br />

Cam International Sa 1%<br />

900,000 899,925 0.35<br />

26/04/2017<br />

Cif Euromortgage 3.625%<br />

850,000 709,788 0.28<br />

16/07/2010<br />

Ciments Francais Sa Emtn 4.75%<br />

1,045,000 1,014,916 0.40<br />

04/04/2017<br />

Cimpor Cimentos De Portuga<br />

550,000 478,373 0.19<br />

4.5% 27/05/2011<br />

Compagnie De Financement<br />

1,735,000 1,637,626 0.64<br />

3.750% 26/02/2010<br />

Compagnie De Financement<br />

Foncier Coumpouned Method.<br />

2,500,000 2,443,979 0.95<br />

5.625% 25/06/2010<br />

Credit Agricole Sa 4.13%<br />

6,000,000 6,055,643 2.36<br />

31/12/2049<br />

Credit Logement 4.223%<br />

2,100,000 1,642,038 0.64<br />

15/06/2017<br />

Delhaize Group 5.625%<br />

950,000 873,606 0.34<br />

27/06/2014<br />

Deutsche Telekom 6.625%<br />

991,000 936,396 0.37<br />

11/07/2011<br />

Deutsche Telekom Ag 4.500%<br />

2,000,000 2,050,741 0.80<br />

25/10/2013<br />

Dexia Municipal Agency Emtn<br />

2,000,000 1,877,850 0.73<br />

3.5% 21/09/ 2009<br />

Dexia Municipal Agency Emtn 4%<br />

3,500,000 3,435,831 1.34<br />

26/01/2011<br />

Dexia Municipal Agency Emtn<br />

193,000 187,698 0.07<br />

4.25% 22/11/2010 807,000 791,398 0.31<br />

Diago Finance Plc 1% 22/05/2012<br />

Efg Private Bank Sa/Zurich<br />

948,000 928,571 0.36<br />

4.8119% 29/11/2049 800,000 465,600 0.18<br />

Die Erläuterungen im Anhang sind Bestandteil dieses Abschlusses.<br />

Bezeichnung Anzahl/<br />

Nennwert<br />

<strong>AXA</strong> World Funds - Euro 3-5<br />

Marktwert % des<br />

Nettover<br />

mögens<br />

Electricite De France 6.25%<br />

20/10/2008 1,200,000 1,203,920 0.47<br />

Enel Spa 5.25% 20/06/2017<br />

Fiat Finance & Trade Limited<br />

1,465,000 1,441,336 0.56<br />

6.625% 15/02/2013<br />

Fiat Finance Na 5.625%<br />

1,000,000 960,523 0.37<br />

12/06/2017<br />

France Telecom 7.25%<br />

1,556,000 1,320,580 0.51<br />

28/01/2013<br />

Gallaher Group 5.875%<br />

850,000 894,680 0.35<br />

06/08/2008<br />

Gaz Capital For Gazprom Emtn<br />

845,000 845,506 0.33<br />

5.364% 31/10/2014<br />

Ge Capital European Funding<br />

1,765,000 1,557,182 0.61<br />

4.125% 27/10/2016<br />

Gmac Bank Gmbh 1%<br />

1,000,000 907,521 0.35<br />

21/05/2010 1,200,000 936,328 0.37<br />

Hbos Cap Fdg 1% 29/05/2049<br />

Iberdrola Finanzas 5.125 %<br />

2,000,000 1,453,786 0.57<br />

09/05/2013 800,000 782,183 0.30<br />

Ifil Sap 5.375% 12/06/2017 1,000,000 864,847 0.34<br />

Imerys Sa 5% 18/04/2017<br />

Kfw International Finance 3.750%<br />

1,050,000 902,475 0.35<br />

14/10/2011<br />

Lvmh Moet Hennessy 4.625%<br />

7,500,000 7,248,123 2.83<br />

01/07/2011<br />

Merrill Lynch & Co 4.625%<br />

2,075,000 2,031,455 0.79<br />

02/10/2013<br />

Merrill Lynch & Co Inc Emtn<br />

700,000 616,393 0.24<br />

5.011% 25/08/2014<br />

Nationwide Building Societ 1%<br />

787,000 671,393 0.26<br />

17/08/2015 980,000 881,288 0.34<br />

Natixis 4.245% 26/01/2017<br />

Nordea Bank Finland 5.75%<br />

1,000,000 919,322 0.36<br />

26/03/2014 410,000 409,762 0.16<br />

Ote Plc 5.375 % 14/02/2011 755,000 742,746 0.29<br />

Ppr Sa Emtn 4% 29/01/2013<br />

Santander Issuances S.A<br />

Unipersonal Emtn 45.435%<br />

1,600,000 1,439,951 0.56<br />

24/10/2017<br />

Schering-Plough Corp 5%<br />

650,000 623,879 0.24<br />

01/10/2010 605,000 592,953 0.24<br />

Seb Ag 4% 14/04/2009<br />

Shinsei Bank Limited 1%<br />

2,300,000 2,282,469 0.89<br />

23/02/2016<br />

Siemens Financieringmaatschap<br />

2,012,000 1,780,825 0.69<br />

5.25 % 12/12/2011<br />

Slm Corp Emtn 5.278%<br />

1,750,000 1,744,357 0.68<br />

01/06/2013 1,600,000 1,331,193 0.52<br />

Sogerim Sa 1% 20/04/2011<br />

Telefonica Emisiones S A 5.58 %<br />

785,000 808,629 0.32<br />

12/06/2013<br />

Transcapitalinvest 5.381%<br />

1,500,000 1,476,641 0.58<br />

27/06/2012<br />

Unicredito Italiano Spa 1%<br />

1,100,000 1,038,534 0.40<br />

16/09/2019<br />

Unicredito Italiano Spa 4.5%<br />

355,000 311,558 0.12<br />

22/09/ 2019<br />

Urenco Finance Nv 5.375 %<br />

630,000 571,362 0.22<br />

22/05/2015<br />

Veolia Environnement Emtn<br />

1,000,000 988,491 0.39<br />

5.375% 28/05/2018 1,500,000 1,428,363 0.56<br />

193