- Page 1 and 2:

DEPARTMENT OF CHILDREN AND FAMILY S

- Page 3 and 4:

REQUEST FOR STATEMENT OF QUALIFICAT

- Page 5 and 6:

1.0 INTRODUCTION 1.1 Preamble For o

- Page 7 and 8:

COUNTY agencies and their partners

- Page 9 and 10:

1.3 DCFS Mission Statement DCFS wil

- Page 11 and 12:

2.0 GENERAL INFORMATION 2.0 Scope o

- Page 13 and 14:

2.4.1.2 Prospective Contractor must

- Page 15 and 16:

old for 30 days or less; (3) provid

- Page 17 and 18:

Contractor protest. In all cases, t

- Page 19 and 20:

2.19 Conflict of Interest No County

- Page 21 and 22:

submit evidence at that hearing. Af

- Page 23 and 24:

solicitation may result in the pros

- Page 25 and 26:

County’s contracting process by c

- Page 27 and 28:

2.33 Contractor’s Charitable Cont

- Page 29 and 30:

3.0 Instructions to Prospective Con

- Page 31 and 32:

The request for a Solicitation Requ

- Page 33 and 34:

3.7.1 Language The SOQ and all docu

- Page 35 and 36:

coverage should the prospective Con

- Page 37 and 38:

3.8.6 Please refer to Section 3.0 I

- Page 39 and 40:

4.0 SOQ REVIEW/SELECTION/QUALIFICAT

- Page 41 and 42:

The Department will execute Board o

- Page 43 and 44:

19 20 21 22 List of Required Forms

- Page 45 and 46:

CONTRACTOR’S ORGANIZATION QUESTIO

- Page 47 and 48:

CONTRACTOR’S ORGANIZATION QUESTIO

- Page 49 and 50:

VENDOR’S EEO CERTIFICATION REQUIR

- Page 51 and 52:

REQUIRED FORMS - FORM 5 FAMILIARITY

- Page 53 and 54:

PROSPECTIVE CONTRACTOR LIST OF TERM

- Page 55 and 56:

REQUIRED FORMS - FORM 9 COUNTY OF L

- Page 57 and 58:

REQUIRED FORMS - FORM 11 OFFER TO P

- Page 59 and 60:

CERTIFICATION OF FISCAL COMPLIANCE

- Page 61 and 62:

LIST OF COMMITMENTS Legal Name of A

- Page 63 and 64:

REQUIRED FORMS - FORM 17 CONTRACTOR

- Page 65 and 66:

CERTIFIED FOSTER PARENT CONFIDENTIA

- Page 67 and 68:

CONTRACTOR’S EMPLOYEE ACKNOWLEDGE

- Page 69 and 70:

Type of program: Foster Family Agen

- Page 71 and 72:

CONTRACTOR’S NAME: CONTRACT NO. N

- Page 73 and 74:

REQUEST FOR STATEMENT OF QUALIFICAT

- Page 75 and 76:

TRANSMITTAL FORM TO REQUEST A RFSQ

- Page 77 and 78:

APPENDIX E LISTING OF CONTRACTORS D

- Page 79 and 80:

SAMPLE CONTRACT COUNTY OF LOS ANGEL

- Page 81 and 82:

LIST OF EXHIBITS SAMPLE CONTRACT Ex

- Page 83 and 84:

SAMPLE CONTRACT COUNTY OF LOS ANGEL

- Page 85 and 86:

SAMPLE CONTRACT Exhibit A-IX Requir

- Page 87 and 88:

as a single process. SAMPLE CONTRAC

- Page 89 and 90:

SAMPLE CONTRACT 2.27 “Foster Care

- Page 91 and 92:

SAMPLE CONTRACT written in accordan

- Page 93 and 94:

SAMPLE CONTRACT Such insurance shal

- Page 95 and 96:

SAMPLE CONTRACT 6.0 INSURANCE COVER

- Page 97 and 98:

SAMPLE CONTRACT partial, and supple

- Page 99 and 100:

SAMPLE CONTRACT 7.15 Provided that

- Page 101 and 102:

10.0 COUNTY’S RESPONSIBILITY SAMP

- Page 103 and 104:

SAMPLE CONTRACT 10.13 The CSWs shal

- Page 105 and 106:

SAMPLE CONTRACT and/or Certified Fo

- Page 107 and 108:

SAMPLE CONTRACT Investigation/Monit

- Page 109 and 110:

SAMPLE CONTRACT will also invite CO

- Page 111 and 112:

SAMPLE CONTRACT 18.4 The CONTRACTOR

- Page 113 and 114:

SAMPLE CONTRACT management review,

- Page 115 and 116:

SAMPLE CONTRACT 20.2 CONTRACTOR and

- Page 117 and 118:

SAMPLE CONTRACT 22.2 CONTRACTOR her

- Page 119 and 120:

SAMPLE CONTRACT notice by the CONTR

- Page 121 and 122:

SAMPLE CONTRACT COUNTY’s prior wr

- Page 123 and 124:

SAMPLE CONTRACT FOSTER FAMILY AGENC

- Page 125 and 126:

SAMPLE CONTRACT to the Contract, wh

- Page 127 and 128:

SAMPLE CONTRACT governing or impact

- Page 129 and 130:

8.0 GRIEVANCES SAMPLE CONTRACT term

- Page 131 and 132:

SAMPLE CONTRACT 11.1.2 For purposes

- Page 133 and 134:

SAMPLE CONTRACT CONTRACTOR will int

- Page 135 and 136:

SAMPLE CONTRACT conduct a hearing w

- Page 137 and 138:

SAMPLE CONTRACT CONTRACTOR warrants

- Page 139 and 140:

SAMPLE CONTRACT solely of CONTRACTO

- Page 141 and 142:

1015, attached hereto as Exhibit L.

- Page 143 and 144:

SAMPLE CONTRACT 30.1.3 CONTRACTOR m

- Page 145 and 146:

SAMPLE CONTRACT not limited to, the

- Page 147 and 148:

SAMPLE CONTRACT amounts COUNTY clai

- Page 149 and 150:

SAMPLE CONTRACT COUNTY OF LOS ANGEL

- Page 151 and 152:

COUNTY OF LOS ANGELES DEPARMENTS OF

- Page 153 and 154:

PART A: INTRODUCTION 1.0 PREAMBLE E

- Page 155 and 156:

EXHIBIT A COUNTY agencies and thei

- Page 157 and 158:

EXHIBIT A (Health and Safety Code),

- Page 159 and 160:

PART B: TARGET DEMOGRAPHICS 1.0 TAR

- Page 161 and 162:

1.0 SAFETY EXHIBIT A PERFORMANCE OU

- Page 163 and 164:

1.1.7 Required Services by CONTRACT

- Page 165 and 166:

EXHIBIT A The CONTRACTOR shall Moni

- Page 167 and 168:

PROGRAM TARGET GROUP: Placed Childr

- Page 169 and 170:

EXHIBIT A the fullest extent possib

- Page 171 and 172:

EXHIBIT A Monitor for Compliance th

- Page 173 and 174:

3.0 WELL-BEING EXHIBIT A PERFORMANC

- Page 175 and 176:

EXHIBIT A participation in treatmen

- Page 177 and 178:

EXHIBIT A individuals to the extent

- Page 179 and 180:

EXHIBIT A 88068.2, 88068.3, and 880

- Page 181 and 182:

EXHIBIT A objectives appropriate to

- Page 183 and 184:

EXHIBIT A The CONTRACTOR shall prov

- Page 185 and 186:

3.7.4 Monetary Consequences EXHIBIT

- Page 187 and 188:

EXHIBIT A Days. After 14 Days, the

- Page 189 and 190:

EXHIBIT A The CONTRACTOR shall have

- Page 191 and 192:

EXHIBIT A for the Placed Child to r

- Page 193 and 194:

EXHIBIT A specified in the Needs an

- Page 195 and 196:

EXHIBIT A The CONTRACTOR shall Moni

- Page 197 and 198:

FOSTER YOUTH BILL OF RIGHTS EXHIBIT

- Page 199 and 200:

EXHIBIT A-I 19. Residents have the

- Page 201 and 202:

EXHIBIT A-I Reprise 25. Residents s

- Page 203 and 204:

INTENTIONALLY LEFT BLANK EXHIBIT A-

- Page 205 and 206:

EXHIBIT A-IVa STATE OF CALIFORNIA

- Page 207:

FOSTER CHILD’S NEEDS AND CASE PLA

- Page 225 and 226: AGENCY - GROUP HOME AGREEMENT Child

- Page 227 and 228: EXHIBIT A-VIII SPECIAL INCIDENT REP

- Page 229 and 230: 5. SERIOUS INJURY, ILLNESS OR ACCID

- Page 231 and 232: EXHIBIT A-VIII 10. SIGNIFICANT INCI

- Page 233 and 234: SCREENING REQUIREMENT PERIODICITY S

- Page 235 and 236: Anticonvulsant medications, when pr

- Page 237 and 238: Dr. faxes pages 1 & 2 of PMAF to th

- Page 239 and 240: EXHIBIT A-X 2. Contact the physicia

- Page 241 and 242: EXHIBIT A-X 1. Instruct the caregiv

- Page 243 and 244: APPROVAL LEVELS Section Level Appro

- Page 245 and 246: (CSW completes top section) Los Ang

- Page 247 and 248: D. Please attach a list of the foll

- Page 249 and 250: TO THE HEADS OF EXECUTIVE DEPARTMEN

- Page 251 and 252: implementation of individual provis

- Page 253 and 254: E. Negotiation and Approval of Indi

- Page 255 and 256: . The restraints or requirements im

- Page 257 and 258: objectives of the organization are

- Page 259 and 260: distribution base. The result of th

- Page 261: special cost studies (such as an en

- Page 265 and 266: g. The results of each negotiation

- Page 267 and 268: 49. Training costs 50. Transportati

- Page 269 and 270: e. Costs identified in subparagraph

- Page 271 and 272: compensation for employees on feder

- Page 273 and 274: (3) Excise taxes on accumulated fun

- Page 275 and 276: with certainty as to time, intensit

- Page 277 and 278: appeals, antitrust suits, or the pr

- Page 279 and 280: (1) Donated or volunteer services m

- Page 281 and 282: (1) Capital expenditures for genera

- Page 283 and 284: (2) "Idle facilities" means complet

- Page 285 and 286: enovations, alterations, equipment,

- Page 287 and 288: . For non-profit organizations subj

- Page 289 and 290: already required or maintained. Als

- Page 291 and 292: see paragraphs 37., Professional se

- Page 293 and 294: 41. Recruiting costs. a. Subject to

- Page 295 and 296: continued to own the property. This

- Page 297 and 298: 48. Termination costs applicable to

- Page 299 and 300: (3) Fees charges by the educational

- Page 301 and 302: e. Foreign travel. Direct charges f

- Page 303 and 304: Southern Research Institute, Birmin

- Page 305 and 306: A-C Handbook Page 1 AUDITOR-CONTROL

- Page 307 and 308: A-C Handbook Page 3 2.2 Cash Receip

- Page 309 and 310: A-C Handbook Page 5 If a Payroll Re

- Page 311 and 312: A-C Handbook Page 7 Outside Meals -

- Page 313 and 314:

A-C Handbook Page 9 CONTRACTOR shal

- Page 315 and 316:

A-C Handbook Page 11 2.3 Petty Cash

- Page 317 and 318:

A-C Handbook Page 13 Salaried emplo

- Page 319 and 320:

A-C Handbook Page 15 Indirect Cost

- Page 321 and 322:

A-C Handbook Page 17 2.3 Acceptable

- Page 323 and 324:

A-C Handbook Page 19 D. UNALLOWABLE

- Page 325 and 326:

EXHIBIT C-II AUDITOR-CONTROLLER/DEP

- Page 327 and 328:

• California Code of Regulations,

- Page 329 and 330:

If CONTRACTOR and A-C/DCFS hold a p

- Page 331 and 332:

XIV. Final Report to the Board of S

- Page 333 and 334:

EXHIBIT D Cont. I understand that I

- Page 335 and 336:

EXHIBIT D-I Cont. I understand that

- Page 337 and 338:

24. Equipment Leases 25. Depreciati

- Page 339 and 340:

Report all costs related to telepho

- Page 341 and 342:

EXHIBIT E D. Total Un-Expended AFDC

- Page 343 and 344:

EXHIBIT F (D) If the State Departme

- Page 345 and 346:

EXHIBIT F (C) Individuals who are e

- Page 347 and 348:

EXHIBIT F subdivision (g). The Stat

- Page 349 and 350:

EXHIBIT F processing. (B) Upon requ

- Page 351 and 352:

EXHIBIT F self-addressed envelope f

- Page 353 and 354:

EXHIBIT F shall disclose that clien

- Page 355 and 356:

EXHIBIT F state, would have been pu

- Page 357 and 358:

statement, fingerprints and photogr

- Page 359 and 360:

Name, Address and Telephone Number

- Page 361 and 362:

EXHIBIT G If a CSW or SCSW has any

- Page 363 and 364:

EXHIBIT G 10) minute orders and cou

- Page 365 and 366:

0500-501.20 (Rev 12/02) EXHIBIT G 4

- Page 367 and 368:

EXHIBIT G See Procedural Guide 0200

- Page 369 and 370:

EXHIBIT G that the research will no

- Page 371 and 372:

EXHIBIT G detrimental to the safety

- Page 373 and 374:

EXHIBIT G Procedural Guide 0500-504

- Page 375 and 376:

EXHIBIT H of changes to the plan. (

- Page 377 and 378:

EXHIBIT I (e) The child's caretaker

- Page 379 and 380:

EXHIBIT I CSW in Concurrent Plannin

- Page 381 and 382:

Procedures A. WHEN: A CHILD IS DETA

- Page 383 and 384:

B. WHEN: A CHILD IS IN OUT-OF-HOME

- Page 385 and 386:

Dependency Investigator CSW Respons

- Page 387 and 388:

EXHIBIT I For offices who have impl

- Page 389 and 390:

EXHIBIT I FB1 Addendum, Family Back

- Page 391 and 392:

CHILD WELFARE SERVICES PROGRAM 31-4

- Page 393 and 394:

Department of the Treasury Internal

- Page 395 and 396:

DCFS FOSTER FAMILY AGENCY CONTRACT

- Page 397 and 398:

EXHIBIT N medication authorizations

- Page 399 and 400:

EXHIBIT N 5. The DCFS Division Chie

- Page 401 and 402:

EXHIBIT O 1. The lesser number is a

- Page 403 and 404:

EXHIBIT O COUNTY OF LOS ANGELES CON

- Page 405 and 406:

CONTRACTOR’S CERTIFICATION OF COM

- Page 407 and 408:

F I F I F I F I EXHIBIT R F O R Y O

- Page 409 and 410:

8. Does the child receive the sport

- Page 411 and 412:

EXHIBIT R 33. Is the child given th

- Page 413 and 414:

Every baby deserves a chance for a

- Page 415 and 416:

Es mejor que las mujeres busquen ay

- Page 417 and 418:

• Llámenos para recibir informac

- Page 419 and 420:

A. WHEN: A FAD INDICATES A POTENTIA

- Page 421 and 422:

EXHIBIT T O/P Collection EW 4. INVA

- Page 423 and 424:

EXHIBIT T NOTE: Overpayment recover

- Page 425 and 426:

Reconciliation EW 3. Receive the Ba

- Page 427 and 428:

Overpayment Recovery Unit ES WHO HO

- Page 429 and 430:

CHARITABLE CONTRIBUTIONS CERTIFICAT

- Page 431 and 432:

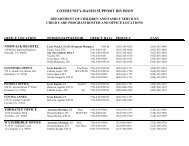

SERVICE DELIVERY SITES Foster Famil

- Page 433 and 434:

TABLE OF CONTENTS INTRODUCTION/SUMM

- Page 435 and 436:

PURPOSE/PHILOSOPHY STATEMENT These

- Page 437 and 438:

TEAMING PROCESS Family-Centered Tea

- Page 439 and 440:

COURT ORDERS Oftentimes, the judici

- Page 441 and 442:

First 24 Hours Child removed from p

- Page 443 and 444:

FAMILY VISITATION PLAN Prior to the

- Page 445 and 446:

• Whether or not the parent is a

- Page 447 and 448:

• Maintain objectivity, and remai

- Page 449 and 450:

Judicial Officers Judicial Officers

- Page 451 and 452:

Unless the FVP specifically states

- Page 453 and 454:

the visitation objectives. In addit

- Page 455 and 456:

Sexual Abuse Permanency Transportat

- Page 457 and 458:

SUBCOMMITTEE MEMBERS The Drafting S

- Page 459 and 460:

EXHIBIT Y of information, including

- Page 461 and 462:

EXHIBIT Y accounting of Disclosures

- Page 463 and 464:

DISCHARGE SUMMARY FOR DCFS: FOSTER

- Page 465 and 466:

INTENTIONALLY LEFT BLANK EXHIBIT BB

- Page 467 and 468:

SAMPLE CONTRACT COUNTY OF LOS ANGEL

- Page 469 and 470:

10.0 COMPLIANCE WITH CIVIL RIGHTS L

- Page 471 and 472:

Exhibit T Overpayments Exhibit U Gr

- Page 473 and 474:

WHEREAS, CONTRACTOR warrants that i

- Page 475 and 476:

2.0 DEFINITIONS Exhibit T Overpayme

- Page 477 and 478:

2.16 “Do Not Refer Status” or

- Page 479 and 480:

2.31 “Pool Rate” - means the ra

- Page 481 and 482:

notify COUNTY of such change. COUNT

- Page 483 and 484:

equivalent providing the CONTRACTOR

- Page 485 and 486:

a bed open for a Placed Child, CONT

- Page 487 and 488:

7.14 CONTRACTOR may appeal the fina

- Page 489 and 490:

9.2 If CONTRACTOR’s staff qualify

- Page 491 and 492:

10.11 COUNTY Workers shall provide

- Page 493 and 494:

13.0 FEES 12.1 CONTRACTOR shall mai

- Page 495 and 496:

Exhibit N, DCFS/Probation Group Hom

- Page 497 and 498:

16.0 FINANCIAL REPORTING 16.1 CONTR

- Page 499 and 500:

closing summary of CONTRACTOR's rec

- Page 501 and 502:

including but not limited to, the U

- Page 503 and 504:

19.6 Nothing herein precludes COUNT

- Page 505 and 506:

entirety; or (2) reduced in accorda

- Page 507 and 508:

accounted for and that unspent fund

- Page 509 and 510:

omissions, resulting from its perfo

- Page 511 and 512:

County of Los Angeles - Department

- Page 513 and 514:

4.0 BUDGET REDUCTIONS In the event

- Page 515 and 516:

6.2.3 The assurance that all employ

- Page 517 and 518:

CONTRACTOR hereby assures that it w

- Page 519 and 520:

12.3 CONTRACTOR shall comply with a

- Page 521 and 522:

modify, deny or adopt the proposed

- Page 523 and 524:

minimum waiting time for clearance.

- Page 525 and 526:

County of Los Angeles Department of

- Page 527 and 528:

eject children for placement consis

- Page 529 and 530:

30.0 DISCLOSURE OF INFORMATION 30.1

- Page 531 and 532:

33.7 CONTRACTOR shall obtain the fo

- Page 533 and 534:

35.0 TERMINATION FOR CONVENIENCE 35

- Page 535 and 536:

CONTRACTOR receives, has access to,

- Page 537 and 538:

COUNTY OF LOS ANGELES DEPARTMENT OF

- Page 539 and 540:

COUNTY OF LOS ANGELES DEPARTMENTS O

- Page 541 and 542:

• Safety and Survival; • Emotio

- Page 543 and 544:

Service Access Service providers wi

- Page 545 and 546:

The CONTRACTOR shall request approv

- Page 547 and 548:

Plan/Quarterly Reports in cooperati

- Page 549 and 550:

6.4 The CONTRACTOR’S Treatment Te

- Page 551 and 552:

PART C: SERVICE TASKS TO ACHIEVE PE

- Page 553 and 554:

1.0: SAFETY PERFORMANCE OUTCOME GOA

- Page 555 and 556:

Placed Children; and (2) abide by a

- Page 557 and 558:

(b) The CONTRACTOR shall use seclus

- Page 559 and 560:

PERFORMANCE OUTCOME SUMMARY 2.0 PER

- Page 561 and 562:

2.0: REUNIFICATION/PERMANENCY PERFO

- Page 563 and 564:

2.2 Visitation Plan: modification i

- Page 565 and 566:

(a) For infants from birth to 6 mon

- Page 567 and 568:

PERFORMANCE OUTCOME SUMMARY 3.0 WEL

- Page 569 and 570:

3.0 WELL-BEING PERFORMANCE OUTCOME

- Page 571 and 572:

(b) Two children’s rights recentl

- Page 573 and 574:

their responsibilities to pupils in

- Page 575 and 576:

3.2.8 Educational Assessments by th

- Page 577 and 578:

information such as immunizations g

- Page 579 and 580:

The CONTRACTOR shall have an emerge

- Page 581 and 582:

assistance with homework; (5) daily

- Page 583 and 584:

3.11.5 Clothing Fit, Appropriatenes

- Page 585 and 586:

placed with a minor parent if the C

- Page 587 and 588:

PART D - PERFORMANCE REQUIREMENT SU

- Page 589 and 590:

FOSTER YOUTH BILL OF RIGHTS EXHIBIT

- Page 591 and 592:

19. Residents have the right to con

- Page 593 and 594:

not prohibited by the resident's ne

- Page 595 and 596:

TABLE OF CONTENTS ii EXHIBIT A-II I

- Page 597 and 598:

OUT-OF-HOME CARE EXHIBIT A-II What

- Page 599 and 600:

EXHIBIT A-II What is a juvenile cou

- Page 601 and 602:

EXHIBIT A-II care still exist, if y

- Page 603 and 604:

EXHIBIT A-II Can I have an attorney

- Page 605 and 606:

TYPES OF PLACEMENTS EXHIBIT A-II Wh

- Page 607 and 608:

GUARDIANSHIP EXHIBIT A-II What is t

- Page 609 and 610:

INDEPENDENT LIVING EXHIBIT A-II Wha

- Page 611 and 612:

CONFIDENTIALITY AND YOUR RECORDS EX

- Page 613 and 614:

WHEN RECORDS ARE DESTROYED Juvenile

- Page 615 and 616:

MONEY EXHIBIT A-II Do I have a righ

- Page 617 and 618:

RELIGION Can my foster parents or N

- Page 619 and 620:

EXHIBIT A-II What if I can't get a

- Page 621 and 622:

EMANCIPATION EXHIBIT A-II What does

- Page 623 and 624:

EXHIBIT A-II What are the disadvant

- Page 625 and 626:

KNOW YOUR RIGHTS EXHIBIT A-II With

- Page 627 and 628:

DEFINITION INDEX The number refers

- Page 629 and 630:

ENDNOTES 1. The following abbreviat

- Page 631 and 632:

35. WIC 317(c) 36. WIC 317(d),(e) E

- Page 633 and 634:

84. VC 12814.6 85. VC 17701 86. FC

- Page 635 and 636:

PROBATION CASE PLAN FORM (PROB 1385

- Page 637 and 638:

EXHIBIT A-V 1. Describe Circumstanc

- Page 639 and 640:

EXHIBIT A-V Probation Officer’s R

- Page 641 and 642:

EXHIBIT A-V _______________________

- Page 643 and 644:

SIGNATURES: EXHIBIT A-V MINOR: THIS

- Page 645:

FOSTER CHILD’S NEEDS AND CASE PLA

- Page 663 and 664:

cc: to group home, child’s(ren’

- Page 665 and 666:

SPECIAL INCIDENT REPORTING GUIDE FO

- Page 667 and 668:

4 EXHIBIT A-VIII 5. SERIOUS INJURY,

- Page 669 and 670:

6 EXHIBIT A-VIII 10. SIGNIFICANT IN

- Page 671 and 672:

SCREENING REQUIREMENT PERIODICITY S

- Page 673 and 674:

Anticonvulsant medications, when pr

- Page 675 and 676:

Dr. faxes pages 1 & 2 of PMAF to th

- Page 677 and 678:

EXHIBIT A-X 2. Contact the physicia

- Page 679 and 680:

EXHIBIT A-X 1. Instruct the caregiv

- Page 681 and 682:

APPROVAL LEVELS Section Level Appro

- Page 683 and 684:

Group Home Organization: FORMAT FOR

- Page 685 and 686:

Exhibit A-XIIIa COUNTY OF LOS ANGEL

- Page 687 and 688:

Exhibit A-XIIIb COUNTY OF LOS ANGEL

- Page 689 and 690:

GROUP HOME PROGRAM STATEMENT EXHIBI

- Page 691 and 692:

TO THE HEADS OF EXECUTIVE DEPARTMEN

- Page 693 and 694:

implementation of individual provis

- Page 695 and 696:

E. Negotiation and Approval of Indi

- Page 697 and 698:

. The restraints or requirements im

- Page 699 and 700:

objectives of the organization are

- Page 701 and 702:

distribution base. The result of th

- Page 703 and 704:

special cost studies (such as an en

- Page 705 and 706:

other activity. The bases must be e

- Page 707 and 708:

g. The results of each negotiation

- Page 709 and 710:

49. Training costs 50. Transportati

- Page 711 and 712:

e. Costs identified in subparagraph

- Page 713 and 714:

compensation for employees on feder

- Page 715 and 716:

(3) Excise taxes on accumulated fun

- Page 717 and 718:

with certainty as to time, intensit

- Page 719 and 720:

appeals, antitrust suits, or the pr

- Page 721 and 722:

(1) Donated or volunteer services m

- Page 723 and 724:

(1) Capital expenditures for genera

- Page 725 and 726:

(2) "Idle facilities" means complet

- Page 727 and 728:

enovations, alterations, equipment,

- Page 729 and 730:

. For non-profit organizations subj

- Page 731 and 732:

already required or maintained. Als

- Page 733 and 734:

see paragraphs 37., Professional se

- Page 735 and 736:

41. Recruiting costs. a. Subject to

- Page 737 and 738:

continued to own the property. This

- Page 739 and 740:

48. Termination costs applicable to

- Page 741 and 742:

(3) Fees charges by the educational

- Page 743 and 744:

e. Foreign travel. Direct charges f

- Page 745 and 746:

Southern Research Institute, Birmin

- Page 747 and 748:

A-C Handbook Page 1 AUDITOR-CONTROL

- Page 749 and 750:

A-C Handbook Page 3 2.2 Cash Receip

- Page 751 and 752:

A-C Handbook Page 5 If a Payroll Re

- Page 753 and 754:

A-C Handbook Page 7 Outside Meals -

- Page 755 and 756:

A-C Handbook Page 9 CONTRACTOR shal

- Page 757 and 758:

A-C Handbook Page 11 2.3 Petty Cash

- Page 759 and 760:

A-C Handbook Page 13 Salaried emplo

- Page 761 and 762:

A-C Handbook Page 15 Indirect Cost

- Page 763 and 764:

A-C Handbook Page 17 2.3 Acceptable

- Page 765 and 766:

A-C Handbook Page 19 D. UNALLOWABLE

- Page 767 and 768:

EXHIBIT C-II AUDITOR-CONTROLLER/DEP

- Page 769 and 770:

EXHIBIT C-II circumstances, the ent

- Page 771 and 772:

EXHIBIT C-II At the pre-exit meetin

- Page 773 and 774:

EXHIBIT C-II will be provided with

- Page 775 and 776:

CONTRACTOR EMPLOYEE ACKNOWLEDGEMENT

- Page 777 and 778:

Group Home Semi-Annual Expenditure

- Page 779 and 780:

EXHIBIT F (D) If the State Departme

- Page 781 and 782:

EXHIBIT F (C) Individuals who are e

- Page 783 and 784:

EXHIBIT F subdivision (g). The Stat

- Page 785 and 786:

EXHIBIT F processing. (B) Upon requ

- Page 787 and 788:

EXHIBIT F self-addressed envelope f

- Page 789 and 790:

EXHIBIT F shall disclose that clien

- Page 791 and 792:

EXHIBIT F state, would have been pu

- Page 793 and 794:

statement, fingerprints and photogr

- Page 795 and 796:

Name, Address and Telephone Number

- Page 797 and 798:

EXHIBIT G If a CSW or SCSW has any

- Page 799 and 800:

EXHIBIT G 10) minute orders and cou

- Page 801 and 802:

0500-501.20 (Rev 12/02) EXHIBIT G 4

- Page 803 and 804:

EXHIBIT G See Procedural Guide 0200

- Page 805 and 806:

EXHIBIT G that the research will no

- Page 807 and 808:

EXHIBIT G detrimental to the safety

- Page 809 and 810:

EXHIBIT G Procedural Guide 0500-504

- Page 811 and 812:

EXHIBIT H of changes to the plan. (

- Page 813 and 814:

EXHIBIT I (e) The child's caretaker

- Page 815 and 816:

EXHIBIT I CSW in Concurrent Plannin

- Page 817 and 818:

Procedures A. WHEN: A CHILD IS DETA

- Page 819 and 820:

B. WHEN: A CHILD IS IN OUT-OF-HOME

- Page 821 and 822:

Dependency Investigator CSW Respons

- Page 823 and 824:

EXHIBIT I For offices who have impl

- Page 825 and 826:

EXHIBIT I FB1 Addendum, Family Back

- Page 827 and 828:

CHILD WELFARE SERVICES PROGRAM 31-4

- Page 829 and 830:

CHILD WELFARE SERVICES PROGRAM 31-4

- Page 831 and 832:

Department of the Treasury Internal

- Page 833 and 834:

DCFS GROUP HOME CONTRACT INVESTIGAT

- Page 835 and 836:

EXHIBIT N c) insufficient or poor f

- Page 837 and 838:

EXHIBIT N 5. The Division Chief or

- Page 839 and 840:

EXHIBIT O 1. The lesser number is a

- Page 841 and 842:

EXHIBIT O COUNTY OF LOS ANGELES CON

- Page 843 and 844:

CONTRACTOR’S CERTIFICATION OF COM

- Page 845 and 846:

F I F I F I F I EXHIBIT R F O R Y O

- Page 847 and 848:

8. Does the child receive the sport

- Page 849 and 850:

EXHIBIT R 33. Is the child given th

- Page 851 and 852:

It is best that women seek help to

- Page 853 and 854:

Safely Surrendered Baby Hotline (87

- Page 855 and 856:

Cada recién nacido merece una opor

- Page 857 and 858:

DATE OF ISSUE: APPLICABLE TO: LEGAL

- Page 859 and 860:

TA/EW b) INVALID OVERPAYMENT EXHIBI

- Page 861 and 862:

WHO HOW following conditions exist:

- Page 863 and 864:

EXHIBIT T Deposit EW 3. Reconcile t

- Page 865 and 866:

O/P Collection EW b) Enter the stat

- Page 867:

c) FAD Exception Distribution d) Ov

- Page 872 and 873:

s mobility and independent function

- Page 874 and 875:

1180.3. (a) This section shall appl

- Page 876 and 877:

(A) Obesity. (B) Pregnancy. (C) Agi

- Page 878 and 879:

PROBATION QUARTERLY REPORT FORMAT E

- Page 880 and 881:

Name of School: Address of School:

- Page 882 and 883:

Date Type Los Angeles County Probat

- Page 884 and 885:

Are there any SIRS to report? Yes N

- Page 886 and 887:

TARGET POPULATIONS WITH CORRESPONDI

- Page 888 and 889:

EXHIBIT Y THE TARGET POPULATION FOR

- Page 890 and 891:

CONTRACT NO. COUNTY PROGRAM DIRECTO

- Page 892 and 893:

EXHIBIT CC LOS ANGELES COUNTY SUPER

- Page 894 and 895:

INTRODUCTION/SUMMARY In June, 2005,

- Page 896 and 897:

elatives) should reflect the unique

- Page 898 and 899:

Additionally, every effort should b

- Page 900 and 901:

DEPENDENCY CASE STAGES Stage 1: Pre

- Page 902 and 903:

The Pre-Disposition Family Visitati

- Page 904 and 905:

PRELIMINARY CONSIDERATIONS/FACTORS

- Page 906 and 907:

• Provide a drug/weapon/violence

- Page 908 and 909:

• Give parents suggestions for wh

- Page 910 and 911:

Visitation Objectives (reason for e

- Page 912 and 913:

issues specific to teen parents. Th

- Page 914 and 915:

Circumstance Team Response in FVP

- Page 916 and 917:

BIBLIOGRAPHY Casey Family Programs.

- Page 918 and 919:

Reporting Runaways A Guide for Care

- Page 920 and 921:

CONTRACTOR’S OBLIGATIONS UNDER HI

- Page 922 and 923:

213-974-2166 EXHIBIT EE The initial

- Page 924 and 925:

5.0 MISCELLANEOUS EXHIBIT EE agents

- Page 926 and 927:

CONTRACTOR’S NAME: CONTRACT NO. C

- Page 928 and 929:

BACKGROUND AND RESOURCES: CALIFORNI

- Page 930 and 931:

It is best that women seek help to

- Page 932 and 933:

Safely Surrendered Baby Hotline (87

- Page 934 and 935:

Cada recién nacido merece una opor

- Page 936 and 937:

2.203.010 Findings. Chapter 2.203,

- Page 938:

APPENDIX M following: 1. Has ten or