team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

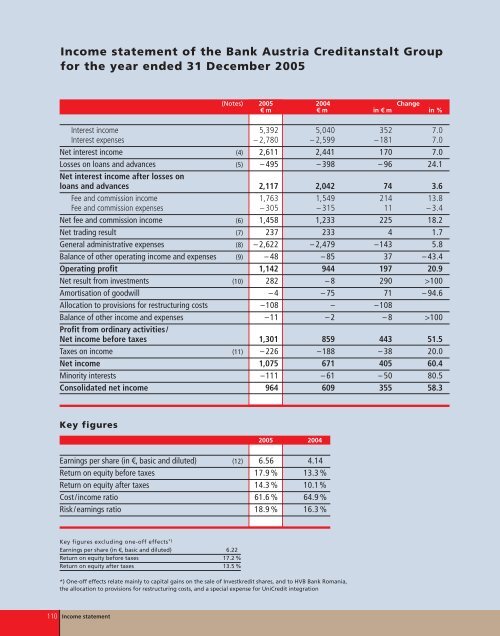

Income statement of the Bank Austria Creditanstalt Group<br />

for the year ended 31 December 2005<br />

110 Income statement<br />

(Notes) 2005 2004 Change<br />

€ m € m in € m in %<br />

Interest income 5,392 5,040 352 7.0<br />

Interest expenses – 2,780 – 2,599 –181 7.0<br />

Net interest income (4) 2,611 2,441 170 7.0<br />

Losses on loans and advances (5) – 495 – 398 – 96 24.1<br />

Net interest income after losses on<br />

loans and advances 2,117 2,042 74 3.6<br />

Fee and commission income 1,763 1,549 214 13.8<br />

Fee and commission expenses – 305 – 315 11 – 3.4<br />

Net fee and commission income (6) 1,458 1,233 225 18.2<br />

Net trading result (7) 237 233 4 1.7<br />

General administrative expenses (8) – 2,622 – 2,479 –143 5.8<br />

Balance of other operating income and expenses (9) – 48 – 85 37 – 43.4<br />

Operating profit 1,142 944 197 20.9<br />

Net result from investments (10) 282 – 8 290 >100<br />

Amortisation of goodwill – 4 – 75 71 – 94.6<br />

Allocation to provisions for restructuring costs –108 – –108<br />

Balance of other income and expenses –11 – 2 – 8 >100<br />

Profit from ordinary activities/<br />

Net income before taxes 1,301 859 443 51.5<br />

Taxes on income (11) – 226 –188 – 38 20.0<br />

Net income 1,075 671 405 60.4<br />

Minority interests –111 – 61 – 50 80.5<br />

Consolidated net income 964 609 355 58.3<br />

Key figures<br />

2005 2004<br />

Earnings per share (in €, basic and diluted) (12) 6.56 4.14<br />

Return on equity before taxes 17.9 % 13.3 %<br />

Return on equity after taxes 14.3 % 10.1%<br />

Cost/income ratio 61.6 % 64.9 %<br />

Risk/earnings ratio 18.9 % 16.3 %<br />

Key figures excluding one-off effects *)<br />

Earnings per share (in €, basic and diluted) 6.22<br />

Return on equity before taxes 17.2 %<br />

Return on equity after taxes 13.5 %<br />

*) One-off effects relate mainly to capital gains on the sale of Investkredit shares, and to HVB Bank Romania,<br />

the allocation to provisions for restructuring costs, and a special expense for UniCredit integration