team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report of the Group<br />

Overview<br />

� Bank Austria Creditanstalt showed a steady upward trend<br />

in its performance in the past years and achieved record results<br />

for 2005: operating profit has improved from year to year over<br />

the past five years; from 2004 to 2005, the increase was<br />

21%, to € 1,142 m. Net income amounted to € 1,075 m, an<br />

increase of 60 %; after deduction of minority interests, consolidated<br />

net income for 2005 was € 964 m, up by 58 %. Earnings<br />

per share increased from € 4.14 in 2004 to € 6.56, after<br />

first-time ap<strong>pl</strong>ication effects resulting from amended and new<br />

IFRSs. Since the launch of BA-CA shares on the stock market<br />

on 8 July 2003, market capitalisation – i.e., the bank’s value –<br />

has risen from € 4.3 bn to € 13.8 bn at the end of 2005. This<br />

means that Bank Austria Creditanstalt remains one of the<br />

three companies with the highest stock market valuation in<br />

Austria. The dynamic growth of profits and market capitalisation<br />

reflects the strong increase in profitability and the confidence<br />

of the capital market in the Group’s performance.<br />

The good results for 2005 confirm the bank’s consistent pursuit<br />

of value-creating growth and capital allocation, sustainable<br />

earnings improvement and efficiency enhancement in the last<br />

five years: the consolidation process in Austria (com<strong>pl</strong>eted with<br />

the merger of Bank Austria and Creditanstalt in 2002) was followed<br />

by the integration of CEE subsidiaries of HVB and BA-CA<br />

(essentially in 2001 and 2002). In the past two years we<br />

switched to expansion in profitable business segments and<br />

enhanced efficiency in retail customer business and back-office<br />

activities.<br />

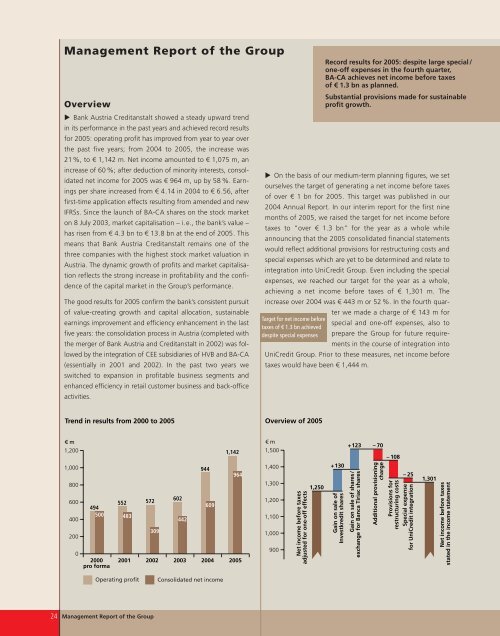

Trend in results from 2000 to 2005<br />

€ m<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

494<br />

500<br />

2000<br />

pro forma<br />

552<br />

483<br />

572<br />

24 Management Report of the Group<br />

309<br />

602<br />

442<br />

944<br />

609<br />

2001 2002 2003 2004 2005<br />

Operating profit Consolidated net income<br />

1,142<br />

964<br />

� On the basis of our medium-term <strong>pl</strong>anning figures, we set<br />

ourselves the target of generating a net income before taxes<br />

of over € 1 bn for 2005. This target was published in our<br />

2004 Annual Report. In our interim report for the first nine<br />

months of 2005, we raised the target for net income before<br />

taxes to “over € 1.3 bn” for the year as a whole while<br />

announcing that the 2005 consolidated financial statements<br />

would reflect additional provisions for restructuring costs and<br />

special expenses which are yet to be determined and relate to<br />

integration into UniCredit Group. Even including the special<br />

expenses, we reached our target for the year as a whole,<br />

achieving a net income before taxes of € 1,301 m. The<br />

increase over 2004 was € 443 m or 52 %. In the fourth quarter<br />

we made a charge of € 143 m for<br />

Target for net income before<br />

special and one-off expenses, also to<br />

taxes of € 1.3 bn achieved<br />

despite special expenses prepare the Group for future requirements<br />

in the course of integration into<br />

UniCredit Group. Prior to these measures, net income before<br />

taxes would have been € 1,444 m.<br />

Overview of 2005<br />

€ m<br />

1,500<br />

1,400<br />

1,300<br />

1,200<br />

1,100<br />

1,000<br />

900<br />

Net income before taxes<br />

adjusted for one-off effects<br />

1,250<br />

Record results for 2005: despite large special/<br />

one-off expenses in the fourth quarter,<br />

BA-CA achieves net income before taxes<br />

of € 1.3 bn as <strong>pl</strong>anned.<br />

Substantial provisions made for sustainable<br />

profit growth.<br />

+130<br />

Gain on sale of<br />

Investkredit shares<br />

+123<br />

Gain on sale of shares/<br />

exchange for Banca Tiriac shares<br />

–70<br />

Additional provisioning<br />

charge<br />

– 108<br />

Provisions for<br />

restructuring costs<br />

–25<br />

Special expense<br />

for UniCredit integration<br />

1,301<br />

Net income before taxes<br />

stated in the income statement