team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

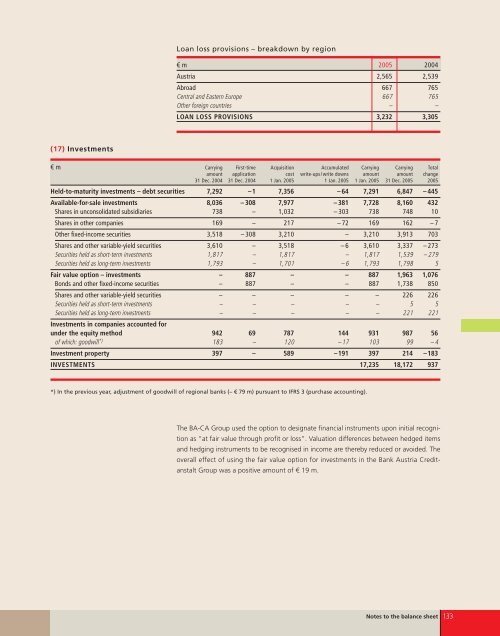

(17) Investments<br />

Loan loss provisions – breakdown by region<br />

€ m 2005 2004<br />

Austria 2,565 2,539<br />

Abroad 667 765<br />

Central and Eastern Europe 667 765<br />

Other foreign countries – –<br />

LOAN LOSS PROVISIONS 3,232 3,305<br />

€ m Carrying First-time Acquisition Accumulated Carrying Carrying Total<br />

amount ap<strong>pl</strong>ication cost write-ups/write downs amount amount change<br />

31 Dec. 2004 31 Dec. 2004 1 Jan. 2005 1 Jan. 2005 1 Jan. 2005 31 Dec. 2005 2005<br />

Held-to-maturity investments – debt securities 7,292 –1 7,356 – 64 7,291 6,847 – 445<br />

Available-for-sale investments 8,036 – 308 7,977 – 381 7,728 8,160 432<br />

Shares in unconsolidated subsidiaries 738 – 1,032 – 303 738 748 10<br />

Shares in other companies 169 – 217 – 72 169 162 – 7<br />

Other fixed-income securities 3,518 – 308 3,210 – 3,210 3,913 703<br />

Shares and other variable-yield securities 3,610 – 3,518 – 6 3,610 3,337 – 273<br />

Securities held as short-term investments 1,817 – 1,817 – 1,817 1,539 – 279<br />

Securities held as long-term investments 1,793 – 1,701 – 6 1,793 1,798 5<br />

Fair value option – investments – 887 – – 887 1,963 1,076<br />

Bonds and other fixed-income securities – 887 – – 887 1,738 850<br />

Shares and other variable-yield securities – – – – – 226 226<br />

Securities held as short-term investments – – – – – 5 5<br />

Securities held as long-term investments<br />

Investments in companies accounted for<br />

– – – – – 221 221<br />

under the equity method 942 69 787 144 931 987 56<br />

of which: goodwill *) 183 – 120 –17 103 99 – 4<br />

Investment property 397 – 589 –191 397 214 –183<br />

INVESTMENTS 17,235 18,172 937<br />

*) In the previous year, adjustment of goodwill of regional banks (– € 79 m) pursuant to IFRS 3 (purchase accounting).<br />

The BA-CA Group used the option to designate financial instruments upon initial recognition<br />

as “at fair value through profit or loss”. Valuation differences between hedged items<br />

and hedging instruments to be recognised in income are thereby reduced or avoided. The<br />

overall effect of using the fair value option for investments in the Bank Austria Creditanstalt<br />

Group was a positive amount of € 19 m.<br />

Notes to the balance sheet 133