team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

higher revenue without significant increases in business volume<br />

and allocation of capital, such as International Markets,<br />

asset management and business with large corporates.<br />

In 2005, the bank’s risk-weighted assets increased by an<br />

average 7 % or € 5.1 bn to € 75.4 bn. While this growth was<br />

driven by the CEE business segment (up by 26 %), business<br />

volume also expanded in line with the bank’s strategy in the<br />

Private Customers Austria segment (up by 19 %). In its business<br />

with companies, both large-volume and in the mid-market<br />

segment, the bank’s efforts were, and still are, focused on<br />

reducing the loan portfolio – independently of customer lending<br />

activities – through secondary market <strong>pl</strong>acements and by<br />

passing risks on through appropriate derivatives. In 2005 the<br />

bank in this way reduced its risk-weighted assets in the Large<br />

Corporates and Real Estate business segment by € 1.9 bn or<br />

9 %, of which about € 700 m was passed on to Active Credit<br />

Portfolio Management (which however belongs to the same<br />

business segment, so that the net reduction is € 1.2 bn or<br />

6 %). A further exam<strong>pl</strong>e of this strategy is the securitisation<br />

transaction with which BA-CA Leasing securitised contracts<br />

totalling € 425 m relating to its Austrian leasing business in<br />

equipment and vehicles, and sold them on the capital market.<br />

In the International Markets segment, the bank has reduced<br />

on-balance sheet business to the required minimum over the<br />

past years and conducted trading activities mainly via derivatives.<br />

Fee-based business is growing strongly in both this segment<br />

and in business with SMEs.<br />

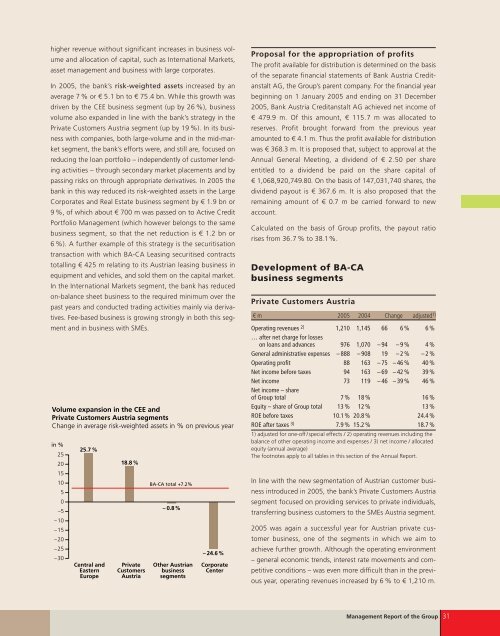

Volume expansion in the CEE and<br />

Private Customers Austria segments<br />

Change in average risk-weighted assets in % on previous year<br />

in %<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

–5<br />

–10<br />

–15<br />

–20<br />

–25<br />

–30<br />

25.7 %<br />

Central and<br />

Eastern<br />

Europe<br />

18.8%<br />

Private<br />

Customers<br />

Austria<br />

BA-CA total +7.2%<br />

–0.8%<br />

Other Austrian<br />

business<br />

segments<br />

– 24.6%<br />

Corporate<br />

Center<br />

Proposal for the appropriation of profits<br />

The profit available for distribution is determined on the basis<br />

of the separate financial statements of Bank Austria Creditanstalt<br />

AG, the Group’s parent company. For the financial year<br />

beginning on 1 January 2005 and ending on 31 December<br />

2005, Bank Austria Creditanstalt AG achieved net income of<br />

€ 479.9 m. Of this amount, € 115.7 m was allocated to<br />

reserves. Profit brought forward from the previous year<br />

amounted to € 4.1 m. Thus the profit available for distribution<br />

was € 368.3 m. It is proposed that, subject to approval at the<br />

Annual General Meeting, a dividend of € 2.50 per share<br />

entitled to a dividend be paid on the share capital of<br />

€ 1,068,920,749.80. On the basis of 147,031,740 shares, the<br />

dividend payout is € 367.6 m. It is also proposed that the<br />

remaining amount of € 0.7 m be carried forward to new<br />

account.<br />

Calculated on the basis of Group profits, the payout ratio<br />

rises from 36.7 % to 38.1%.<br />

Development of BA-CA<br />

business segments<br />

Private Customers Austria<br />

€ m 2005 2004 Change adjusted 1)<br />

Operating revenues 2) … after net charge for losses<br />

1,210 1,145 66 6 % 6 %<br />

on loans and advances 976 1,070 – 94 – 9 % 4 %<br />

General administrative expenses – 888 – 908 19 – 2 % – 2 %<br />

Operating profit 88 163 – 75 – 46 % 40 %<br />

Net income before taxes 94 163 – 69 – 42 % 39 %<br />

Net income<br />

Net income – share<br />

73 119 – 46 – 39 % 46 %<br />

of Group total 7 % 18 % 16 %<br />

Equity – share of Group total 13 % 12 % 13 %<br />

ROE before taxes 10.1% 20.8 % 24.4 %<br />

ROE after taxes 3) 7.9 % 15.2 % 18.7 %<br />

1) adjusted for one-off/special effects / 2) operating revenues including the<br />

balance of other operating income and expenses / 3) net income / allocated<br />

equity (annual average)<br />

The footnotes ap<strong>pl</strong>y to all tables in this section of the Annual Report.<br />

In line with the new segmentation of Austrian customer business<br />

introduced in 2005, the bank’s Private Customers Austria<br />

segment focused on providing services to private individuals,<br />

transferring business customers to the SMEs Austria segment.<br />

2005 was again a successful year for Austrian private customer<br />

business, one of the segments in which we aim to<br />

achieve further growth. Although the operating environment<br />

– general economic trends, interest rate movements and competitive<br />

conditions – was even more difficult than in the previous<br />

year, operating revenues increased by 6 % to € 1,210 m.<br />

Management Report of the Group 31