team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

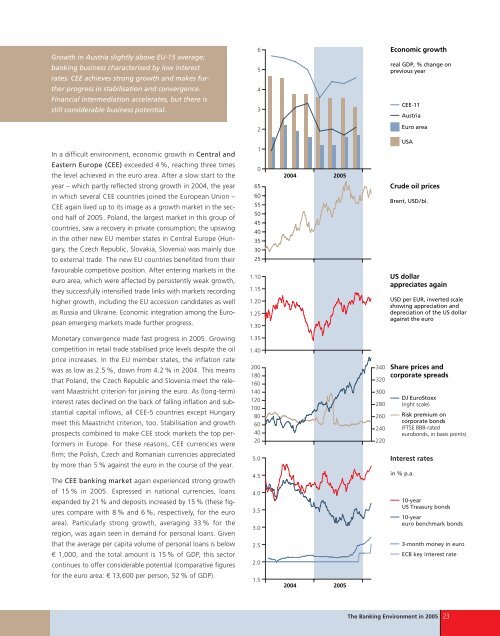

Growth in Austria slightly above EU-15 average;<br />

banking business characterised by low interest<br />

rates. CEE achieves strong growth and makes further<br />

progress in stabilisation and convergence.<br />

Financial intermediation accelerates, but there is<br />

still considerable business potential.<br />

In a difficult environment, economic growth in Central and<br />

Eastern Europe (CEE) exceeded 4 %, reaching three times<br />

the level achieved in the euro area. After a slow start to the<br />

year – which partly reflected strong growth in 2004, the year<br />

in which several CEE countries joined the European Union –<br />

CEE again lived up to its image as a growth market in the second<br />

half of 2005. Poland, the largest market in this group of<br />

countries, saw a recovery in private consumption; the upswing<br />

in the other new EU member states in Central Europe (Hungary,<br />

the Czech Republic, Slovakia, Slovenia) was mainly due<br />

to external trade. The new EU countries benefited from their<br />

favourable competitive position. After entering markets in the<br />

euro area, which were affected by persistently weak growth,<br />

they successfully intensified trade links with markets recording<br />

higher growth, including the EU accession candidates as well<br />

as Russia and Ukraine. Economic integration among the European<br />

emerging markets made further progress.<br />

Monetary convergence made fast progress in 2005. Growing<br />

competition in retail trade stabilised price levels despite the oil<br />

price increases. In the EU member states, the inflation rate<br />

was as low as 2.5 %, down from 4.2 % in 2004. This means<br />

that Poland, the Czech Republic and Slovenia meet the relevant<br />

Maastricht criterion for joining the euro. As (long-term)<br />

interest rates declined on the back of falling inflation and substantial<br />

capital inflows, all CEE-5 countries except Hungary<br />

meet this Maastricht criterion, too. Stabilisation and growth<br />

prospects combined to make CEE stock markets the top performers<br />

in Europe. For these reasons, CEE currencies were<br />

firm; the Polish, Czech and Romanian currencies appreciated<br />

by more than 5 % against the euro in the course of the year.<br />

The CEE banking market again experienced strong growth<br />

of 15 % in 2005. Expressed in national currencies, loans<br />

expanded by 21% and deposits increased by 15 % (these figures<br />

compare with 8 % and 6 %, respectively, for the euro<br />

area). Particularly strong growth, averaging 33 % for the<br />

region, was again seen in demand for personal loans. Given<br />

that the average per capita volume of personal loans is below<br />

€ 1,000, and the total amount is 15 % of GDP, this sector<br />

continues to offer considerable potential (comparative figures<br />

for the euro area: € 13,600 per person, 52 % of GDP).<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

1.10<br />

1.15<br />

1.20<br />

1.25<br />

1.30<br />

1.35<br />

1.40<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

2004 2005<br />

2004 2005<br />

340<br />

320<br />

300<br />

280<br />

260<br />

240<br />

220<br />

Economic growth<br />

real GDP, % change on<br />

previous year<br />

CEE-11<br />

Austria<br />

Euro area<br />

USA<br />

Crude oil prices<br />

Brent, USD/bl.<br />

US dollar<br />

appreciates again<br />

USD per EUR, inverted scale<br />

showing appreciation and<br />

depreciation of the US dollar<br />

against the euro<br />

Share prices and<br />

corporate spreads<br />

DJ EuroStoxx<br />

(right scale)<br />

Risk premium on<br />

corporate bonds<br />

(FTSE BBB-rated<br />

eurobonds, in basis points)<br />

Interest rates<br />

in % p.a.<br />

10-year<br />

US Treasury bonds<br />

10-year<br />

euro benchmark bonds<br />

3-month money in euro<br />

ECB key interest rate<br />

The Banking Environment in 2005 23