team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

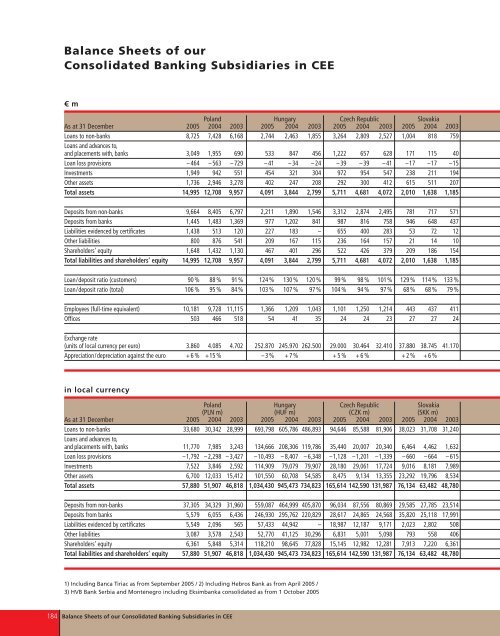

Balance Sheets of our<br />

Consolidated Banking Subsidiaries in CEE<br />

€ m<br />

Poland Hungary Czech Republic Slovakia<br />

As at 31 December 2005 2004 2003 2005 2004 2003 2005 2004 2003 2005 2004 2003<br />

Loans to non-banks 8,725 7,428 6,168 2,744 2,463 1,855 3,264 2,809 2,527 1,004 818 759<br />

Loans and advances to,<br />

and <strong>pl</strong>acements with, banks 3,049 1,955 690 533 847 456 1,222 657 628 171 115 40<br />

Loan loss provisions – 464 – 563 – 729 – 41 – 34 – 24 – 39 – 39 – 41 –17 –17 –15<br />

Investments 1,949 942 551 454 321 304 972 954 547 238 211 194<br />

Other assets 1,736 2,946 3,278 402 247 208 292 300 412 615 511 207<br />

Total assets 14,995 12,708 9,957 4,091 3,844 2,799 5,711 4,681 4,072 2,010 1,638 1,185<br />

Deposits from non-banks 9,664 8,405 6,797 2,211 1,890 1,546 3,312 2,874 2,495 781 717 571<br />

Deposits from banks 1,445 1,483 1,369 977 1,202 841 987 816 758 946 648 437<br />

Liabilities evidenced by certificates 1,438 513 120 227 183 – 655 400 283 53 72 12<br />

Other liabilities 800 876 541 209 167 115 236 164 157 21 14 10<br />

Shareholders’ equity 1,648 1,432 1,130 467 401 296 522 426 379 209 186 154<br />

Total liabilities and shareholders’ equity 14,995 12,708 9,957 4,091 3,844 2,799 5,711 4,681 4,072 2,010 1,638 1,185<br />

Loan/deposit ratio (customers) 90 % 88 % 91% 124 % 130 % 120 % 99 % 98 % 101% 129 % 114 % 133 %<br />

Loan/deposit ratio (total) 106 % 95 % 84 % 103 % 107 % 97 % 104 % 94 % 97 % 68 % 68 % 79 %<br />

Em<strong>pl</strong>oyees (full-time equivalent) 10,181 9,728 11,115 1,366 1,209 1,043 1,101 1,250 1,214 443 437 411<br />

Offices 503 466 518 54 41 35 24 24 23 27 27 24<br />

Exchange rate<br />

(units of local currency per euro) 3.860 4.085 4.702 252.870 245.970 262.500 29.000 30.464 32.410 37.880 38.745 41.170<br />

Appreciation/depreciation against the euro + 6 % +15 % – 3 % + 7 % + 5 % + 6 % + 2 % + 6 %<br />

in local currency<br />

Poland Hungary Czech Republic Slovakia<br />

(PLN m) (HUF m) (CZK m) (SKK m)<br />

As at 31 December 2005 2004 2003 2005 2004 2003 2005 2004 2003 2005 2004 2003<br />

Loans to non-banks 33,680 30,342 28,999 693,798 605,786 486,893 94,646 85,588 81,906 38,023 31,708 31,240<br />

Loans and advances to,<br />

and <strong>pl</strong>acements with, banks 11,770 7,985 3,243 134,666 208,306 119,786 35,440 20,007 20,340 6,464 4,462 1,632<br />

Loan loss provisions –1,792 – 2,298 – 3,427 –10,493 – 8,407 – 6,348 –1,128 –1,201 –1,339 – 660 – 664 – 615<br />

Investments 7,522 3,846 2,592 114,909 79,079 79,907 28,180 29,061 17,724 9,016 8,181 7,989<br />

Other assets 6,700 12,033 15,412 101,550 60,708 54,585 8,475 9,134 13,355 23,292 19,796 8,534<br />

Total assets 57,880 51,907 46,818 1,034,430 945,473 734,823 165,614 142,590 131,987 76,134 63,482 48,780<br />

Deposits from non-banks 37,305 34,329 31,960 559,087 464,999 405,870 96,034 87,556 80,869 29,585 27,785 23,514<br />

Deposits from banks 5,579 6,055 6,436 246,930 295,762 220,829 28,617 24,865 24,568 35,820 25,118 17,991<br />

Liabilities evidenced by certificates 5,549 2,096 565 57,433 44,942 – 18,987 12,187 9,171 2,023 2,802 508<br />

Other liabilities 3,087 3,578 2,543 52,770 41,125 30,296 6,831 5,001 5,098 793 558 406<br />

Shareholders’ equity 6,361 5,848 5,314 118,210 98,645 77,828 15,145 12,982 12,281 7,913 7,220 6,361<br />

Total liabilities and shareholders’ equity 57,880 51,907 46,818 1,034,430 945,473 734,823 165,614 142,590 131,987 76,134 63,482 48,780<br />

1) Including Banca Tiriac as from September 2005 / 2) Including Hebros Bank as from April 2005 /<br />

3) HVB Bank Serbia and Montenegro including Eksimbanka consolidated as from 1 October 2005<br />

184 Balance Sheets of our Consolidated Banking Subsidiaries in CEE