team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

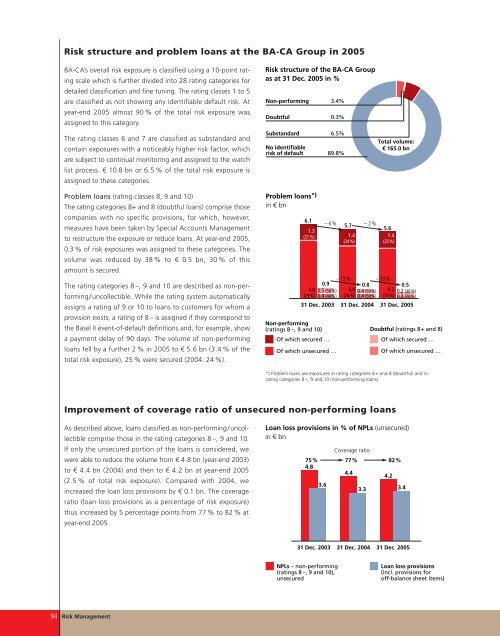

Risk structure and problem loans at the BA-CA Group in 2005<br />

BA-CA’s overall risk exposure is classified using a 10-point rating<br />

scale which is further divided into 28 rating categories for<br />

detailed classification and fine tuning. The rating classes 1 to 5<br />

are classified as not showing any identifiable default risk. At<br />

year-end 2005 almost 90 % of the total risk exposure was<br />

assigned to this category.<br />

The rating classes 6 and 7 are classified as substandard and<br />

contain exposures with a noticeably higher risk factor, which<br />

are subject to continual monitoring and assigned to the watch<br />

list process. € 10.8 bn or 6.5 % of the total risk exposure is<br />

assigned to these categories.<br />

Problem loans (rating classes 8, 9 and 10)<br />

The rating categories 8+ and 8 (doubtful loans) comprise those<br />

companies with no specific provisions, for which, however,<br />

measures have been taken by Special Accounts Management<br />

to restructure the exposure or reduce loans. At year-end 2005,<br />

0.3 % of risk exposures was assigned to these categories. The<br />

volume was reduced by 38 % to € 0.5 bn, 30 % of this<br />

amount is secured.<br />

The rating categories 8 –, 9 and 10 are described as non-performing/uncollectible.<br />

While the rating system automatically<br />

assigns a rating of 9 or 10 to loans to customers for whom a<br />

provision exists, a rating of 8 – is assigned if they correspond to<br />

the Basel II event-of-default definitions and, for exam<strong>pl</strong>e, show<br />

a payment delay of 90 days. The volume of non-performing<br />

loans fell by a further 2 % in 2005 to € 5.6 bn (3.4 % of the<br />

total risk exposure), 25 % were secured (2004: 24 %).<br />

As described above, loans classified as non-performing/uncollectible<br />

comprise those in the rating categories 8 –, 9 and 10.<br />

If only the unsecured portion of the loans is considered, we<br />

were able to reduce the volume from € 4.8 bn (year-end 2003)<br />

to € 4.4 bn (2004) and then to € 4.2 bn at year-end 2005<br />

(2.5 % of total risk exposure). Compared with 2004, we<br />

increased the loan loss provisions by € 0.1 bn. The coverage<br />

ratio (loan loss provisions as a percentage of risk exposure)<br />

thus increased by 5 percentage points from 77 % to 82 % at<br />

year-end 2005.<br />

94 Risk Management<br />

Risk structure of the BA-CA Group<br />

as at 31 Dec. 2005 in %<br />

Non-performing 3.4%<br />

Doubtful 0.3%<br />

Substandard 6.5%<br />

No identifiable<br />

risk of default 89.8%<br />

Problem loans *)<br />

in € bn<br />

6.1<br />

1.3<br />

(21%)<br />

– 6%<br />

0.9<br />

4.8 0.5 (56%)<br />

(79%) 0.4 (44%)<br />

31 Dec. 2003<br />

Non-performing<br />

(ratings 8 –, 9 and 10)<br />

Of which secured …<br />

Of which unsecured …<br />

5.7<br />

1.4<br />

(24%)<br />

–13%<br />

4.4<br />

(76%)<br />

–2%<br />

0.8<br />

0.4 (50%)<br />

0.4 (50%)<br />

Total volume:<br />

€ 165.0 bn<br />

5.6<br />

1.4<br />

(25%)<br />

–38%<br />

0.5<br />

4.2 0.2 (30%)<br />

(75%) 0.3 (70%)<br />

31 Dec. 2004 31 Dec. 2005<br />

Doubtful (ratings 8+ and 8)<br />

Of which secured …<br />

Of which unsecured …<br />

*) Problem loans are exposures in rating categories 8 + and 8 (doubtful) and in<br />

rating categories 8 –, 9 and 10 (non-performing loans)<br />

Improvement of coverage ratio of unsecured non-performing loans<br />

Loan loss provisions in % of NPLs (unsecured)<br />

in € bn<br />

75%<br />

4.8<br />

3.6<br />

31 Dec. 2003<br />

NPLs – non-performing<br />

(ratings 8 –, 9 and 10),<br />

unsecured<br />

Coverage ratio<br />

77% 82%<br />

4.4<br />

3.3<br />

4.2<br />

3.4<br />

31 Dec. 2004 31 Dec. 2005<br />

Loan loss provisions<br />

(incl. provisions for<br />

off-balance sheet items)