team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

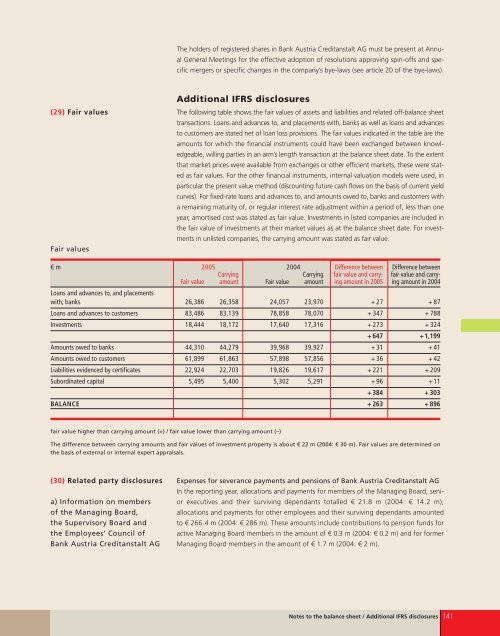

(29) Fair values<br />

Fair values<br />

The holders of registered shares in Bank Austria Creditanstalt AG must be present at Annual<br />

General Meetings for the effective adoption of resolutions approving spin-offs and specific<br />

mergers or specific changes in the company’s bye-laws (see article 20 of the bye-laws).<br />

Additional IFRS disclosures<br />

The following table shows the fair values of assets and liabilities and related off-balance sheet<br />

transactions. Loans and advances to, and <strong>pl</strong>acements with, banks as well as loans and advances<br />

to customers are stated net of loan loss provisions. The fair values indicated in the table are the<br />

amounts for which the financial instruments could have been exchanged between knowledgeable,<br />

willing parties in an arm’s length transaction at the balance sheet date. To the extent<br />

that market prices were available from exchanges or other efficient markets, these were stated<br />

as fair values. For the other financial instruments, internal valuation models were used, in<br />

particular the present value method (discounting future cash flows on the basis of current yield<br />

curves). For fixed-rate loans and advances to, and amounts owed to, banks and customers with<br />

a remaining maturity of, or regular interest rate adjustment within a period of, less than one<br />

year, amortised cost was stated as fair value. Investments in listed companies are included in<br />

the fair value of investments at their market values as at the balance sheet date. For investments<br />

in unlisted companies, the carrying amount was stated as fair value.<br />

€ m 2005 2004 Difference between Difference between<br />

Carrying Carrying fair value and carry- fair value and carry-<br />

Fair value amount Fair value amount ing amount in 2005 ing amount in 2004<br />

Loans and advances to, and <strong>pl</strong>acements<br />

with, banks 26,386 26,358 24,057 23,970 + 27 + 87<br />

Loans and advances to customers 83,486 83,139 78,858 78,070 + 347 + 788<br />

Investments 18,444 18,172 17,640 17,316 + 273 + 324<br />

+ 647 +1,199<br />

Amounts owed to banks 44,310 44,279 39,968 39,927 + 31 + 41<br />

Amounts owed to customers 61,899 61,863 57,898 57,856 + 36 + 42<br />

Liabilities evidenced by certificates 22,924 22,703 19,826 19,617 + 221 + 209<br />

Subordinated capital 5,495 5,400 5,302 5,291 + 96 +11<br />

+384 +303<br />

BALANCE +263 +896<br />

fair value higher than carrying amount (+) / fair value lower than carrying amount (–)<br />

The difference between carrying amounts and fair values of investment property is about € 22 m (2004: € 30 m). Fair values are determined on<br />

the basis of external or internal expert appraisals.<br />

(30) Related party disclosures<br />

a) Information on members<br />

of the Managing Board,<br />

the Supervisory Board and<br />

the Em<strong>pl</strong>oyees’ Council of<br />

Bank Austria Creditanstalt AG<br />

Expenses for severance payments and pensions of Bank Austria Creditanstalt AG<br />

In the reporting year, allocations and payments for members of the Managing Board, senior<br />

executives and their surviving dependants totalled € 21.8 m (2004: € 14.2 m);<br />

allocations and payments for other em<strong>pl</strong>oyees and their surviving dependants amounted<br />

to € 266.4 m (2004: € 286 m). These amounts include contributions to pension funds for<br />

active Managing Board members in the amount of € 0.3 m (2004: € 0.2 m) and for former<br />

Managing Board members in the amount of € 1.7 m (2004: € 2 m).<br />

Notes to the balance sheet / Additional IFRS disclosures 141