team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

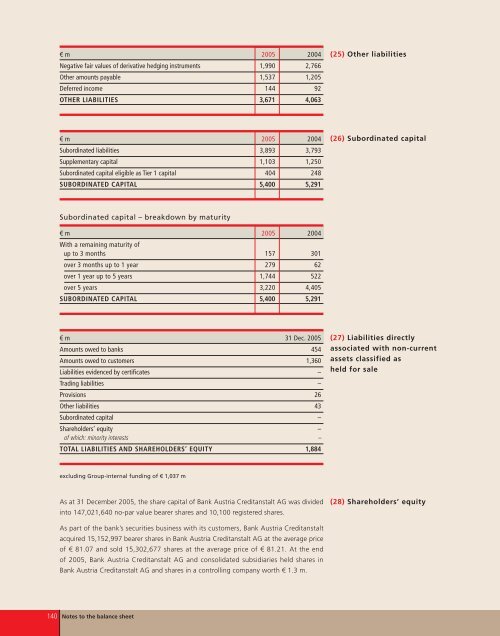

€ m 2005 2004<br />

Negative fair values of derivative hedging instruments 1,990 2,766<br />

Other amounts payable 1,537 1,205<br />

Deferred income 144 92<br />

OTHER LIABILITIES 3,671 4,063<br />

€ m 2005 2004<br />

Subordinated liabilities 3,893 3,793<br />

Sup<strong>pl</strong>ementary capital 1,103 1,250<br />

Subordinated capital eligible as Tier 1 capital 404 248<br />

SUBORDINATED CAPITAL 5,400 5,291<br />

Subordinated capital – breakdown by maturity<br />

€ m<br />

With a remaining maturity of<br />

2005 2004<br />

up to 3 months 157 301<br />

over 3 months up to 1 year 279 62<br />

over 1 year up to 5 years 1,744 522<br />

over 5 years 3,220 4,405<br />

SUBORDINATED CAPITAL 5,400 5,291<br />

€ m 31 Dec. 2005<br />

Amounts owed to banks 454<br />

Amounts owed to customers 1,360<br />

Liabilities evidenced by certificates –<br />

Trading liabilities –<br />

Provisions 26<br />

Other liabilities 43<br />

Subordinated capital –<br />

Shareholders’ equity –<br />

of which: minority interests –<br />

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 1,884<br />

excluding Group-internal funding of € 1,037 m<br />

As at 31 December 2005, the share capital of Bank Austria Creditanstalt AG was divided<br />

into 147,021,640 no-par value bearer shares and 10,100 registered shares.<br />

As part of the bank’s securities business with its customers, Bank Austria Creditanstalt<br />

acquired 15,152,997 bearer shares in Bank Austria Creditanstalt AG at the average price<br />

of € 81.07 and sold 15,302,677 shares at the average price of € 81.21. At the end<br />

of 2005, Bank Austria Creditanstalt AG and consolidated subsidiaries held shares in<br />

Bank Austria Creditanstalt AG and shares in a controlling company worth € 1.3 m.<br />

140 Notes to the balance sheet<br />

(25) Other liabilities<br />

(26) Subordinated capital<br />

(27) Liabilities directly<br />

associated with non-current<br />

assets classified as<br />

held for sale<br />

(28) Shareholders’ equity