team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

as the identification of intangible assets, this results in a difference of € 178.7 m between<br />

the purchase price and the net assets of Banca Comerciala “Ion Tiriac” S.A.; the differential<br />

amount was allocated to goodwill for the time being. The price of the transaction<br />

reflects the intrinsic value of Banca Tiriac, the synergies that can be achieved and, above<br />

all, the potential of the Romanian market.<br />

Eksimbanka, Belgrade, Serbia and Montenegro, was merged with HVB Bank Serbia and<br />

Montenegro on 1 October 2005 and included in the group of consolidated companies as<br />

at the same date. Since then the new bank has operated under the name of “HVB Banka<br />

Srbija i Crna Gora A.D.”. The difference of € 24.9 m between acquisition cost and net<br />

assets of the merged bank was allocated to goodwill for the time being.<br />

At the end of December 2005, Hypo Stavebni Sporitelna, Prague, the mortgage bank of<br />

HVB Czech Republic, was included in the group of consolidated companies.<br />

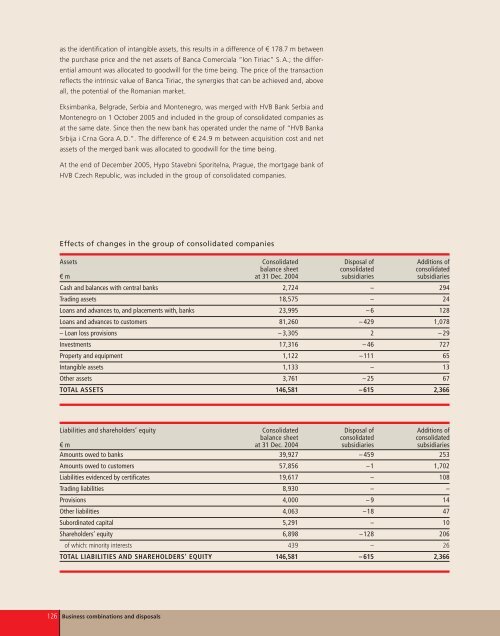

Effects of changes in the group of consolidated companies<br />

Assets Consolidated Disposal of Additions of<br />

balance sheet consolidated consolidated<br />

€ m at 31 Dec. 2004 subsidiaries subsidiaries<br />

Cash and balances with central banks 2,724 – 294<br />

Trading assets 18,575 – 24<br />

Loans and advances to, and <strong>pl</strong>acements with, banks 23,995 – 6 128<br />

Loans and advances to customers 81,260 – 429 1,078<br />

– Loan loss provisions – 3,305 2 – 29<br />

Investments 17,316 – 46 727<br />

Property and equipment 1,122 –111 65<br />

Intangible assets 1,133 – 13<br />

Other assets 3,761 – 25 67<br />

TOTAL ASSETS 146,581 – 615 2,366<br />

Liabilities and shareholders’ equity Consolidated Disposal of Additions of<br />

balance sheet consolidated consolidated<br />

€ m at 31 Dec. 2004 subsidiaries subsidiaries<br />

Amounts owed to banks 39,927 – 459 253<br />

Amounts owed to customers 57,856 –1 1,702<br />

Liabilities evidenced by certificates 19,617 – 108<br />

Trading liabilities 8,930 – –<br />

Provisions 4,000 – 9 14<br />

Other liabilities 4,063 –18 47<br />

Subordinated capital 5,291 – 10<br />

Shareholders’ equity 6,898 –128 206<br />

of which: minority interests 439 – 26<br />

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 146,581 – 615 2,366<br />

126 Business combinations and disposals