team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

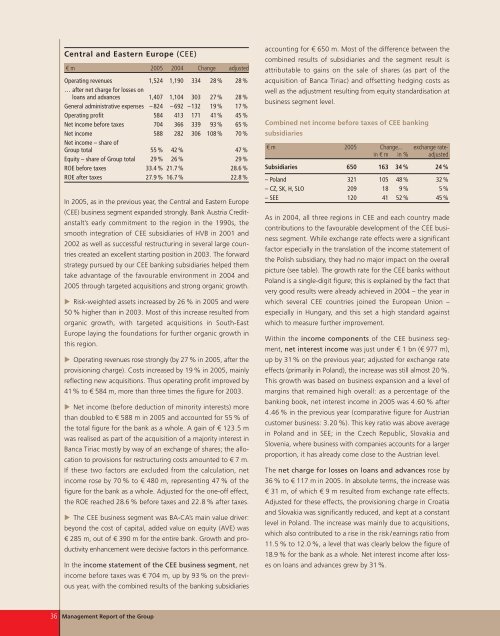

Central and Eastern Europe (CEE)<br />

€ m 2005 2004 Change adjusted<br />

Operating revenues<br />

… after net charge for losses on<br />

1,524 1,190 334 28 % 28 %<br />

loans and advances 1,407 1,104 303 27 % 28 %<br />

General administrative expenses – 824 – 692 –132 19 % 17 %<br />

Operating profit 584 413 171 41% 45 %<br />

Net income before taxes 704 366 339 93 % 65 %<br />

Net income<br />

Net income – share of<br />

588 282 306 108 % 70 %<br />

Group total 55 % 42 % 47 %<br />

Equity – share of Group total 29 % 26 % 29 %<br />

ROE before taxes 33.4 % 21.7 % 28.6 %<br />

ROE after taxes 27.9 % 16.7 % 22.8 %<br />

In 2005, as in the previous year, the Central and Eastern Europe<br />

(CEE) business segment expanded strongly. Bank Austria Creditanstalt’s<br />

early commitment to the region in the 1990s, the<br />

smooth integration of CEE subsidiaries of HVB in 2001 and<br />

2002 as well as successful restructuring in several large countries<br />

created an excellent starting position in 2003. The forward<br />

strategy pursued by our CEE banking subsidiaries helped them<br />

take advantage of the favourable environment in 2004 and<br />

2005 through targeted acquisitions and strong organic growth.<br />

� Risk-weighted assets increased by 26 % in 2005 and were<br />

50 % higher than in 2003. Most of this increase resulted from<br />

organic growth, with targeted acquisitions in South-East<br />

Europe laying the foundations for further organic growth in<br />

this region.<br />

� Operating revenues rose strongly (by 27 % in 2005, after the<br />

provisioning charge). Costs increased by 19 % in 2005, mainly<br />

reflecting new acquisitions. Thus operating profit improved by<br />

41% to € 584 m, more than three times the figure for 2003.<br />

� Net income (before deduction of minority interests) more<br />

than doubled to € 588 m in 2005 and accounted for 55 % of<br />

the total figure for the bank as a whole. A gain of € 123.5 m<br />

was realised as part of the acquisition of a majority interest in<br />

Banca Tiriac mostly by way of an exchange of shares; the allocation<br />

to provisions for restructuring costs amounted to € 7 m.<br />

If these two factors are excluded from the calculation, net<br />

income rose by 70 % to € 480 m, representing 47 % of the<br />

figure for the bank as a whole. Adjusted for the one-off effect,<br />

the ROE reached 28.6 % before taxes and 22.8 % after taxes.<br />

� The CEE business segment was BA-CA’s main value driver:<br />

beyond the cost of capital, added value on equity (AVE) was<br />

€ 285 m, out of € 390 m for the entire bank. Growth and productivity<br />

enhancement were decisive factors in this performance.<br />

In the income statement of the CEE business segment, net<br />

income before taxes was € 704 m, up by 93 % on the previous<br />

year, with the combined results of the banking subsidiaries<br />

36 Management Report of the Group<br />

accounting for € 650 m. Most of the difference between the<br />

combined results of subsidiaries and the segment result is<br />

attributable to gains on the sale of shares (as part of the<br />

acquisition of Banca Tiriac) and offsetting hedging costs as<br />

well as the adjustment resulting from equity standardisation at<br />

business segment level.<br />

Combined net income before taxes of CEE banking<br />

subsidiaries<br />

€ m 2005 Change... exchange ratein<br />

€ m in % adjusted<br />

Subsidiaries 650 163 34 % 24 %<br />

– Poland 321 105 48 % 32 %<br />

– CZ, SK, H, SLO 209 18 9 % 5 %<br />

– SEE 120 41 52 % 45 %<br />

As in 2004, all three regions in CEE and each country made<br />

contributions to the favourable development of the CEE business<br />

segment. While exchange rate effects were a significant<br />

factor especially in the translation of the income statement of<br />

the Polish subsidiary, they had no major impact on the overall<br />

picture (see table). The growth rate for the CEE banks without<br />

Poland is a single-digit figure; this is ex<strong>pl</strong>ained by the fact that<br />

very good results were already achieved in 2004 – the year in<br />

which several CEE countries joined the European Union –<br />

especially in Hungary, and this set a high standard against<br />

which to measure further improvement.<br />

Within the income components of the CEE business segment,<br />

net interest income was just under € 1 bn (€ 977 m),<br />

up by 31% on the previous year; adjusted for exchange rate<br />

effects (primarily in Poland), the increase was still almost 20 %.<br />

This growth was based on business expansion and a level of<br />

margins that remained high overall: as a percentage of the<br />

banking book, net interest income in 2005 was 4.60 % after<br />

4.46 % in the previous year (comparative figure for Austrian<br />

customer business: 3.20 %). This key ratio was above average<br />

in Poland and in SEE; in the Czech Republic, Slovakia and<br />

Slovenia, where business with companies accounts for a larger<br />

proportion, it has already come close to the Austrian level.<br />

The net charge for losses on loans and advances rose by<br />

36 % to € 117 m in 2005. In absolute terms, the increase was<br />

€ 31 m, of which € 9 m resulted from exchange rate effects.<br />

Adjusted for these effects, the provisioning charge in Croatia<br />

and Slovakia was significantly reduced, and kept at a constant<br />

level in Poland. The increase was mainly due to acquisitions,<br />

which also contributed to a rise in the risk/earnings ratio from<br />

11.5 % to 12.0 %, a level that was clearly below the figure of<br />

18.9 % for the bank as a whole. Net interest income after losses<br />

on loans and advances grew by 31%.