team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

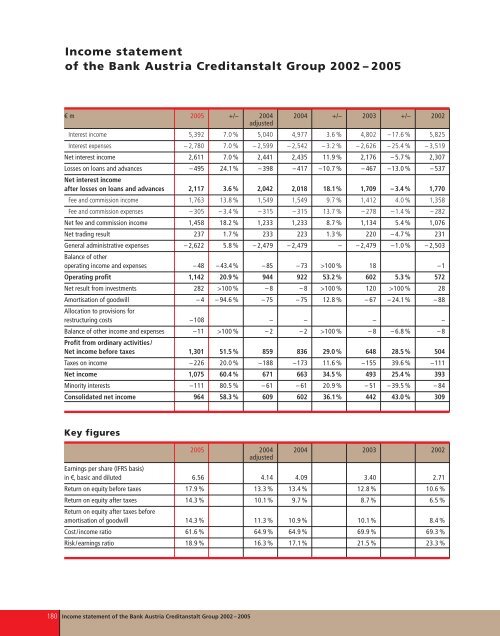

Income statement<br />

of the Bank Austria Creditanstalt Group 2002 – 2005<br />

€ m 2005 +/– 2004 2004 +/– 2003 +/– 2002<br />

adjusted<br />

Interest income 5,392 7.0 % 5,040 4,977 3.6 % 4,802 –17.6 % 5,825<br />

Interest expenses – 2,780 7.0 % – 2,599 – 2,542 – 3.2 % – 2,626 – 25.4 % – 3,519<br />

Net interest income 2,611 7.0 % 2,441 2,435 11.9 % 2,176 – 5.7 % 2,307<br />

Losses on loans and advances<br />

Net interest income<br />

– 495 24.1% – 398 – 417 –10.7 % – 467 –13.0 % – 537<br />

after losses on loans and advances 2,117 3.6 % 2,042 2,018 18.1% 1,709 – 3.4 % 1,770<br />

Fee and commission income 1,763 13.8 % 1,549 1,549 9.7 % 1,412 4.0 % 1,358<br />

Fee and commission expenses – 305 – 3.4 % – 315 – 315 13.7 % – 278 –1.4 % – 282<br />

Net fee and commission income 1,458 18.2 % 1,233 1,233 8.7 % 1,134 5.4 % 1,076<br />

Net trading result 237 1.7 % 233 223 1.3 % 220 – 4.7 % 231<br />

General administrative expenses<br />

Balance of other<br />

– 2,622 5.8 % – 2,479 – 2,479 – – 2,479 –1.0 % – 2,503<br />

operating income and expenses – 48 – 43.4 % – 85 – 73 >100 % 18 –1<br />

Operating profit 1,142 20.9 % 944 922 53.2 % 602 5.3 % 572<br />

Net result from investments 282 >100 % – 8 – 8 >100 % 120 >100 % 28<br />

Amortisation of goodwill<br />

Allocation to provisions for<br />

– 4 – 94.6 % – 75 – 75 12.8 % – 67 – 24.1% – 88<br />

restructuring costs –108 – – – –<br />

Balance of other income and expenses<br />

Profit from ordinary activities/<br />

–11 >100 % – 2 – 2 >100 % – 8 – 6.8 % – 8<br />

Net income before taxes 1,301 51.5 % 859 836 29.0 % 648 28.5 % 504<br />

Taxes on income – 226 20.0 % –188 –173 11.6 % –155 39.6 % –111<br />

Net income 1,075 60.4 % 671 663 34.5 % 493 25.4 % 393<br />

Minority interests –111 80.5 % – 61 – 61 20.9 % – 51 – 39.5 % – 84<br />

Consolidated net income 964 58.3 % 609 602 36.1% 442 43.0 % 309<br />

Key figures<br />

2005 2004<br />

adjusted<br />

2004 2003 2002<br />

Earnings per share (IFRS basis)<br />

in €, basic and diluted 6.56 4.14 4.09 3.40 2.71<br />

Return on equity before taxes 17.9 % 13.3 % 13.4 % 12.8 % 10.6 %<br />

Return on equity after taxes<br />

Return on equity after taxes before<br />

14.3 % 10.1% 9.7 % 8.7 % 6.5 %<br />

amortisation of goodwill 14.3 % 11.3 % 10.9 % 10.1% 8.4 %<br />

Cost/income ratio 61.6 % 64.9 % 64.9 % 69.9 % 69.3 %<br />

Risk/earnings ratio 18.9 % 16.3 % 17.1% 21.5 % 23.3 %<br />

180 Income statement of the Bank Austria Creditanstalt Group 2002 – 2005