team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Risk structure by region and business unit<br />

Considered by region (domicile of borrower), the risk exposure<br />

reflects Bank Austria Creditanstalt’s business model, i.e. concentration<br />

on Austria and CEE. In respect of 24.6 % of exposures,<br />

the borrower is located in one of the Central and Eastern European<br />

countries. This is an increase of 2.6 percentage points. The<br />

Austrian market accounts for 45.2 % of total risk exposure<br />

(2004: 46 %). Thus 70 % of the total risk exposure is related to<br />

our core markets, the remaining 30 % (2004: 32 %) is related to<br />

Western Europe, North America and the rest of the world.<br />

An analysis of risk exposures on the basis of the business unit<br />

recording the transaction shows that our banking subsidiaries<br />

in CEE account for € 37.8 bn or 22.9 % of the total volume;<br />

€ 127.1 bn or 77.1% are accounted for by the BA-CA Group’s<br />

other business units. Unsecured non-performing loans (as a<br />

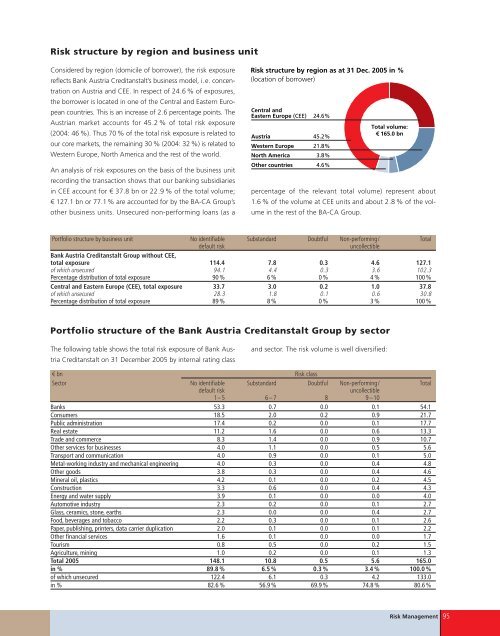

Risk structure by region as at 31 Dec. 2005 in %<br />

(location of borrower)<br />

Central and<br />

Eastern Europe (CEE) 24.6%<br />

Austria 45.2%<br />

Western Europe 21.8%<br />

North America 3.8%<br />

Other countries 4.6%<br />

Total volume:<br />

€ 165.0 bn<br />

percentage of the relevant total volume) represent about<br />

1.6 % of the volume at CEE units and about 2.8 % of the volume<br />

in the rest of the BA-CA Group.<br />

Portfolio structure by business unit No identifiable Substandard Doubtful Non-performing/ Total<br />

default risk uncollectible<br />

Bank Austria Creditanstalt Group without CEE,<br />

total exposure 114.4 7.8 0.3 4.6 127.1<br />

of which unsecured 94.1 4.4 0.3 3.6 102.3<br />

Percentage distribution of total exposure 90 % 6 % 0 % 4 % 100 %<br />

Central and Eastern Europe (CEE), total exposure 33.7 3.0 0.2 1.0 37.8<br />

of which unsecured 28.3 1.8 0.1 0.6 30.8<br />

Percentage distribution of total exposure 89 % 8 % 0 % 3 % 100 %<br />

Portfolio structure of the Bank Austria Creditanstalt Group by sector<br />

The following table shows the total risk exposure of Bank Austria<br />

Creditanstalt on 31 December 2005 by internal rating class<br />

and sector. The risk volume is well diversified:<br />

€bn Risk class<br />

Sector No identifiable Substandard Doubtful Non-performing/ Total<br />

default risk uncollectible<br />

1–5 6–7 8 9–10<br />

Banks 53.3 0.7 0.0 0.1 54.1<br />

Consumers 18.5 2.0 0.2 0.9 21.7<br />

Public administration 17.4 0.2 0.0 0.1 17.7<br />

Real estate 11.2 1.6 0.0 0.6 13.3<br />

Trade and commerce 8.3 1.4 0.0 0.9 10.7<br />

Other services for businesses 4.0 1.1 0.0 0.5 5.6<br />

Transport and communication 4.0 0.9 0.0 0.1 5.0<br />

Metal-working industry and mechanical engineering 4.0 0.3 0.0 0.4 4.8<br />

Other goods 3.8 0.3 0.0 0.4 4.6<br />

Mineral oil, <strong>pl</strong>astics 4.2 0.1 0.0 0.2 4.5<br />

Construction 3.3 0.6 0.0 0.4 4.3<br />

Energy and water sup<strong>pl</strong>y 3.9 0.1 0.0 0.0 4.0<br />

Automotive industry 2.3 0.2 0.0 0.1 2.7<br />

Glass, ceramics, stone, earths 2.3 0.0 0.0 0.4 2.7<br />

Food, beverages and tobacco 2.2 0.3 0.0 0.1 2.6<br />

Paper, publishing, printers, data carrier du<strong>pl</strong>ication 2.0 0.1 0.0 0.1 2.2<br />

Other financial services 1.6 0.1 0.0 0.0 1.7<br />

Tourism 0.8 0.5 0.0 0.2 1.5<br />

Agriculture, mining 1.0 0.2 0.0 0.1 1.3<br />

Total 2005 148.1 10.8 0.5 5.6 165.0<br />

in % 89.8 % 6.5 % 0.3 % 3.4 % 100.0 %<br />

of which unsecured 122.4 6.1 0.3 4.2 133.0<br />

in % 82.6 % 56.9 % 69.9 % 74.8 % 80.6 %<br />

Risk Management 95