team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

etween Germany, Austria and CEE intensified, as did those<br />

among the various CEE countries and with Russia and Ukraine.<br />

In business with local companies, intensive use is made of<br />

corporate finance products and risk management services at<br />

an early stage of market maturity. We benefited from these<br />

developments. New issue business, customer-driven trading<br />

activities in financial market instruments and M&A advisory<br />

services also generated good results.<br />

� Following the acquisition of Hebros Bank in Bulgaria and of<br />

Eksimbanka in Serbia in 2004, we acquired two more banks in<br />

South-East Europe (SEE) in 2005. At the end of August 2005,<br />

we acquired a majority interest in Banca Comerciala “Ion Tiriac”<br />

S.A., Bucharest, by way of an exchange of shares; this<br />

bank will be merged with HVB Bank Romania S.A. to form the<br />

fourth-largest bank in Romania. With its focus on private customer<br />

business, Banca Tiriac has a large customer base and a<br />

country-wide network of branches, optimally com<strong>pl</strong>ementing<br />

HVB Bank Romania’s strength in corporate banking. Bank Austria<br />

Creditanstalt also acquired 83.3 % of Nova banjalucka<br />

banka, the third-largest bank in Republika Srpska, which concentrates<br />

on serving small and medium-sized businesses and<br />

private customers. On the basis of this acquisition, BA-CA’s<br />

market share as the fourth-largest bank in Bosnia and Herzegovina<br />

rose from 8.5 % to 10.9 %.<br />

International Markets (INM)<br />

€ m 2005 2004 Change adjusted<br />

Operating revenues<br />

… after net charge for losses on<br />

275 254 22 9 % 9 %<br />

loans and advances 286 254 32 13 % 13 %<br />

General administrative expenses –158 –140 –18 13 % 13 %<br />

Operating profit 128 114 14 12 % 12 %<br />

Net income before taxes 147 117 30 25 % 28 %<br />

Net income<br />

Net income – share of<br />

126 87 39 44 % 46 %<br />

Group total 12 % 13 % 12 %<br />

Equity – share of Group total 3 % 3 % 3 %<br />

ROE before taxes 68.0 % 55.0 % 69.3 %<br />

ROE after taxes 58.4 % 41.1% 59.3 %<br />

2005 was a very successful year for the International Markets<br />

(INM) business segment: both the results as reflected in<br />

the income statement and the total return, the guiding princi<strong>pl</strong>e<br />

for the bank’s financial market activities, climbed to new<br />

record levels. All areas of the bank’s proprietary trading operations<br />

and customer business contributed to the outstanding<br />

results. In addition to the expertise perfected over the years,<br />

and the broad diversification of business in all risk categories,<br />

INM in 2005 took full advantage of the outstanding competence<br />

in the CEE markets. In this way, it strengthened Bank<br />

Austria Creditanstalt’s unique selling proposition. The results<br />

achieved in 2005 also underline the successful strategy of<br />

38 Management Report of the Group<br />

expanding all areas of customer business with a view to making<br />

greater use of value creating products without impacting<br />

the balance sheet, while further reducing and offsetting fluctuations<br />

in results from the generally more volatile trading<br />

business.<br />

Operating revenues improved by 9 % over the good level of<br />

the previous year; this growth is even higher (+13 %) after the<br />

net charge for losses on loans and advances on account of<br />

revenues generated from the positive outcome of a debt<br />

rescheduling arrangement. With the inclusion of the net result<br />

from investments, which in the INM segment constitutes<br />

income from operating activities, operating revenues, after the<br />

provisioning charge, rose by 16 % to € 305 m.<br />

Individual income components showed a varied pattern: net<br />

interest income was about one third below the previous year’s<br />

figure, while the net trading result was 46 % up on 2004, and<br />

the net result from investments was almost twice as high. One<br />

should not read too much into these figures since, depending<br />

on the use of the spot and derivative markets and the time<br />

horizon, the success of the trading strategies and the performance<br />

of the investment books reflected in the income statement<br />

are included in net interest income, in the net trading<br />

result, and in the net result from investments. In 2005, net fee<br />

and commission income more than doubled to € 40 m due to<br />

an outstanding performance on the primary equity and bond<br />

markets and, above all, income from custody services.<br />

General administrative expenses increased by 13 % to<br />

€ 158 m in 2005. For this reason, the cost/income ratio was<br />

slightly higher than in 2004 (57.3 % after 55.2 %), but low in<br />

comparison with the staff-intensive financial market and<br />

investment banking sector. With a further improvement in<br />

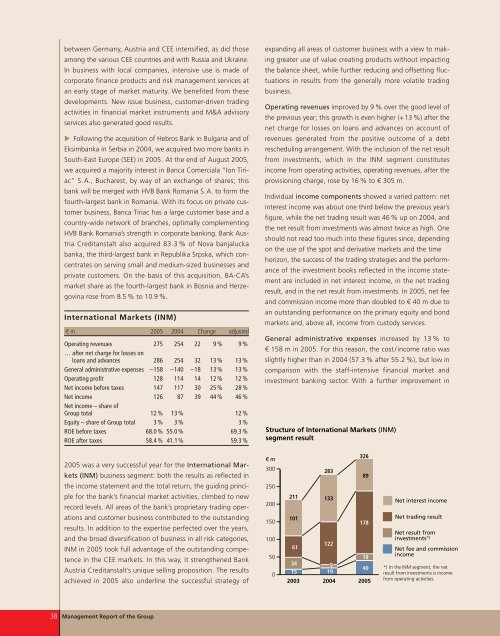

Structure of International Markets (INM)<br />

segment result<br />

€ m<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

211<br />

101<br />

61<br />

34<br />

15<br />

283<br />

133<br />

122<br />

9<br />

19<br />

326<br />

89<br />

178<br />

19<br />

40<br />

2003 2004 2005<br />

Net interest income<br />

Net trading result<br />

Net result from<br />

investments *)<br />

Net fee and commission<br />

income<br />

*) In the INM segment, the net<br />

result from investments is income<br />

from operating activities.