team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

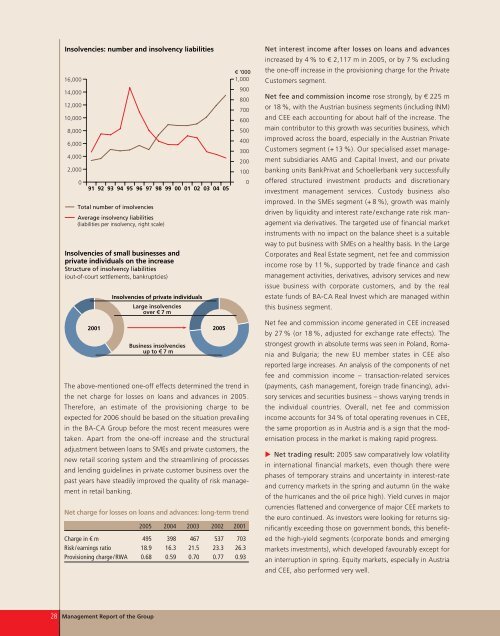

Insolvencies: number and insolvency liabilities<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05<br />

Total number of insolvencies<br />

Average insolvency liabilities<br />

(liabilities per insolvency, right scale)<br />

Insolvencies of small businesses and<br />

private individuals on the increase<br />

Structure of insolvency liabilities<br />

(out-of-court settlements, bankruptcies)<br />

The above-mentioned one-off effects determined the trend in<br />

the net charge for losses on loans and advances in 2005.<br />

Therefore, an estimate of the provisioning charge to be<br />

expected for 2006 should be based on the situation prevailing<br />

in the BA-CA Group before the most recent measures were<br />

taken. Apart from the one-off increase and the structural<br />

adjustment between loans to SMEs and private customers, the<br />

new retail scoring system and the streamlining of processes<br />

and lending guidelines in private customer business over the<br />

past years have steadily improved the quality of risk management<br />

in retail banking.<br />

Net charge for losses on loans and advances: long-term trend<br />

2005 2004 2003 2002 2001<br />

Charge in € m 495 398 467 537 703<br />

Risk/earnings ratio 18.9 16.3 21.5 23.3 26.3<br />

Provisioning charge/RWA 0.68 0.59 0.70 0.77 0.93<br />

28 Management Report of the Group<br />

Insolvencies of private individuals<br />

Large insolvencies<br />

over € 7 m<br />

2001 2005<br />

Business insolvencies<br />

up to € 7 m<br />

€ ’000<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Net interest income after losses on loans and advances<br />

increased by 4 % to € 2,117 m in 2005, or by 7 % excluding<br />

the one-off increase in the provisioning charge for the Private<br />

Customers segment.<br />

Net fee and commission income rose strongly, by € 225 m<br />

or 18 %, with the Austrian business segments (including INM)<br />

and CEE each accounting for about half of the increase. The<br />

main contributor to this growth was securities business, which<br />

improved across the board, especially in the Austrian Private<br />

Customers segment (+13 %). Our specialised asset management<br />

subsidiaries AMG and Capital Invest, and our private<br />

banking units BankPrivat and Schoellerbank very successfully<br />

offered structured investment products and discretionary<br />

investment management services. Custody business also<br />

improved. In the SMEs segment (+ 8 %), growth was mainly<br />

driven by liquidity and interest rate/exchange rate risk management<br />

via derivatives. The targeted use of financial market<br />

instruments with no impact on the balance sheet is a suitable<br />

way to put business with SMEs on a healthy basis. In the Large<br />

Corporates and Real Estate segment, net fee and commission<br />

income rose by 11%, supported by trade finance and cash<br />

management activities, derivatives, advisory services and new<br />

issue business with corporate customers, and by the real<br />

estate funds of BA-CA Real Invest which are managed within<br />

this business segment.<br />

Net fee and commission income generated in CEE increased<br />

by 27 % (or 18 %, adjusted for exchange rate effects). The<br />

strongest growth in absolute terms was seen in Poland, Romania<br />

and Bulgaria; the new EU member states in CEE also<br />

reported large increases. An analysis of the components of net<br />

fee and commission income – transaction-related services<br />

(payments, cash management, foreign trade financing), advisory<br />

services and securities business – shows varying trends in<br />

the individual countries. Overall, net fee and commission<br />

income accounts for 34 % of total operating revenues in CEE,<br />

the same proportion as in Austria and is a sign that the modernisation<br />

process in the market is making rapid progress.<br />

� Net trading result: 2005 saw comparatively low volatility<br />

in international financial markets, even though there were<br />

phases of temporary strains and uncertainty in interest-rate<br />

and currency markets in the spring and autumn (in the wake<br />

of the hurricanes and the oil price high). Yield curves in major<br />

currencies flattened and convergence of major CEE markets to<br />

the euro continued. As investors were looking for returns significantly<br />

exceeding those on government bonds, this benefited<br />

the high-yield segments (corporate bonds and emerging<br />

markets investments), which developed favourably except for<br />

an interruption in spring. Equity markets, especially in Austria<br />

and CEE, also performed very well.