team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Outlook<br />

Global economic environment and<br />

financial markets<br />

We assume that the global economy will continue to grow in<br />

2006 despite higher oil prices, though at a lower rate. While<br />

China (+ 9.5 %) and the Asian emerging markets (+ 6.5 %) are<br />

still achieving strong growth, interest rate increases in the US<br />

over the past one and a half years will have their intended<br />

effect: the real estate boom which supports consumption is<br />

coming to an end, and US economic growth will slow to 3 %.<br />

Interest rate increases are therefore expected to end soon.<br />

Early indicators for the euro area suggest higher growth in<br />

the early months of the year, supported by exports and industrial<br />

activity; am<strong>pl</strong>e liquidity will also benefit real investments.<br />

Yet structural problems still largely prevent these favourable<br />

factors from feeding through to incomes and consumption.<br />

Nevertheless, economic growth will be strong enough to permit<br />

some tightening of the expansionary monetary policy in<br />

the euro area.<br />

This economic profile suggests that interest rates in the US<br />

and in the euro area may move closer to each other. Expectations<br />

of low inflation and, above all, high long-term investment<br />

requirements will keep long-term yields low and the<br />

yield curve in the bond market flat. The euro will probably<br />

benefit from global investors’ diversification efforts. For this<br />

reason we believe that the US dollar is facing higher risk:<br />

fundamental factors which were kept under control in 2005<br />

will at least result in stronger volatility in 2006.<br />

Economic prospects in our core markets<br />

The Austrian business sector has started the year with somewhat<br />

greater confidence. Strong impetus comes from export<br />

demand. After a subdued trend in private consumption in<br />

2005 (+1.3 %), growth in this sector will accelerate to about<br />

2 %, supported by lower inflation (1.6 % after 2.1%). On the<br />

basis of high levels of industrial activity at the end of 2005 and<br />

in early 2006, investments should again increase more strongly<br />

after having stagnated in 2005. Against the background of<br />

slightly slower growth of the global economy and uncertainty<br />

over future developments in key markets such as Germany<br />

and Italy, however, the Austrian economy will slacken somewhat<br />

in the course of the year.<br />

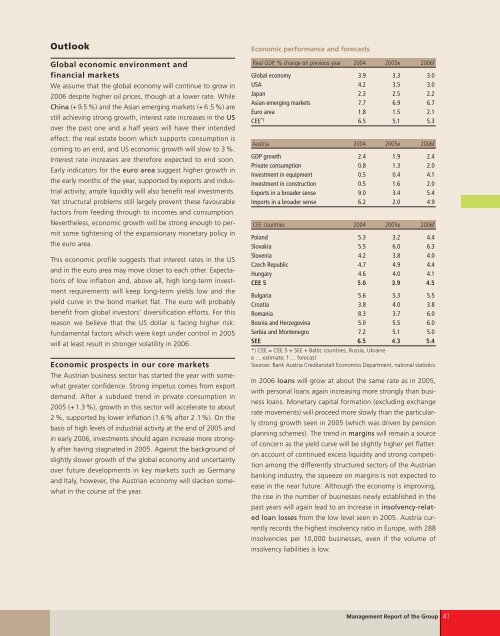

Economic performance and forecasts<br />

Real GDP, % change on previous year 2004 2005e 2006f<br />

Global economy 3.9 3.3 3.0<br />

USA 4.2 3.5 3.0<br />

Japan 2.3 2.5 2.2<br />

Asian emerging markets 7.7 6.9 6.7<br />

Euro area 1.8 1.5 2.1<br />

CEE *) 6.5 5.1 5.3<br />

Austria 2004 2005e 2006f<br />

GDP growth 2.4 1.9 2.4<br />

Private consumption 0.8 1.3 2.0<br />

Investment in equipment 0.5 0.4 4.1<br />

Investment in construction 0.5 1.6 2.0<br />

Exports in a broader sense 9.0 3.4 5.4<br />

Imports in a broader sense 6.2 2.0 4.9<br />

CEE countries 2004 2005e 2006f<br />

Poland 5.3 3.2 4.4<br />

Slovakia 5.5 6.0 6.3<br />

Slovenia 4.2 3.8 4.0<br />

Czech Republic 4.7 4.9 4.4<br />

Hungary 4.6 4.0 4.1<br />

CEE 5 5.0 3.9 4.5<br />

Bulgaria 5.6 5.3 5.5<br />

Croatia 3.8 4.0 3.8<br />

Romania 8.3 3.7 6.0<br />

Bosnia and Herzegovina 5.0 5.5 6.0<br />

Serbia and Montenegro 7.2 5.1 5.0<br />

SEE 6.5 4.3 5.4<br />

*) CEE = CEE 5 + SEE + Baltic countries, Russia, Ukraine<br />

e … estimate; f … forecast<br />

Sources: Bank Austria Creditanstalt Economics Department, national statistics<br />

In 2006 loans will grow at about the same rate as in 2005,<br />

with personal loans again increasing more strongly than business<br />

loans. Monetary capital formation (excluding exchange<br />

rate movements) will proceed more slowly than the particularly<br />

strong growth seen in 2005 (which was driven by pension<br />

<strong>pl</strong>anning schemes). The trend in margins will remain a source<br />

of concern as the yield curve will be slightly higher yet flatter:<br />

on account of continued excess liquidity and strong competition<br />

among the differently structured sectors of the Austrian<br />

banking industry, the squeeze on margins is not expected to<br />

ease in the near future. Although the economy is improving,<br />

the rise in the number of businesses newly established in the<br />

past years will again lead to an increase in insolvency-related<br />

loan losses from the low level seen in 2005. Austria currently<br />

records the highest insolvency ratio in Europe, with 288<br />

insolvencies per 10,000 businesses, even if the volume of<br />

insolvency liabilities is low.<br />

Management Report of the Group 41