team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The two banking subsidiaries will remain separate legal entities<br />

for the time being, and operate side by side. With the<br />

acquisition of Nova banjalucka banka we have reinforced our<br />

market position as number 4 and increased our overall market<br />

share to about 11%.<br />

Business structure and development<br />

Retail customers<br />

The realignment of the branch network started in the previous<br />

year to create a service-oriented sales organisation was successfully<br />

com<strong>pl</strong>eted in 2005. This is reflected in key figures:<br />

lending volume rose by more than 55 %, credit card business<br />

grew by over 40 %. Housing loans for young cou<strong>pl</strong>es, mortgage<br />

loans and car loans have been added to our product<br />

range. The account packages tailored to meet specific customer<br />

needs were a great success: 13,000 account packages<br />

were sold within nine months.<br />

Marketing activities supported all our sales initiatives, including<br />

a special offering in the winter sales season which focused<br />

on “instant loans”, account packages and short-term deposits<br />

on favourable terms and conditions.<br />

In 2005 we concluded an agency agreement with MoneyGram<br />

International, a provider of international money transfer services,<br />

to widen the range of services for our customers.<br />

We are strengthening our sales network by entering into partnerships<br />

with micro credit organisations, a relatively new, fastgrowing<br />

and highly promising sector in Bosnia and Herzegovina.<br />

Corporate customers<br />

We have a strong market position among state-owned companies<br />

and government agencies. Based on these business<br />

relationships, we aim to pursue further growth in the private<br />

sector of the economy. As a first step we im<strong>pl</strong>emented a comprehensive<br />

service approach supporting the Bosnian business<br />

sector by financing ambitious domestic projects.<br />

The volume of loans outstanding more than doubled in 2005.<br />

Financing transactions for large national and international<br />

companies with a strong market presence accounted for a significant<br />

portion of total volume. For exam<strong>pl</strong>e, we signed a<br />

loan agreement with a local pharmaceutical company for BAM<br />

6.5 m (about € 3.3 m) and a financing arrangement with<br />

OMV, the Austrian oil company, for € 14.4 m.<br />

We also prepared the ground for the first real estate transaction<br />

and the introduction of new services. Forfaiting is a new<br />

product in the trade finance sector which has met with a very<br />

favourable market response.<br />

90 CEE Network of Bank Austria Creditanstalt in 2005<br />

Outlook<br />

The further expansion of HVB Central Profit Banka and the<br />

transformation/reorganisation of the newly acquired Nova<br />

banjalucka banka will be our top priorities in 2006. We also<br />

want to achieve further growth on our own, winning new customers<br />

by offering innovative products and attractive terms. At<br />

the end of 2005 we started to create a quality management<br />

system which will be im<strong>pl</strong>emented in 2006.<br />

Serbia and Montenegro*) –<br />

HVB Bank Serbia and Montenegro<br />

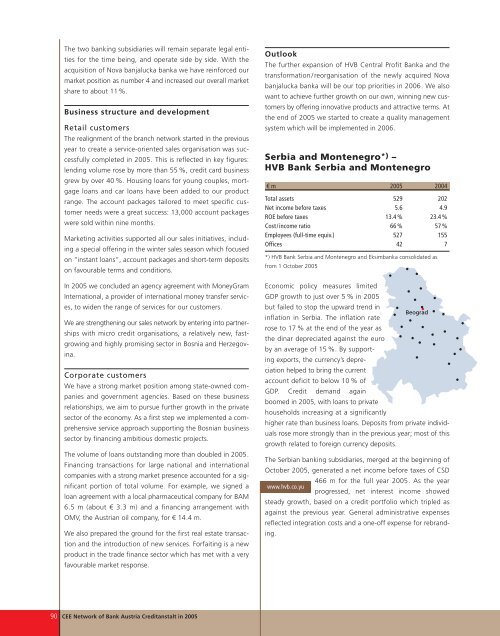

€ m 2005 2004<br />

Total assets 529 202<br />

Net income before taxes 5.6 4.9<br />

ROE before taxes 13.4 % 23.4 %<br />

Cost/income ratio 66 % 57 %<br />

Em<strong>pl</strong>oyees (full-time equiv.) 527 155<br />

Offices 42 7<br />

*) HVB Bank Serbia and Montenegro and Eksimbanka consolidated as<br />

from 1 October 2005<br />

Economic policy measures limited<br />

GDP growth to just over 5 % in 2005<br />

but failed to stop the upward trend in<br />

inflation in Serbia. The inflation rate<br />

rose to 17 % at the end of the year as<br />

the dinar depreciated against the euro<br />

by an average of 15 %. By supporting<br />

exports, the currency’s depreciation<br />

helped to bring the current<br />

account deficit to below 10 % of<br />

Beograd<br />

GDP. Credit demand again<br />

boomed in 2005, with loans to private<br />

households increasing at a significantly<br />

higher rate than business loans. Deposits from private individuals<br />

rose more strongly than in the previous year; most of this<br />

growth related to foreign currency deposits.<br />

The Serbian banking subsidiaries, merged at the beginning of<br />

October 2005, generated a net income before taxes of CSD<br />

466 m for the full year 2005. As the year<br />

www.hvb.co.yu<br />

progressed, net interest income showed<br />

steady growth, based on a credit portfolio which tri<strong>pl</strong>ed as<br />

against the previous year. General administrative expenses<br />

reflected integration costs and a one-off expense for rebranding.