team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

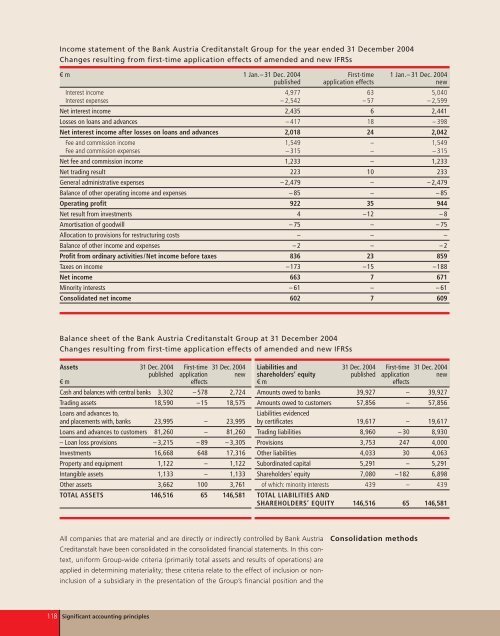

Income statement of the Bank Austria Creditanstalt Group for the year ended 31 December 2004<br />

Changes resulting from first-time ap<strong>pl</strong>ication effects of amended and new IFRSs<br />

€ m 1 Jan.– 31 Dec. 2004 First-time 1 Jan.– 31 Dec. 2004<br />

published ap<strong>pl</strong>ication effects new<br />

Interest income 4,977 63 5,040<br />

Interest expenses – 2,542 – 57 – 2,599<br />

Net interest income 2,435 6 2,441<br />

Losses on loans and advances – 417 18 – 398<br />

Net interest income after losses on loans and advances 2,018 24 2,042<br />

Fee and commission income 1,549 – 1,549<br />

Fee and commission expenses – 315 – – 315<br />

Net fee and commission income 1,233 – 1,233<br />

Net trading result 223 10 233<br />

General administrative expenses – 2,479 – – 2,479<br />

Balance of other operating income and expenses – 85 – – 85<br />

Operating profit 922 35 944<br />

Net result from investments 4 –12 – 8<br />

Amortisation of goodwill – 75 – – 75<br />

Allocation to provisions for restructuring costs – – –<br />

Balance of other income and expenses – 2 – – 2<br />

Profit from ordinary activities/Net income before taxes 836 23 859<br />

Taxes on income –173 –15 –188<br />

Net income 663 7 671<br />

Minority interests – 61 – – 61<br />

Consolidated net income 602 7 609<br />

Balance sheet of the Bank Austria Creditanstalt Group at 31 December 2004<br />

Changes resulting from first-time ap<strong>pl</strong>ication effects of amended and new IFRSs<br />

Assets 31 Dec. 2004 First-time 31 Dec. 2004 Liabilities and 31 Dec. 2004 First-time 31 Dec. 2004<br />

published ap<strong>pl</strong>ication new shareholders’ equity published ap<strong>pl</strong>ication new<br />

€ m effects € m effects<br />

Cash and balances with central banks 3,302 – 578 2,724 Amounts owed to banks 39,927 – 39,927<br />

Trading assets 18,590 –15 18,575 Amounts owed to customers 57,856 – 57,856<br />

Loans and advances to, Liabilities evidenced<br />

and <strong>pl</strong>acements with, banks 23,995 – 23,995 by certificates 19,617 – 19,617<br />

Loans and advances to customers 81,260 – 81,260 Trading liabilities 8,960 – 30 8,930<br />

– Loan loss provisions – 3,215 – 89 – 3,305 Provisions 3,753 247 4,000<br />

Investments 16,668 648 17,316 Other liabilities 4,033 30 4,063<br />

Property and equipment 1,122 – 1,122 Subordinated capital 5,291 – 5,291<br />

Intangible assets 1,133 – 1,133 Shareholders’ equity 7,080 –182 6,898<br />

Other assets 3,662 100 3,761 of which: minority interests 439 – 439<br />

TOTAL ASSETS 146,516 65 146,581 TOTAL LIABILITIES AND<br />

SHAREHOLDERS’ EQUITY 146,516 65 146,581<br />

All companies that are material and are directly or indirectly controlled by Bank Austria Consolidation methods<br />

Creditanstalt have been consolidated in the consolidated financial statements. In this context,<br />

uniform Group-wide criteria (primarily total assets and results of operations) are<br />

ap<strong>pl</strong>ied in determining materiality; these criteria relate to the effect of inclusion or noninclusion<br />

of a subsidiary in the presentation of the Group’s financial position and the<br />

118 Significant accounting princi<strong>pl</strong>es