team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Following the big success of the previous year’s HIT lending initiative,<br />

we offered this product again in the fourth quarter of<br />

2005. By the end of December, the bank granted more than<br />

8,700 new loans totalling over HRK 650 m. We maintained<br />

our strong position in the card business.<br />

Corporate customers<br />

In 2005 we improved our market share in all sectors of corporate<br />

customer business. In particular, deposits rose by almost<br />

35 % to HKR 2.4 bn compared with the previous year.<br />

Our Croatian banking subsidiary is very strong in business with<br />

large international companies, especially in trade and export<br />

finance. Cooperation with the Croatian Bank for Reconstruction<br />

and Development (HBOR) was intensified, with most of<br />

the funds – HVB S<strong>pl</strong>itska banka is market leader in this sector,<br />

with a total volume of about € 1 bn – going into export and<br />

pre-export financing transactions.<br />

Another major strength is our local expertise for structured<br />

finance. HVB S<strong>pl</strong>itska banka, in cooperation with the Viennabased<br />

specialists, financed a number of important projects,<br />

including the acquisition and renovation of a five-star hotel in<br />

S<strong>pl</strong>it.<br />

International Markets<br />

We maintained our undisputed position as market leader in<br />

the custody business and received international recognition in<br />

this area: Global Custodian named HVB S<strong>pl</strong>itska banka “Best<br />

agent bank in Croatia”.<br />

Outlook<br />

The Italian banking group UniCredit has acquired HVB Group<br />

and thus also the CEE network of the BA-CA Group. For competitive<br />

reasons, our equity interest in HVB S<strong>pl</strong>itska banka<br />

must be sold because the Croatian market leader Zagrebačka<br />

banka is a member of UniCredit Group. The sale is <strong>pl</strong>anned for<br />

the second quarter of 2006.<br />

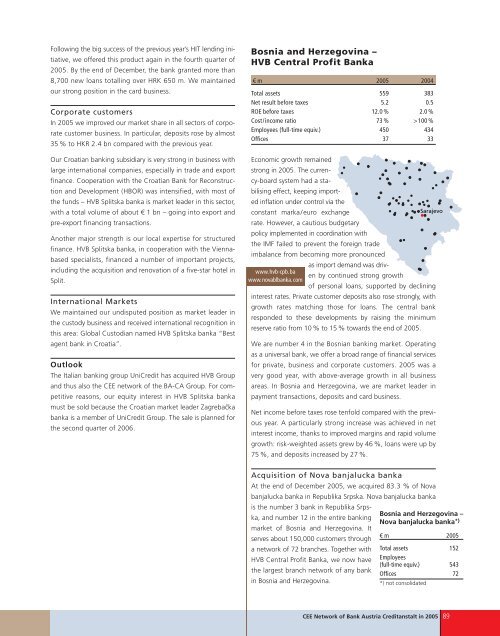

Bosnia and Herzegovina –<br />

HVB Central Profit Banka<br />

€ m 2005 2004<br />

Total assets 559 383<br />

Net result before taxes 5.2 0.5<br />

ROE before taxes 12.0 % 2.0 %<br />

Cost/income ratio 73 % >100 %<br />

Em<strong>pl</strong>oyees (full-time equiv.) 450 434<br />

Offices 37 33<br />

Economic growth remained<br />

strong in 2005. The currency-board<br />

system had a stabilising<br />

effect, keeping imported<br />

inflation under control via the<br />

constant marka/euro exchange<br />

Sarajevo<br />

rate. However, a cautious budgetary<br />

policy im<strong>pl</strong>emented in coordination with<br />

the IMF failed to prevent the foreign trade<br />

imbalance from becoming more pronounced<br />

as import demand was driv-<br />

www.hvb-cpb.ba<br />

en by continued strong growth<br />

www.novablbanka.com<br />

of personal loans, supported by declining<br />

interest rates. Private customer deposits also rose strongly, with<br />

growth rates matching those for loans. The central bank<br />

responded to these developments by raising the minimum<br />

reserve ratio from 10 % to 15 % towards the end of 2005.<br />

We are number 4 in the Bosnian banking market. Operating<br />

as a universal bank, we offer a broad range of financial services<br />

for private, business and corporate customers. 2005 was a<br />

very good year, with above-average growth in all business<br />

areas. In Bosnia and Herzegovina, we are market leader in<br />

payment transactions, deposits and card business.<br />

Net income before taxes rose tenfold compared with the previous<br />

year. A particularly strong increase was achieved in net<br />

interest income, thanks to improved margins and rapid volume<br />

growth: risk-weighted assets grew by 46 %, loans were up by<br />

75 %, and deposits increased by 27 %.<br />

Acquisition of Nova banjalucka banka<br />

At the end of December 2005, we acquired 83.3 % of Nova<br />

banjalucka banka in Republika Srpska. Nova banjalucka banka<br />

is the number 3 bank in Republika Srpska,<br />

and number 12 in the entire banking<br />

market of Bosnia and Herzegovina. It<br />

Bosnia and Herzegovina –<br />

Nova banjalucka banka<br />

serves about 150,000 customers through<br />

a network of 72 branches. Together with<br />

HVB Central Profit Banka, we now have<br />

the largest branch network of any bank<br />

in Bosnia and Herzegovina.<br />

*)<br />

€ m 2005<br />

Total assets 152<br />

Em<strong>pl</strong>oyees<br />

(full-time equiv.)<br />

Offices<br />

543<br />

72<br />

*) not consolidated<br />

CEE Network of Bank Austria Creditanstalt in 2005 89