team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As at 31 December 2005, one member of the Management Board of HVB was a member<br />

of the Supervisory Board of BA-CA AG.<br />

A company of HVB Group has provided a capital guarantee which totalled US$ 181 m as at<br />

31 December 2005 for alternative investments managed by Bank Austria Cayman Islands.<br />

On 29 November 2005, UniCredit S.p.A., Genoa, Italy (UniCredit), acquired 17.45 %, i.e.<br />

25,657,724, of the shares in Bank Austria Creditanstalt (BA-CA AG) through an exchange<br />

of shares. On the basis of these directly held shares and the shares held indirectly through<br />

Bayerische Hypo- und Vereinsbank AG, Munich (HVB), UniCredit holds about 94.98 % of<br />

the share capital and voting rights of BA-CA AG.<br />

As at 31 December 2005, one member of the Managing Board of Bank Austria Creditanstalt<br />

AG was a member of the Management Committee of UniCredit S.p.A.<br />

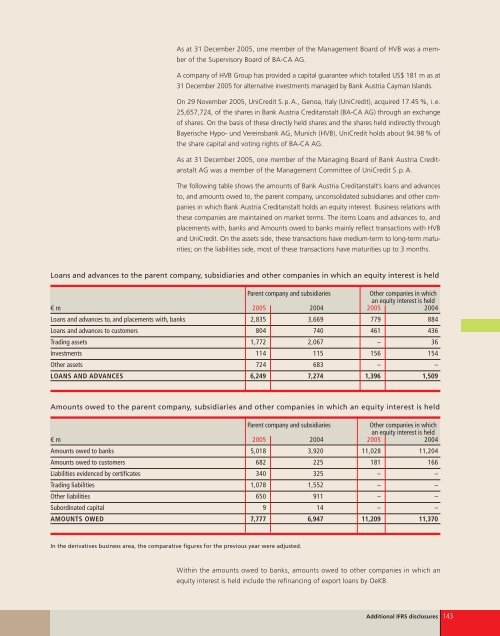

The following table shows the amounts of Bank Austria Creditanstalt’s loans and advances<br />

to, and amounts owed to, the parent company, unconsolidated subsidiaries and other companies<br />

in which Bank Austria Creditanstalt holds an equity interest. Business relations with<br />

these companies are maintained on market terms. The items Loans and advances to, and<br />

<strong>pl</strong>acements with, banks and Amounts owed to banks mainly reflect transactions with HVB<br />

and UniCredit. On the assets side, these transactions have medium-term to long-term maturities;<br />

on the liabilities side, most of these transactions have maturities up to 3 months.<br />

Loans and advances to the parent company, subsidiaries and other companies in which an equity interest is held<br />

Parent company and subsidiaries Other companies in which<br />

an equity interest is held<br />

€ m 2005 2004 2005 2004<br />

Loans and advances to, and <strong>pl</strong>acements with, banks 2,835 3,669 779 884<br />

Loans and advances to customers 804 740 461 436<br />

Trading assets 1,772 2,067 – 36<br />

Investments 114 115 156 154<br />

Other assets 724 683 – –<br />

LOANS AND ADVANCES 6,249 7,274 1,396 1,509<br />

Amounts owed to the parent company, subsidiaries and other companies in which an equity interest is held<br />

Parent company and subsidiaries Other companies in which<br />

an equity interest is held<br />

€ m 2005 2004 2005 2004<br />

Amounts owed to banks 5,018 3,920 11,028 11,204<br />

Amounts owed to customers 682 225 181 166<br />

Liabilities evidenced by certificates 340 325 – –<br />

Trading liabilities 1,078 1,552 – –<br />

Other liabilities 650 911 – –<br />

Subordinated capital 9 14 – –<br />

AMOUNTS OWED 7,777 6,947 11,209 11,370<br />

In the derivatives business area, the comparative figures for the previous year were adjusted.<br />

Within the amounts owed to banks, amounts owed to other companies in which an<br />

equity interest is held include the refinancing of export loans by OeKB.<br />

Additional IFRS disclosures 143