team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Outlook<br />

In 2006, our activities will continue to focus on retail customers.<br />

A sales expansion programme and the introduction of<br />

new products, including combined banking/insurance products,<br />

will provide fresh impetus. Preparing for the introduction<br />

of the euro on 1 January 2007 will be a major challenge.<br />

Romania –<br />

HVB Bank Romania (incl. Banca Tiriac)<br />

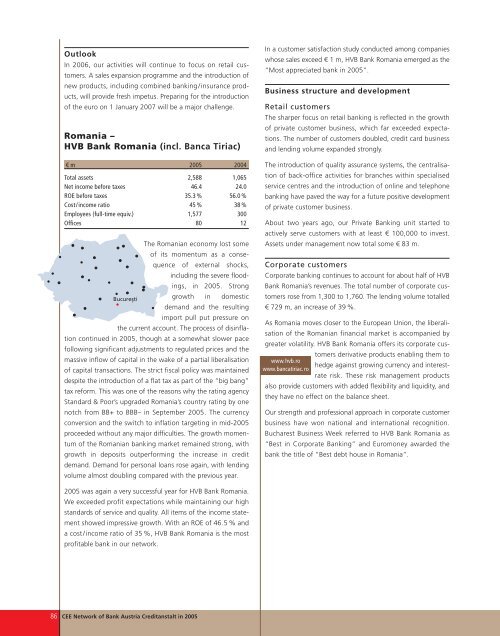

€ m 2005 2004<br />

Total assets 2,588 1,065<br />

Net income before taxes 46.4 24.0<br />

ROE before taxes 35.3 % 56.0 %<br />

Cost/income ratio 45 % 38 %<br />

Em<strong>pl</strong>oyees (full-time equiv.) 1,577 300<br />

Offices 80 12<br />

The Romanian economy lost some<br />

of its momentum as a consequence<br />

of external shocks,<br />

including the severe floodings,<br />

in 2005. Strong<br />

Bucures¸ti<br />

growth in domestic<br />

demand and the resulting<br />

import pull put pressure on<br />

the current account. The process of disinflation<br />

continued in 2005, though at a somewhat slower pace<br />

following significant adjustments to regulated prices and the<br />

massive inflow of capital in the wake of a partial liberalisation<br />

of capital transactions. The strict fiscal policy was maintained<br />

despite the introduction of a flat tax as part of the “big bang”<br />

tax reform. This was one of the reasons why the rating agency<br />

Standard & Poor’s upgraded Romania’s country rating by one<br />

notch from BB+ to BBB– in September 2005. The currency<br />

conversion and the switch to inflation targeting in mid-2005<br />

proceeded without any major difficulties. The growth momentum<br />

of the Romanian banking market remained strong, with<br />

growth in deposits outperforming the increase in credit<br />

demand. Demand for personal loans rose again, with lending<br />

volume almost doubling compared with the previous year.<br />

2005 was again a very successful year for HVB Bank Romania.<br />

We exceeded profit expectations while maintaining our high<br />

standards of service and quality. All items of the income statement<br />

showed impressive growth. With an ROE of 46.5 % and<br />

a cost/income ratio of 35 %, HVB Bank Romania is the most<br />

profitable bank in our network.<br />

86 CEE Network of Bank Austria Creditanstalt in 2005<br />

In a customer satisfaction study conducted among companies<br />

whose sales exceed € 1 m, HVB Bank Romania emerged as the<br />

“Most appreciated bank in 2005”.<br />

Business structure and development<br />

Retail customers<br />

The sharper focus on retail banking is reflected in the growth<br />

of private customer business, which far exceeded expectations.<br />

The number of customers doubled, credit card business<br />

and lending volume expanded strongly.<br />

The introduction of quality assurance systems, the centralisation<br />

of back-office activities for branches within specialised<br />

service centres and the introduction of online and telephone<br />

banking have paved the way for a future positive development<br />

of private customer business.<br />

About two years ago, our Private Banking unit started to<br />

actively serve customers with at least € 100,000 to invest.<br />

Assets under management now total some € 83 m.<br />

Corporate customers<br />

Corporate banking continues to account for about half of HVB<br />

Bank Romania’s revenues. The total number of corporate customers<br />

rose from 1,300 to 1,760. The lending volume totalled<br />

€ 729 m, an increase of 39 %.<br />

As Romania moves closer to the European Union, the liberalisation<br />

of the Romanian financial market is accompanied by<br />

greater volatility. HVB Bank Romania offers its corporate customers<br />

derivative products enabling them to<br />

www.hvb.ro<br />

hedge against growing currency and interest-<br />

www.bancatiriac.ro<br />

rate risk. These risk management products<br />

also provide customers with added flexibility and liquidity, and<br />

they have no effect on the balance sheet.<br />

Our strength and professional approach in corporate customer<br />

business have won national and international recognition.<br />

Bucharest Business Week referred to HVB Bank Romania as<br />

“Best in Corporate Banking” and Euromoney awarded the<br />

bank the title of “Best debt house in Romania”.