team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The upward economic trend in CEE countries is fully intact<br />

and is even improving in terms of quality: growth in the region<br />

will remain above 5 %. Foreign trade and industry will continue<br />

to provide strong impetus, with the growing integration of<br />

the economies with each other strengthening the growth<br />

momentum. Private consumption and investments will join<br />

foreign trade, which was the main engine of growth in several<br />

countries in the previous year, in driving the economy and<br />

will thus help to make the upswing sustainable.<br />

� In Poland, growth will return to a level in excess of 4 %.<br />

This development will be supported by a recovery of em<strong>pl</strong>oyment<br />

and real personal incomes, which in turn will stimulate<br />

consumption. A contribution to growth will also come from<br />

heavier investment activity from financially stronger companies<br />

and public programmes for road and housing construction<br />

which benefit from EU financial assistance. From 2007, Poland<br />

will be the largest net beneficiary of transfers from the EU,<br />

receiving about € 13 bn per year, which will provide the basis<br />

for a positive development in the long term.<br />

� The other new EU member states will also benefit from<br />

large investments in 2006, especially thanks to the expansion<br />

of car production in Slovakia. In these countries, too, consumption<br />

will be the mainstay of economic growth, additionally<br />

supported in Hungary and the Czech Republic by tax<br />

reductions ahead of this year’s parliamentary elections.<br />

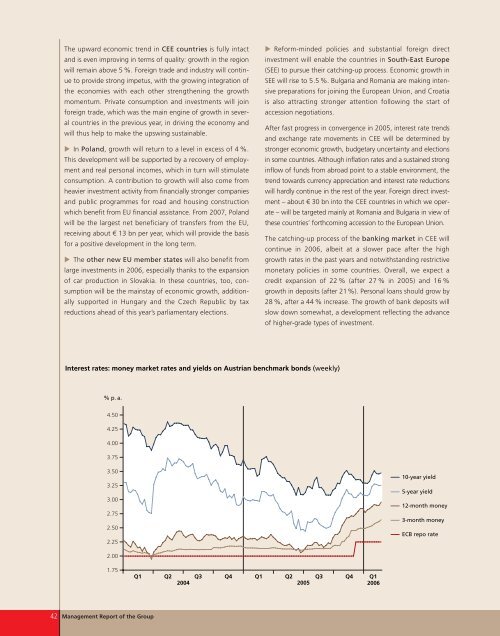

Interest rates: money market rates and yields on Austrian benchmark bonds (weekly)<br />

% p. a.<br />

4.50<br />

4.25<br />

4.00<br />

3.75<br />

3.50<br />

3.25<br />

3.00<br />

2.75<br />

2.50<br />

2.25<br />

2.00<br />

1.75<br />

42 Management Report of the Group<br />

� Reform-minded policies and substantial foreign direct<br />

investment will enable the countries in South-East Europe<br />

(SEE) to pursue their catching-up process. Economic growth in<br />

SEE will rise to 5.5 %. Bulgaria and Romania are making intensive<br />

preparations for joining the European Union, and Croatia<br />

is also attracting stronger attention following the start of<br />

accession negotiations.<br />

After fast progress in convergence in 2005, interest rate trends<br />

and exchange rate movements in CEE will be determined by<br />

stronger economic growth, budgetary uncertainty and elections<br />

in some countries. Although inflation rates and a sustained strong<br />

inflow of funds from abroad point to a stable environment, the<br />

trend towards currency appreciation and interest rate reductions<br />

will hardly continue in the rest of the year. Foreign direct investment<br />

– about € 30 bn into the CEE countries in which we operate<br />

– will be targeted mainly at Romania and Bulgaria in view of<br />

these countries’ forthcoming accession to the European Union.<br />

The catching-up process of the banking market in CEE will<br />

continue in 2006, albeit at a slower pace after the high<br />

growth rates in the past years and notwithstanding restrictive<br />

monetary policies in some countries. Overall, we expect a<br />

credit expansion of 22 % (after 27 % in 2005) and 16 %<br />

growth in deposits (after 21%). Personal loans should grow by<br />

28 %, after a 44 % increase. The growth of bank deposits will<br />

slow down somewhat, a development reflecting the advance<br />

of higher-grade types of investment.<br />

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1<br />

2004 2005 2006<br />

10-year yield<br />

5-year yield<br />

12-month money<br />

3-month money<br />

ECB repo rate