team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Loans to private<br />

customers grow<br />

more strongly<br />

than the market<br />

as a whole<br />

� Financing activities for private customers: In our financing<br />

campaigns we focused on the topic of insurance in the<br />

form of ZukunftsPaket. We went a step further with the popular<br />

campaign “One free loan instalment”, and offered BA-CA<br />

Residential Construction Promotion of up to € 600, which was<br />

a big sales success. As a result, our market share in private<br />

customer financing continued to grow. Our strategy of offering<br />

customers flexible financing solutions together with retirement<br />

<strong>pl</strong>anning components was extremely successful. Construction<br />

and home loans grew by 17 % and consumer loans<br />

by 9 %, both more strongly than the market, over and above<br />

the good results achieved in 2004. Our cooperation with sales<br />

partners again made an important contribution to this success;<br />

sales partners account for about 45 % of all new financings<br />

for private customers.<br />

� Financing activities for business customers: In 2005, by<br />

way of sales campaigns targeted at specific requirements and<br />

an individual relationship management approach, we continued<br />

to cater successfully to our business customers’ financing<br />

needs. The focus of further sales campaigns in 2006 will be on<br />

standard advisory services addressing the requirements of specific<br />

customer groups. In the area of financing activities we<br />

continue to pursue selective growth in customer segments<br />

with good credit ratings. Using our FinanzCheck product for<br />

SMEs, our relationship managers analyse the customer’s<br />

requirements jointly with the customer. This analysis is used as<br />

the starting point for intensified cross-selling in the fields of<br />

financing, investment, retirement <strong>pl</strong>anning and payment transactions.<br />

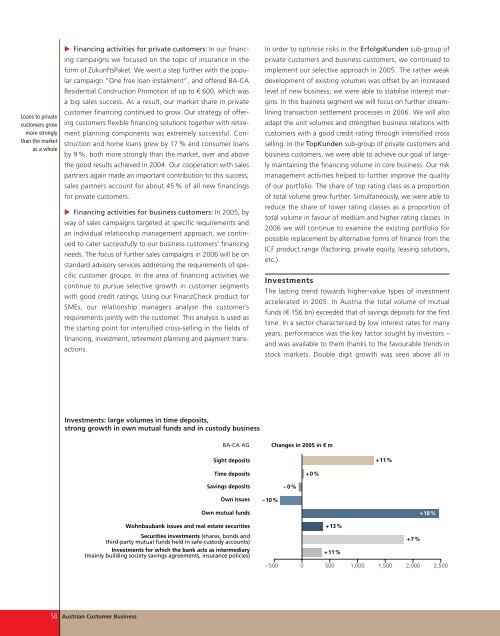

Investments: large volumes in time deposits,<br />

strong growth in own mutual funds and in custody business<br />

BA-CA AG<br />

Sight deposits<br />

Time deposits<br />

Savings deposits<br />

Own issues<br />

Own mutual funds<br />

Wohnbaubank issues and real estate securities<br />

Securities investments (shares, bonds and<br />

third-party mutual funds held in safe-custody accounts)<br />

Investments for which the bank acts as intermediary<br />

(mainly building society savings agreements, insurance policies)<br />

58 Austrian Customer Business<br />

In order to optimise risks in the ErfolgsKunden sub-group of<br />

private customers and business customers, we continued to<br />

im<strong>pl</strong>ement our selective approach in 2005. The rather weak<br />

development of existing volumes was offset by an increased<br />

level of new business; we were able to stabilise interest margins.<br />

In this business segment we will focus on further streamlining<br />

transaction settlement processes in 2006. We will also<br />

adapt the unit volumes and strengthen business relations with<br />

customers with a good credit rating through intensified cross<br />

selling. In the TopKunden sub-group of private customers and<br />

business customers, we were able to achieve our goal of largely<br />

maintaining the financing volume in core business. Our risk<br />

management activities helped to further improve the quality<br />

of our portfolio. The share of top rating class as a proportion<br />

of total volume grew further. Simultaneously, we were able to<br />

reduce the share of lower rating classes as a proportion of<br />

total volume in favour of medium and higher rating classes. In<br />

2006 we will continue to examine the existing portfolio for<br />

possible re<strong>pl</strong>acement by alternative forms of finance from the<br />

ICF product range (factoring, private equity, leasing solutions,<br />

etc.).<br />

Investments<br />

The lasting trend towards higher-value types of investment<br />

accelerated in 2005. In Austria the total volume of mutual<br />

funds (€ 156 bn) exceeded that of savings deposits for the first<br />

time. In a sector characterised by low interest rates for many<br />

years, performance was the key factor sought by investors –<br />

and was available to them thanks to the favourable trends in<br />

stock markets. Double digit growth was seen above all in<br />

–10%<br />

Changes in 2005 in € m<br />

–0%<br />

+0%<br />

+13%<br />

+11%<br />

+11%<br />

+7%<br />

+18%<br />

–500 0 500 1,000 1,500 2,000 2,500