team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

“The upswing experienced by the CEE countries after the difficult years of system transformation is a real<br />

success story. It is primarily the result of the countries’ own strong efforts, while also reflecting the targeted<br />

em<strong>pl</strong>oyment of capital. A number of our banking subsidiaries have reached levels of market position and<br />

maturity which suggest that stronger links can be established with the entire banking group, in terms of both<br />

customer service and production. And South-East Europe is an area where entrepreneurial initiative can thrive,<br />

an area characterised by optimism about the future which often seems to be missing in the “old EU” countries.”<br />

resentative office in the region was opened more than 30<br />

years ago. When the borders were opened, the bank made<br />

initial acquisitions and established banking subsidiaries. During<br />

that period, by acting as an adviser on privatisations and<br />

providing assistance for direct investment, we won the confidence<br />

of the business sector and of public authorities as a<br />

long-term investor. The difficult years of system transformation<br />

in the second half of the 1990s were marked by the<br />

development of corporate banking activities. The integration<br />

of HVB’s CEE banking subsidiaries following the first crossborder<br />

merger of banks was a major step forward, almost<br />

doubling the business volume in CEE. The years that followed<br />

saw consolidation and rationalisation efforts, which required<br />

major adjustments in several countries, especially in Poland. In<br />

the past two to three years we launched a drive for expansion:<br />

around the time when several CEE countries joined the<br />

European Union, we expanded the banking business, including<br />

retail banking activities, with different regional focuses. In<br />

South-East Europe we were already present when the region’s<br />

economy started to grow strongly.<br />

We have not reached the end of the path, there is still considerable<br />

potential available. Some countries have attained a<br />

level of professionalism in banking which meets international<br />

standards. The pioneering work is over, and convergence is<br />

making rapid progress. Markets are becoming more difficult.<br />

Other regions in CEE are experiencing a dynamic upturn; in<br />

these countries, we aim to further develop business from the<br />

very start with a focus on profitability and an awareness of<br />

risks and costs. In several new areas, business is yet to be<br />

developed.<br />

Bright outlook in a larger group<br />

The CEE Division of UniCredit now enables us to reach the<br />

scale required for a sustainable upward trend in many countries.<br />

The strategy behind this is to benefit from synergies and<br />

location advantages, using the princi<strong>pl</strong>e of best practice and<br />

leveraging the effects in the entire Group. This is exactly what<br />

Bank Austria Creditanstalt has been doing in its CEE business<br />

Regina Prehofer, Managing Board member responsible for CEE, Large Corporates and Real Estate<br />

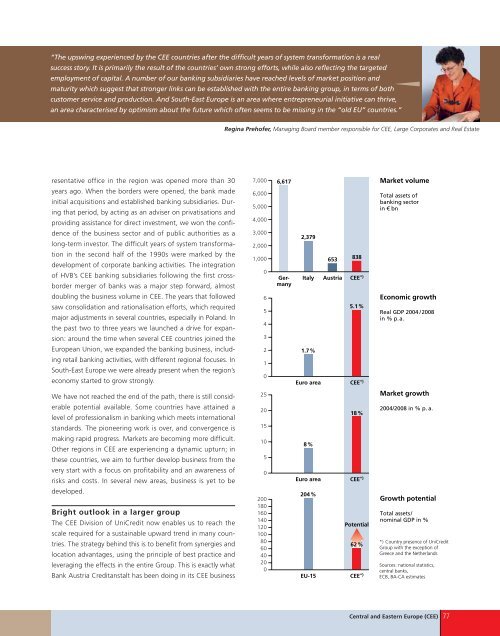

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

6,617<br />

Germany<br />

2,379<br />

1.7%<br />

8%<br />

204%<br />

EU-15<br />

653<br />

838<br />

Italy Austria CEE *)<br />

5.1%<br />

Euro area CEE *)<br />

18%<br />

Euro area CEE *)<br />

Potential<br />

62%<br />

CEE *)<br />

Market volume<br />

Total assets of<br />

banking sector<br />

in € bn<br />

Economic growth<br />

Real GDP 2004 /2008<br />

in % p.a.<br />

Market growth<br />

2004/2008 in % p. a.<br />

Growth potential<br />

Total assets/<br />

nominal GDP in %<br />

*) Country presence of UniCredit<br />

Group with the exception of<br />

Greece and the Netherlands<br />

Sources: national statistics,<br />

central banks,<br />

ECB, BA-CA estimates<br />

Central and Eastern Europe (CEE) 77