team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Flexible products<br />

for closing the<br />

pension gap<br />

� Pension <strong>pl</strong>anning: The two state-assisted retirement <strong>pl</strong>anning<br />

products, BA-CA VorsorgePlus-Plan and BA-CA Vorsorge-<br />

Plus-Pension, continued to be of interest to customers in<br />

2005. Together with other guaranteed-capital retirement <strong>pl</strong>anning<br />

products they make it easier for our customers to close<br />

their pension gap. In addition, the “PensionsManagement<br />

Golden Gate” product – a very flexible product with tax benefits,<br />

which guarantees the buyer an additional private pension<br />

for the rest of his life – was the focus of several product<br />

campaigns and was in strong demand. The possibility to structure<br />

the components in a very flexible manner is in conformity<br />

with our product philosophy: to meet the needs arising in<br />

the different periods of a person’s life with standardised, but<br />

flexible, products. BA-CA’s Global IndexGarant 05 is an indexlinked<br />

life insurance product with tax benefits. It offers<br />

investors the average performance of the three leading share<br />

indices and a 100 % guarantee on the invested capital, and<br />

was well-received by BA-CA customers.<br />

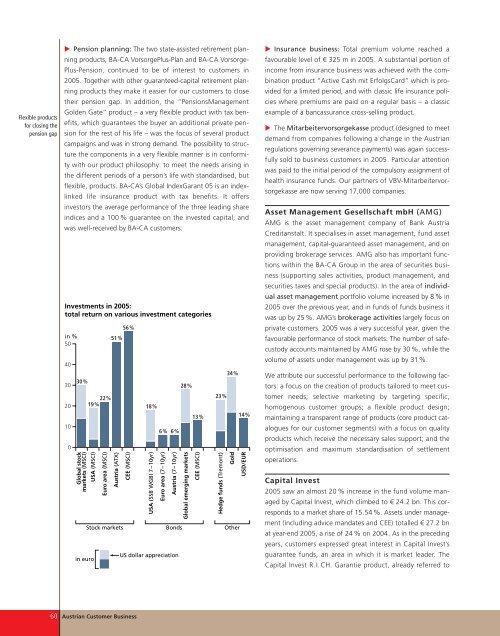

Investments in 2005:<br />

total return on various investment categories<br />

in %<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

30%<br />

Global stock<br />

markets (MSCI)<br />

USA (MSCI)<br />

in euro<br />

22%<br />

19%<br />

Euro area (MSCI)<br />

51%<br />

Austria (ATX)<br />

56%<br />

CEE (MSCI)<br />

60 Austrian Customer Business<br />

18%<br />

USA (SSB WGBI 7–10yr)<br />

6% 6%<br />

Euro area (7–10yr)<br />

Austria (7–10yr)<br />

28%<br />

13%<br />

23%<br />

34%<br />

Stock markets Bonds Other<br />

US dollar appreciation<br />

Global emerging markets<br />

CEE (MSCI)<br />

Hedge funds (Tremont)<br />

Gold<br />

14%<br />

USD/EUR<br />

� Insurance business: Total premium volume reached a<br />

favourable level of € 325 m in 2005. A substantial portion of<br />

income from insurance business was achieved with the combination<br />

product “Active Cash mit ErfolgsCard” which is provided<br />

for a limited period, and with classic life insurance policies<br />

where premiums are paid on a regular basis – a classic<br />

exam<strong>pl</strong>e of a bancassurance cross-selling product.<br />

� The Mitarbeitervorsorgekasse product (designed to meet<br />

demand from companies following a change in the Austrian<br />

regulations governing severance payments) was again successfully<br />

sold to business customers in 2005. Particular attention<br />

was paid to the initial period of the compulsory assignment of<br />

health insurance funds. Our partners of VBV-Mitarbeitervorsorgekasse<br />

are now serving 17,000 companies.<br />

Asset Management Gesellschaft mbH (AMG)<br />

AMG is the asset management company of Bank Austria<br />

Creditanstalt. It specialises in asset management, fund asset<br />

management, capital-guaranteed asset management, and on<br />

providing brokerage services. AMG also has important functions<br />

within the BA-CA Group in the area of securities business<br />

(supporting sales activities, product management, and<br />

securities taxes and special products). In the area of individual<br />

asset management portfolio volume increased by 8 % in<br />

2005 over the previous year, and in funds of funds business it<br />

was up by 25 %. AMG’s brokerage activities largely focus on<br />

private customers. 2005 was a very successful year, given the<br />

favourable performance of stock markets. The number of safecustody<br />

accounts maintained by AMG rose by 30 %, while the<br />

volume of assets under management was up by 31%.<br />

We attribute our successful performance to the following factors:<br />

a focus on the creation of products tailored to meet customer<br />

needs; selective marketing by targeting specific,<br />

homogenous customer groups; a flexible product design;<br />

maintaining a transparent range of products (core product catalogues<br />

for our customer segments) with a focus on quality<br />

products which receive the necessary sales support; and the<br />

optimisation and maximum standardisation of settlement<br />

operations.<br />

Capital Invest<br />

2005 saw an almost 20 % increase in the fund volume managed<br />

by Capital Invest, which climbed to € 24.2 bn. This corresponds<br />

to a market share of 15.54 %. Assets under management<br />

(including advice mandates and CEE) totalled € 27.2 bn<br />

at year-end 2005, a rise of 24 % on 2004. As in the preceding<br />

years, customers expressed great interest in Capital Invest’s<br />

guarantee funds, an area in which it is market leader. The<br />

Capital Invest R.I.CH. Garantie product, already referred to