team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

“Based on our new customer service approach, we offer customers exactly the level of service intensity<br />

they need. We also take a closer look and use modern methods to analyse the typical requirements of<br />

our customers in their respective circumstances, be it in their lives or in the company. Standardised<br />

products go a long way towards meeting their needs. In this way we make the world easier for customers –<br />

and for ourselves. And we find that customers want to be contacted by the bank and they appreciate the<br />

competence required to find sim<strong>pl</strong>e solutions for them.”<br />

type and intensity of service that meets their requirements,<br />

even if this involves turning away from banks’ traditional style<br />

of doing business.<br />

In 2005 we redefined the customer segments and im<strong>pl</strong>emented<br />

the appropriate customer service model. The new customer<br />

segmentation has brought service intensity into line<br />

with customer expectations. We have also defined profiles for<br />

four different categories of account managers – corresponding<br />

to the four customer groups comprising “ErfolgsKunden”<br />

private customers, “TopKunden” private customers, “Erfolgs-<br />

Kunden” business customers and “TopKunden” business customers<br />

– and allocated our em<strong>pl</strong>oyees to these categories<br />

depending on their preferences and skills. In this context we<br />

have upgraded sales career paths and adjusted basic and<br />

advanced training programmes of our Sales Academy to<br />

reflect the new structure. Our product range is of course<br />

geared to a more detailed segmentation, with dynamic and<br />

life-cycle activity features taking precedence over static sociological<br />

criteria.<br />

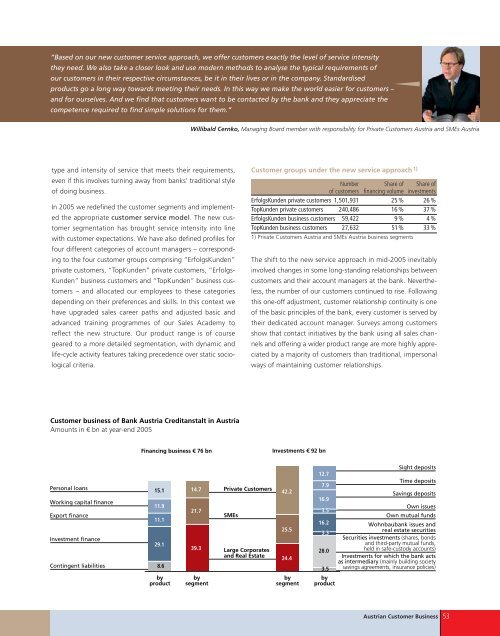

Customer business of Bank Austria Creditanstalt in Austria<br />

Amounts in € bn at year-end 2005<br />

Personal loans<br />

15.1 14.7 Private Customers<br />

Working capital finance<br />

Export finance<br />

Investment finance<br />

Contingent liabilities<br />

Financing business € 76 bn<br />

11.9<br />

11.1<br />

29.1<br />

8.6<br />

by<br />

product<br />

Willibald Cernko, Managing Board member with responsibility for Private Customers Austria and SMEs Austria<br />

21.7<br />

39.3<br />

by<br />

segment<br />

SMEs<br />

Large Corporates<br />

and Real Estate<br />

Customer groups under the new service approach 1)<br />

Number Share of Share of<br />

of customers financing volume investments<br />

ErfolgsKunden private customers 1,501,931 25 % 26 %<br />

TopKunden private customers 240,486 16 % 37 %<br />

ErfolgsKunden business customers 59,422 9 % 4 %<br />

TopKunden business customers 27,632 51% 33 %<br />

1) Private Customers Austria and SMEs Austria business segments<br />

The shift to the new service approach in mid-2005 inevitably<br />

involved changes in some long-standing relationships between<br />

customers and their account managers at the bank. Nevertheless,<br />

the number of our customers continued to rise. Following<br />

this one-off adjustment, customer relationship continuity is one<br />

of the basic princi<strong>pl</strong>es of the bank, every customer is served by<br />

their dedicated account manager. Surveys among customers<br />

show that contact initiatives by the bank using all sales channels<br />

and offering a wider product range are more highly appreciated<br />

by a majority of customers than traditional, impersonal<br />

ways of maintaining customer relationships.<br />

Investments € 92 bn<br />

42.2<br />

25.5<br />

24.4<br />

by<br />

segment<br />

12.7<br />

7.9<br />

16.9<br />

3.5<br />

16.2<br />

3.3<br />

28.0<br />

3.5<br />

by<br />

product<br />

Sight deposits<br />

Time deposits<br />

Savings deposits<br />

Own issues<br />

Own mutual funds<br />

Wohnbaubank issues and<br />

real estate securities<br />

Securities investments (shares, bonds<br />

and third-party mutual funds,<br />

held in safe-custody accounts)<br />

Investments for which the bank acts<br />

as intermediary (mainly building society<br />

savings agreements, insurance policies)<br />

Austrian Customer Business 53