team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Net trading result<br />

€ m 2005 2004 2003 2002 2001<br />

237 233 220 231 261<br />

In this environment, BA-CA demonstrated its expertise and<br />

achieved a net trading result of € 237 m, exceeding the high<br />

figure of the previous year by 2 %. The contribution from<br />

BA-CA Cayman, which is part of the Corporate Center segment,<br />

was positive, though slightly lower than in the previous<br />

year. Quite generally, 2005 was characterised by a belowaverage<br />

performance of the hedge fund industry, especially<br />

convertible arbitrage strategies.<br />

� General administrative expenses rose by € 143 m or 6 %<br />

to € 2,622 m in 2005. Costs again rose at a slower pace than<br />

revenues, reflecting a further improvement in productivity.<br />

Almost all of the increase in general administrative expenses<br />

was recorded in the CEE business segment (up by € 132 m or<br />

19 %). In this segment, exchange rate effects amounted to<br />

€ 55 m and changes in the group of consolidated companies<br />

accounted for € 41 m. Adjusted for exchange rate effects and<br />

additions to and disposals of consolidated companies, general<br />

administrative expenses in the CEE segment increased by € 35 m<br />

or 5 %. Total costs in the other business segments rose by only<br />

1%; in the three Austrian customer business segments, general<br />

administrative expenses remained unchanged. The 2005<br />

income statement reflects a special expense of € 23 m related<br />

to the integration into UniCredit Group.<br />

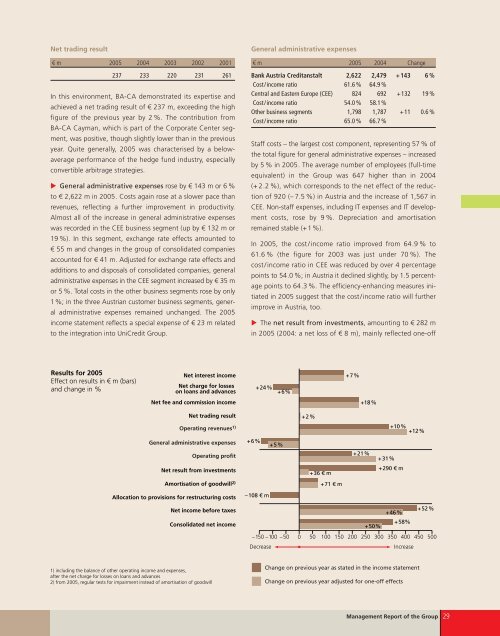

Results for 2005<br />

Effect on results in € m (bars)<br />

and change in %<br />

Net interest income<br />

Net charge for losses<br />

on loans and advances<br />

Net fee and commission income<br />

Net trading result<br />

Operating revenues 1)<br />

General administrative expenses<br />

Operating profit<br />

Net result from investments<br />

Amortisation of goodwill 2)<br />

Allocation to provisions for restructuring costs<br />

Net income before taxes<br />

Consolidated net income<br />

1) including the balance of other operating income and expenses,<br />

after the net charge for losses on loans and advances<br />

2) from 2005, regular tests for impairment instead of amortisation of goodwill<br />

General administrative expenses<br />

€ m 2005 2004 Change<br />

Bank Austria Creditanstalt 2,622 2,479 +143 6 %<br />

Cost/income ratio 61.6 % 64.9 %<br />

Central and Eastern Europe (CEE) 824 692 +132 19 %<br />

Cost/income ratio 54.0 % 58.1%<br />

Other business segments 1,798 1,787 +11 0.6 %<br />

Cost/income ratio 65.0 % 66.7 %<br />

Staff costs – the largest cost component, representing 57 % of<br />

the total figure for general administrative expenses – increased<br />

by 5 % in 2005. The average number of em<strong>pl</strong>oyees (full-time<br />

equivalent) in the Group was 647 higher than in 2004<br />

(+ 2.2 %), which corresponds to the net effect of the reduction<br />

of 920 (– 7.5 %) in Austria and the increase of 1,567 in<br />

CEE. Non-staff expenses, including IT expenses and IT development<br />

costs, rose by 9 %. Depreciation and amortisation<br />

remained stable (+1%).<br />

In 2005, the cost/income ratio improved from 64.9 % to<br />

61.6 % (the figure for 2003 was just under 70 %). The<br />

cost/income ratio in CEE was reduced by over 4 percentage<br />

points to 54.0 %; in Austria it declined slightly, by 1.5 percentage<br />

points to 64.3 %. The efficiency-enhancing measures initiated<br />

in 2005 suggest that the cost/income ratio will further<br />

improve in Austria, too.<br />

� The net result from investments, amounting to € 282 m<br />

in 2005 (2004: a net loss of € 8 m), mainly reflected one-off<br />

+6%<br />

+24%<br />

–108 € m<br />

+5%<br />

+6%<br />

+2%<br />

+36 € m<br />

+71 € m<br />

+7%<br />

+18%<br />

+21%<br />

+31%<br />

+290 € m<br />

+10%<br />

+12%<br />

+46%<br />

+58%<br />

+50%<br />

–150 –100 –50 0 50 100 150 200 250 300 350 400 450 500<br />

Decrease Increase<br />

Change on previous year as stated in the income statement<br />

Change on previous year adjusted for one-off effects<br />

+52%<br />

Management Report of the Group 29