team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

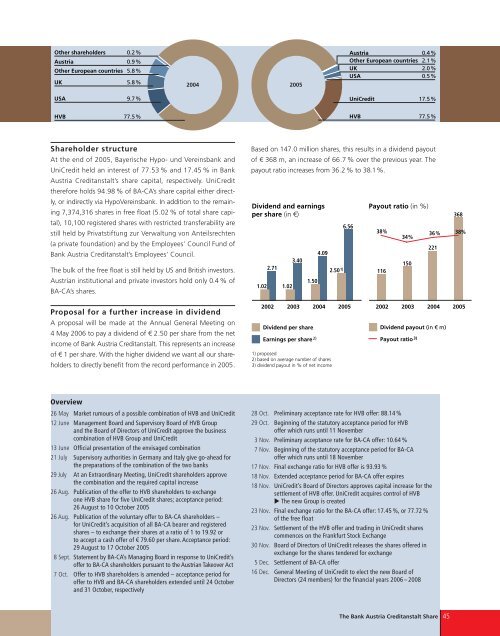

Other shareholders 0.2%<br />

Austria 0.9%<br />

Other European countries 5.8%<br />

UK 5.8%<br />

USA 9.7%<br />

HVB 77.5%<br />

2004<br />

Shareholder structure<br />

At the end of 2005, Bayerische Hypo- und Vereinsbank and<br />

UniCredit held an interest of 77.53 % and 17.45 % in Bank<br />

Austria Creditanstalt’s share capital, respectively. UniCredit<br />

therefore holds 94.98 % of BA-CA’s share capital either directly,<br />

or indirectly via HypoVereinsbank. In addition to the remaining<br />

7,374,316 shares in free float (5.02 % of total share capital),<br />

10,100 registered shares with restricted transferability are<br />

still held by Privatstiftung zur Verwaltung von Anteilsrechten<br />

(a private foundation) and by the Em<strong>pl</strong>oyees’ Council Fund of<br />

Bank Austria Creditanstalt’s Em<strong>pl</strong>oyees’ Council.<br />

The bulk of the free float is still held by US and British investors.<br />

Austrian institutional and private investors hold only 0.4 % of<br />

BA-CA’s shares.<br />

Proposal for a further increase in dividend<br />

A proposal will be made at the Annual General Meeting on<br />

4 May 2006 to pay a dividend of € 2.50 per share from the net<br />

income of Bank Austria Creditanstalt. This represents an increase<br />

of € 1 per share. With the higher dividend we want all our shareholders<br />

to directly benefit from the record performance in 2005.<br />

Overview<br />

26 May Market rumours of a possible combination of HVB and UniCredit<br />

12 June Management Board and Supervisory Board of HVB Group<br />

and the Board of Directors of UniCredit approve the business<br />

combination of HVB Group and UniCredit<br />

13 June Official presentation of the envisaged combination<br />

21 July Supervisory authorities in Germany and Italy give go-ahead for<br />

the preparations of the combination of the two banks<br />

29 July At an Extraordinary Meeting, UniCredit shareholders approve<br />

the combination and the required capital increase<br />

26 Aug. Publication of the offer to HVB shareholders to exchange<br />

one HVB share for five UniCredit shares; acceptance period:<br />

26 August to 10 October 2005<br />

26 Aug. Publication of the voluntary offer to BA-CA shareholders –<br />

for UniCredit’s acquisition of all BA-CA bearer and registered<br />

shares – to exchange their shares at a ratio of 1 to 19.92 or<br />

to accept a cash offer of € 79.60 per share. Acceptance period:<br />

29 August to 17 October 2005<br />

8 Sept. Statement by BA-CA’s Managing Board in response to UniCredit’s<br />

offer to BA-CA shareholders pursuant to the Austrian Takeover Act<br />

7 Oct. Offer to HVB shareholders is amended – acceptance period for<br />

offer to HVB and BA-CA shareholders extended until 24 October<br />

and 31 October, respectively<br />

Based on 147.0 million shares, this results in a dividend payout<br />

of € 368 m, an increase of 66.7 % over the previous year. The<br />

payout ratio increases from 36.2 % to 38.1%.<br />

Dividend and earnings<br />

per share (in €)<br />

2.71<br />

1.02 1.02<br />

2005<br />

3.40<br />

1.50<br />

Payout ratio (in %)<br />

2002 2003 2004 2005 2002 2003 2004 2005<br />

Dividend per share<br />

4.09<br />

Dividend payout (in € m)<br />

Earnings per share 2) Payout ratio 3)<br />

1) proposed<br />

2) based on average number of shares<br />

3) dividend payout in % of net income<br />

2.50 1)<br />

Austria 0.4%<br />

Other European countries 2.1%<br />

UK 2.0%<br />

USA 0.5%<br />

6.56<br />

UniCredit 17.5%<br />

HVB 77.5%<br />

38%<br />

116<br />

34%<br />

28 Oct. Preliminary acceptance rate for HVB offer: 88.14 %<br />

29 Oct. Beginning of the statutory acceptance period for HVB<br />

offer which runs until 11 November<br />

3 Nov. Preliminary acceptance rate for BA-CA offer: 10.64 %<br />

7 Nov. Beginning of the statutory acceptance period for BA-CA<br />

offer which runs until 18 November<br />

17 Nov. Final exchange ratio for HVB offer is 93.93 %<br />

18 Nov. Extended acceptance period for BA-CA offer expires<br />

18 Nov. UniCredit’s Board of Directors approves capital increase for the<br />

settlement of HVB offer. UniCredit acquires control of HVB<br />

� The new Group is created<br />

23 Nov. Final exchange ratio for the BA-CA offer: 17.45 %, or 77.72 %<br />

of the free float<br />

23 Nov. Settlement of the HVB offer and trading in UniCredit shares<br />

commences on the Frankfurt Stock Exchange<br />

30 Nov. Board of Directors of UniCredit releases the shares offered in<br />

exchange for the shares tendered for exchange<br />

5 Dec. Settlement of BA-CA offer<br />

16 Dec. General Meeting of UniCredit to elect the new Board of<br />

Directors (24 members) for the financial years 2006 – 2008<br />

150<br />

36%<br />

221<br />

The Bank Austria Creditanstalt Share 45<br />

368<br />

38%