team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

“As a bank with growing business volume, we deliberately take more risk on our books while aiming to<br />

reduce the relative risk content of business. In these efforts we are supported by progress in quantitative<br />

risk management methods. On the basis of our rating advisory service and a financial structure analysis, we<br />

also want to enhance our customers' credit rating. We improve the em<strong>pl</strong>oyment of capital by <strong>pl</strong>acing risks<br />

in the secondary market or via derivatives, with no impact on customer relationships. This helps us to free<br />

up additional resources for expansion in strategically important areas.”<br />

The presentation of our risk exposure in this section is based<br />

on all assets involving credit risk. This corresponds to the BA-<br />

CA risk position on a consolidated basis. The following table<br />

shows a breakdown of the risk position according to balance<br />

sheet items, including guarantees and undrawn portions of<br />

credit facilities.<br />

€ m as at 31 December 2005 *) Loans and advances to,<br />

2004 2003<br />

and <strong>pl</strong>acements with, banks 26,556 23,995 25,130<br />

Loans and advances to customers 88,317 81,260 75,997<br />

Trading assets<br />

Investments excl. interests in<br />

17,887 18,590 16,140<br />

subsidiaries and other companies 8,885 14,420 13,319<br />

Contingent liabilities and commitments 23,327 18,250 19,888<br />

TOTAL 164,972 156,515 150,474<br />

*) Balance sheet figures including non-current assets classified as held for<br />

sale (see note 20 to the consolidated financial statements of BA-CA).<br />

The categories listed above cover the following products:<br />

� Loans and advances to, and <strong>pl</strong>acements with, banks comprise<br />

loans, advances and money market <strong>pl</strong>acements.<br />

� Loans and advances to customers (private individuals, businesses<br />

and public entities) include loans (revolving loans, term<br />

loans and overdraft facilities), mortgage loans, export loans and<br />

finance lease receivables.<br />

� Trading assets comprise bonds and other fixed-income securities,<br />

shares and floating-rate securities, positive market values<br />

of derivative financial instruments and other trading assets.<br />

� Investments excl. interests in subsidiaries and other companies:<br />

bonds and other fixed-income securities, shares and floating-rate<br />

securities. Not included are interests in subsidiaries,<br />

interests in companies accounted for under the equity method,<br />

and investment properties.<br />

� Contingent liabilities and commitments include letters of<br />

credit and other trade-related guarantees, loan commitments<br />

not yet utilised, and acceptances and endorsements. From<br />

2004, excluding contingent liabilities to companies included in<br />

consolidation.<br />

Johann Strobl, Managing Board member, Chief Risk Officer (CRO)<br />

Further increase in risk exposures<br />

and risk-weighted assets<br />

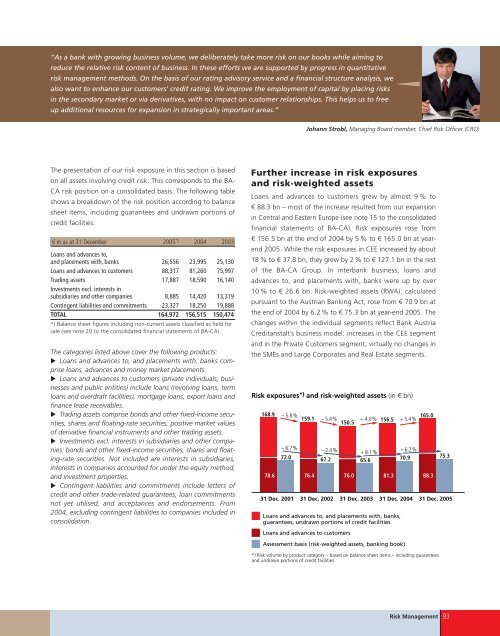

Loans and advances to customers grew by almost 9 % to<br />

€ 88.3 bn – most of the increase resulted from our expansion<br />

in Central and Eastern Europe (see note 15 to the consolidated<br />

financial statements of BA-CA). Risk exposures rose from<br />

€ 156.5 bn at the end of 2004 by 5 % to € 165.0 bn at yearend<br />

2005. While the risk exposures in CEE increased by about<br />

18 % to € 37.8 bn, they grew by 2 % to € 127.1 bn in the rest<br />

of the BA-CA Group. In interbank business, loans and<br />

advances to, and <strong>pl</strong>acements with, banks were up by over<br />

10 % to € 26.6 bn. Risk-weighted assets (RWA), calculated<br />

pursuant to the Austrian Banking Act, rose from € 70.9 bn at<br />

the end of 2004 by 6.2 % to € 75.3 bn at year-end 2005. The<br />

changes within the individual segments reflect Bank Austria<br />

Creditanstalt’s business model: increases in the CEE segment<br />

and in the Private Customers segment, virtually no changes in<br />

the SMEs and Large Corporates and Real Estate segments.<br />

Risk exposures *) and risk-weighted assets (in € bn)<br />

168.9 –5.8%<br />

78.6<br />

– 6.7%<br />

72.0<br />

31 Dec. 2001<br />

159.1 – 5.4%<br />

76.4<br />

– 2.4%<br />

67.2<br />

31 Dec. 2002<br />

150.5<br />

76.0<br />

+ 4.0%<br />

+ 8.1%<br />

65.6<br />

31 Dec. 2003<br />

156.5<br />

81.3<br />

+ 5.4%<br />

+ 6.2%<br />

70.9<br />

31 Dec. 2004<br />

Loans and advances to, and <strong>pl</strong>acements with, banks,<br />

guarantees, undrawn portions of credit facilities<br />

Loans and advances to customers<br />

Assessment basis (risk-weighted assets, banking book)<br />

165.0<br />

88.3<br />

75.3<br />

31 Dec. 2005<br />

*) Risk volume by product category – based on balance sheet items – including guarantees<br />

and undrawn portions of credit facilities<br />

Risk Management 93