team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Outlook<br />

With the <strong>pl</strong>anned expansion of the branch network and alternative<br />

distribution channels, we will further strengthen our<br />

competitive position in retail banking. We aim to use synergies<br />

from the large banking group for cross-border business while<br />

further intensifying our efforts to strengthen our position in<br />

the business customer market, a fast-growing segment in the<br />

Hungarian banking sector.<br />

Slovenia –<br />

Bank Austria Creditanstalt Ljubljana<br />

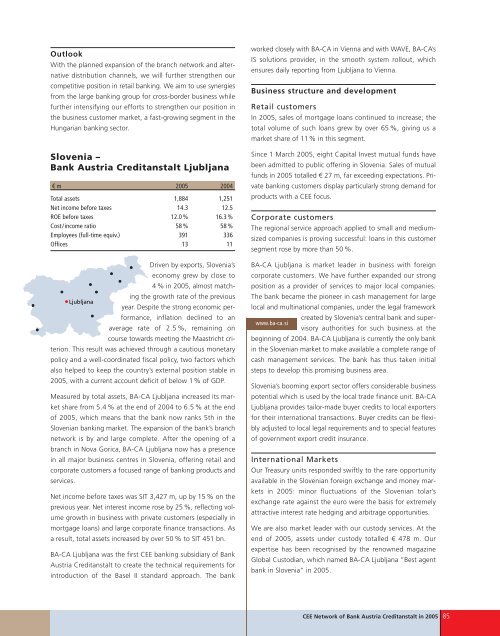

€ m 2005 2004<br />

Total assets 1,884 1,251<br />

Net income before taxes 14.3 12.5<br />

ROE before taxes 12.0 % 16.3 %<br />

Cost/income ratio 58 % 58 %<br />

Em<strong>pl</strong>oyees (full-time equiv.) 391 336<br />

Offices 13 11<br />

Driven by exports, Slovenia’s<br />

economy grew by close to<br />

4 % in 2005, almost matching<br />

the growth rate of the previous<br />

Ljubljana<br />

year. Despite the strong economic performance,<br />

inflation declined to an<br />

average rate of 2.5 %, remaining on<br />

course towards meeting the Maastricht criterion.<br />

This result was achieved through a cautious monetary<br />

policy and a well-coordinated fiscal policy, two factors which<br />

also helped to keep the country’s external position stable in<br />

2005, with a current account deficit of below 1% of GDP.<br />

Measured by total assets, BA-CA Ljubljana increased its market<br />

share from 5.4 % at the end of 2004 to 6.5 % at the end<br />

of 2005, which means that the bank now ranks 5th in the<br />

Slovenian banking market. The expansion of the bank’s branch<br />

network is by and large com<strong>pl</strong>ete. After the opening of a<br />

branch in Nova Gorica, BA-CA Ljubljana now has a presence<br />

in all major business centres in Slovenia, offering retail and<br />

corporate customers a focused range of banking products and<br />

services.<br />

Net income before taxes was SIT 3,427 m, up by 15 % on the<br />

previous year. Net interest income rose by 25 %, reflecting volume<br />

growth in business with private customers (especially in<br />

mortgage loans) and large corporate finance transactions. As<br />

a result, total assets increased by over 50 % to SIT 451 bn.<br />

BA-CA Ljubljana was the first CEE banking subsidiary of Bank<br />

Austria Creditanstalt to create the technical requirements for<br />

introduction of the Basel II standard approach. The bank<br />

worked closely with BA-CA in Vienna and with WAVE, BA-CA’s<br />

IS solutions provider, in the smooth system rollout, which<br />

ensures daily reporting from Ljubljana to Vienna.<br />

Business structure and development<br />

Retail customers<br />

In 2005, sales of mortgage loans continued to increase; the<br />

total volume of such loans grew by over 65 %, giving us a<br />

market share of 11% in this segment.<br />

Since 1 March 2005, eight Capital Invest mutual funds have<br />

been admitted to public offering in Slovenia. Sales of mutual<br />

funds in 2005 totalled € 27 m, far exceeding expectations. Private<br />

banking customers dis<strong>pl</strong>ay particularly strong demand for<br />

products with a CEE focus.<br />

Corporate customers<br />

The regional service approach ap<strong>pl</strong>ied to small and mediumsized<br />

companies is proving successful: loans in this customer<br />

segment rose by more than 50 %.<br />

BA-CA Ljubljana is market leader in business with foreign<br />

corporate customers. We have further expanded our strong<br />

position as a provider of services to major local companies.<br />

The bank became the pioneer in cash management for large<br />

local and multinational companies, under the legal framework<br />

created by Slovenia’s central bank and super-<br />

www.ba-ca.si<br />

visory authorities for such business at the<br />

beginning of 2004. BA-CA Ljubljana is currently the only bank<br />

in the Slovenian market to make available a com<strong>pl</strong>ete range of<br />

cash management services. The bank has thus taken initial<br />

steps to develop this promising business area.<br />

Slovenia’s booming export sector offers considerable business<br />

potential which is used by the local trade finance unit. BA-CA<br />

Ljubljana provides tailor-made buyer credits to local exporters<br />

for their international transactions. Buyer credits can be flexibly<br />

adjusted to local legal requirements and to special features<br />

of government export credit insurance.<br />

International Markets<br />

Our Treasury units responded swiftly to the rare opportunity<br />

available in the Slovenian foreign exchange and money markets<br />

in 2005: minor fluctuations of the Slovenian tolar’s<br />

exchange rate against the euro were the basis for extremely<br />

attractive interest rate hedging and arbitrage opportunities.<br />

We are also market leader with our custody services. At the<br />

end of 2005, assets under custody totalled € 478 m. Our<br />

expertise has been recognised by the renowned magazine<br />

Global Custodian, which named BA-CA Ljubljana “Best agent<br />

bank in Slovenia” in 2005.<br />

CEE Network of Bank Austria Creditanstalt in 2005 85