team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

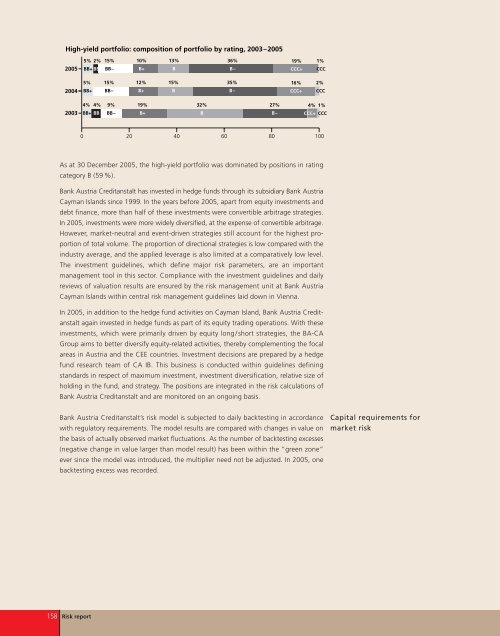

High-yield portfolio: composition of portfolio by rating, 2003–2005<br />

2005<br />

2004<br />

2003<br />

5%<br />

BB+<br />

4% 4%<br />

BB+ BB<br />

0<br />

As at 30 December 2005, the high-yield portfolio was dominated by positions in rating<br />

category B (59 %).<br />

Bank Austria Creditanstalt has invested in hedge funds through its subsidiary Bank Austria<br />

Cayman Islands since 1999. In the years before 2005, apart from equity investments and<br />

debt finance, more than half of these investments were convertible arbitrage strategies.<br />

In 2005, investments were more widely diversified, at the expense of convertible arbitrage.<br />

However, market-neutral and event-driven strategies still account for the highest proportion<br />

of total volume. The proportion of directional strategies is low compared with the<br />

industry average, and the ap<strong>pl</strong>ied leverage is also limited at a comparatively low level.<br />

The investment guidelines, which define major risk parameters, are an important<br />

management tool in this sector. Com<strong>pl</strong>iance with the investment guidelines and daily<br />

reviews of valuation results are ensured by the risk management unit at Bank Austria<br />

Cayman Islands within central risk management guidelines laid down in Vienna.<br />

In 2005, in addition to the hedge fund activities on Cayman Island, Bank Austria Creditanstalt<br />

again invested in hedge funds as part of its equity trading operations. With these<br />

investments, which were primarily driven by equity long/short strategies, the BA-CA<br />

Group aims to better diversify equity-related activities, thereby com<strong>pl</strong>ementing the focal<br />

areas in Austria and the CEE countries. Investment decisions are prepared by a hedge<br />

fund research <strong>team</strong> of CA IB. This business is conducted within guidelines defining<br />

standards in respect of maximum investment, investment diversification, relative size of<br />

holding in the fund, and strategy. The positions are integrated in the risk calculations of<br />

Bank Austria Creditanstalt and are monitored on an ongoing basis.<br />

Bank Austria Creditanstalt’s risk model is subjected to daily backtesting in accordance<br />

with regulatory requirements. The model results are compared with changes in value on<br />

the basis of actually observed market fluctuations. As the number of backtesting excesses<br />

(negative change in value larger than model result) has been within the “green zone”<br />

ever since the model was introduced, the multi<strong>pl</strong>ier need not be adjusted. In 2005, one<br />

backtesting excess was recorded.<br />

158 Risk report<br />

5% 2% 15%<br />

BB+ BB<br />

BB–<br />

15%<br />

BB–<br />

9%<br />

BB–<br />

10%<br />

B+<br />

12%<br />

B+<br />

19%<br />

B+<br />

13%<br />

B<br />

15%<br />

B<br />

32%<br />

B<br />

36%<br />

35%<br />

20 40 60 80 100<br />

B–<br />

B–<br />

27%<br />

B–<br />

19%<br />

CCC+<br />

16%<br />

CCC+<br />

1%<br />

CCC<br />

2%<br />

CCC<br />

4% 1%<br />

CCC+ CCC<br />

Capital requirements for<br />

market risk