team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

as an organisational princi<strong>pl</strong>e has priority in the new Group.<br />

The divisions set binding targets which ap<strong>pl</strong>y to all regional<br />

units. Moreover, cost and revenue synergies need to be<br />

unlocked through best practice, by optimising capacity at<br />

product factories, and by rationalising overlapping or du<strong>pl</strong>icate<br />

functions.<br />

The Group embraces diversity in the form of different languages,<br />

legal systems and cultures; this is a basic value of the<br />

European Union. Like Bank Austria Creditanstalt, UniCredit has<br />

attached great importance to regional diver-<br />

Regional diversity<br />

sity for many years. The Group is based on<br />

and supraregional<br />

strong brands which have developed in the<br />

divisions<br />

various home markets. It uses the wide variety<br />

of talents in the whole of Europe. The Group is aware that<br />

customer relationships are always personal and regional relationships.<br />

In this way the Group combines and benefits from<br />

the very best elements of centralisation and decentralisation.<br />

The business combination received approval from shareholders<br />

in a clear vote. On 12 June 2005, HVB and UniCredit<br />

announced that they would join forces and presented their<br />

vision of a truly European bank to the capital market. The<br />

business combination was carried out through several voluntary<br />

share exchange offers. By the time the exchange offer in<br />

Germany was com<strong>pl</strong>eted on 18 November 2005, HypoVereins-<br />

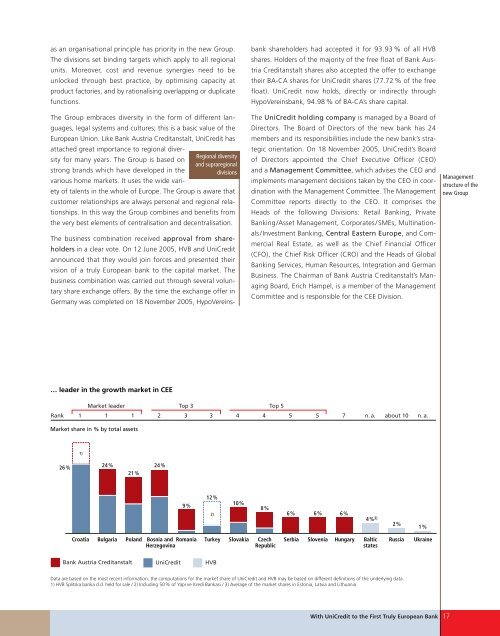

… leader in the growth market in CEE<br />

Rank<br />

Market leader<br />

Market share in % by total assets<br />

26%<br />

1<br />

1)<br />

1 1<br />

24%<br />

Top 3 Top 5<br />

bank shareholders had accepted it for 93.93 % of all HVB<br />

shares. Holders of the majority of the free float of Bank Austria<br />

Creditanstalt shares also accepted the offer to exchange<br />

their BA-CA shares for UniCredit shares (77.72 % of the free<br />

float). UniCredit now holds, directly or indirectly through<br />

HypoVereinsbank, 94.98 % of BA-CA’s share capital.<br />

The UniCredit holding company is managed by a Board of<br />

Directors. The Board of Directors of the new bank has 24<br />

members and its responsibilities include the new bank’s strategic<br />

orientation. On 18 November 2005, UniCredit’s Board<br />

of Directors appointed the Chief Executive Officer (CEO)<br />

and a Management Committee, which advises the CEO and<br />

im<strong>pl</strong>ements management decisions taken by the CEO in coordination<br />

with the Management Committee. The Management<br />

Committee reports directly to the CEO. It comprises the<br />

Heads of the following Divisions: Retail Banking, Private<br />

Banking/Asset Management, Corporates/SMEs, Multinationals/Investment<br />

Banking, Central Eastern Europe, and Commercial<br />

Real Estate, as well as the Chief Financial Officer<br />

(CFO), the Chief Risk Officer (CRO) and the Heads of Global<br />

Banking Services, Human Resources, Integration and German<br />

Business. The Chairman of Bank Austria Creditanstalt’s Managing<br />

Board, Erich Hampel, is a member of the Management<br />

Committee and is responsible for the CEE Division.<br />

Croatia Bulgaria Poland Bosnia and Romania Turkey Slovakia Czech Serbia Slovenia Hungary Baltic<br />

Herzegovina<br />

Republic<br />

states<br />

Bank Austria Creditanstalt<br />

21%<br />

2<br />

24%<br />

3<br />

9%<br />

3<br />

12%<br />

2)<br />

UniCredit HVB<br />

n. a. about 10 n. a.<br />

Data are based on the most recent information; the computations for the market share of UniCredit and HVB may be based on different definitions of the underlying data.<br />

1) HVB S<strong>pl</strong>itska banka d.d. held for sale / 2) Including 50% of Yapı ve Kredi Bankasi / 3) Average of the market shares in Estonia, Latvia and Lithuania<br />

4<br />

10%<br />

4<br />

8%<br />

5<br />

6%<br />

5<br />

6%<br />

7<br />

6%<br />

4% 3)<br />

2%<br />

1%<br />

Russia Ukraine<br />

With UniCredit to the First Truly European Bank 17<br />

Management<br />

structure of the<br />

new Group