team spirit - Bankier.pl

team spirit - Bankier.pl

team spirit - Bankier.pl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

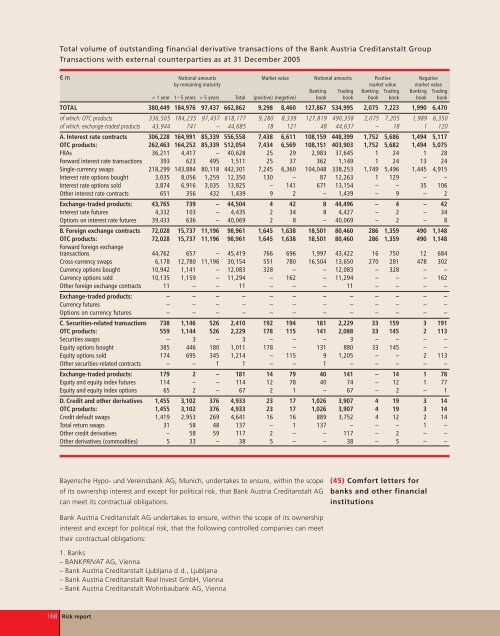

Total volume of outstanding financial derivative transactions of the Bank Austria Creditanstalt Group<br />

Transactions with external counterparties as at 31 December 2005<br />

€ m Notional amounts Market value Notional amounts Positive Negative<br />

by remaining maturity market value market value<br />

Banking Trading Banking Trading Banking Trading<br />

< 1 year 1– 5 years > 5 years Total (positive) (negative) book book book book book book<br />

TOTAL 380,449 184,976 97,437 662,862 9,298 8,460 127,867 534,995 2,075 7,223 1,990 6,470<br />

of which: OTC products 336,505 184,235 97,437 618,177 9,280 8,339 127,819 490,358 2,075 7,205 1,989 6,350<br />

of which: exchange-traded products 43,944 741 – 44,685 18 121 48 44,637 – 18 1 120<br />

A. Interest rate contracts 306,228 164,991 85,339 556,558 7,438 6,611 108,159 448,399 1,752 5,686 1,494 5,117<br />

OTC products: 262,463 164,252 85,339 512,054 7,434 6,569 108,151 403,903 1,752 5,682 1,494 5,075<br />

FRAs 36,211 4,417 – 40,628 25 29 2,983 37,645 1 24 1 28<br />

Forward interest rate transactions 393 623 495 1,511 25 37 362 1,149 1 24 13 24<br />

Single-currency swaps 218,299 143,884 80,118 442,301 7,245 6,360 104,048 338,253 1,749 5,496 1,445 4,915<br />

Interest rate options bought 3,035 8,056 1,259 12,350 130 – 87 12,263 1 129 – –<br />

Interest rate options sold 3,874 6,916 3,035 13,825 – 141 671 13,154 – – 35 106<br />

Other interest rate contracts 651 356 432 1,439 9 2 – 1,439 – 9 – 2<br />

Exchange-traded products: 43,765 739 – 44,504 4 42 8 44,496 – 4 – 42<br />

Interest rate futures 4,332 103 – 4,435 2 34 8 4,427 – 2 – 34<br />

Options on interest rate futures 39,433 636 – 40,069 2 8 – 40,069 – 2 – 8<br />

B. Foreign exchange contracts 72,028 15,737 11,196 98,961 1,645 1,638 18,501 80,460 286 1,359 490 1,148<br />

OTC products:<br />

Forward foreign exchange<br />

72,028 15,737 11,196 98,961 1,645 1,638 18,501 80,460 286 1,359 490 1,148<br />

transactions 44,762 657 – 45,419 766 696 1,997 43,422 16 750 12 684<br />

Cross-currency swaps 6,178 12,780 11,196 30,154 551 780 16,504 13,650 270 281 478 302<br />

Currency options bought 10,942 1,141 – 12,083 328 – – 12,083 – 328 – –<br />

Currency options sold 10,135 1,159 – 11,294 – 162 – 11,294 – – – 162<br />

Other foreign exchange contracts 11 – – 11 – – – 11 – – – –<br />

Exchange-traded products: – – – – – – – – – – – –<br />

Currency futures – – – – – – – – – – – –<br />

Options on currency futures – – – – – – – – – – – –<br />

C. Securities-related transactions 738 1,146 526 2,410 192 194 181 2,229 33 159 3 191<br />

OTC products: 559 1,144 526 2,229 178 115 141 2,088 33 145 2 113<br />

Securities swaps – 3 – 3 – – – 3 – – – –<br />

Equity options bought 385 446 180 1,011 178 – 131 880 33 145 – –<br />

Equity options sold 174 695 345 1,214 – 115 9 1,205 – – 2 113<br />

Other securities-related contracts – – 1 1 – – 1 – – – – –<br />

Exchange-traded products: 179 2 – 181 14 79 40 141 – 14 1 78<br />

Equity and equity index futures 114 – – 114 12 78 40 74 – 12 1 77<br />

Equity and equity index options 65 2 – 67 2 1 – 67 – 2 – 1<br />

D. Credit and other derivatives 1,455 3,102 376 4,933 23 17 1,026 3,907 4 19 3 14<br />

OTC products: 1,455 3,102 376 4,933 23 17 1,026 3,907 4 19 3 14<br />

Credit default swaps 1,419 2,953 269 4,641 16 16 889 3,752 4 12 2 14<br />

Total return swaps 31 58 48 137 – 1 137 – – – 1 –<br />

Other credit derivatives – 58 59 117 2 – – 117 – 2 – –<br />

Other derivatives (commodities) 5 33 – 38 5 – – 38 – 5 – –<br />

Bayerische Hypo- und Vereinsbank AG, Munich, undertakes to ensure, within the scope<br />

of its ownership interest and except for political risk, that Bank Austria Creditanstalt AG<br />

can meet its contractual obligations.<br />

Bank Austria Creditanstalt AG undertakes to ensure, within the scope of its ownership<br />

interest and except for political risk, that the following controlled companies can meet<br />

their contractual obligations:<br />

1. Banks<br />

– BANKPRIVAT AG, Vienna<br />

– Bank Austria Creditanstalt Ljubljana d.d., Ljubljana<br />

– Bank Austria Creditanstalt Real Invest GmbH, Vienna<br />

– Bank Austria Creditanstalt Wohnbaubank AG, Vienna<br />

168 Risk report<br />

(45) Comfort letters for<br />

banks and other financial<br />

institutions