- Page 1 and 2:

FINAL REPORT Options for Managing L

- Page 3:

FINAL REPORT Options for Managing L

- Page 6 and 7:

FINAL REPORT current operating regi

- Page 8 and 9:

FINAL REPORT The current regulation

- Page 10 and 11:

FINAL REPORT If none of the candida

- Page 12 and 13:

FINAL REPORT Divergent Viewpoints T

- Page 14 and 15:

FINAL REPORT Transition to Implemen

- Page 16 and 17:

FINAL REPORT 10: Priority Performan

- Page 18 and 19:

FINAL REPORT a considerable amount

- Page 20 and 21:

FINAL REPORT The plan consists of a

- Page 22 and 23:

FINAL REPORT Figure 2: The Lake Ont

- Page 24 and 25:

FINAL REPORT 2. Criteria and regula

- Page 26 and 27:

FINAL REPORT water level and flow d

- Page 28 and 29:

FINAL REPORT Independent Review Ind

- Page 30 and 31:

FINAL REPORT Coastal Processes The

- Page 32 and 33:

FINAL REPORT The current estimate o

- Page 34 and 35:

FINAL REPORT Table 2: Economic Perf

- Page 36 and 37:

FINAL REPORT • Shore protection m

- Page 38 and 39:

FINAL REPORT Abbreviations STELLA -

- Page 40 and 41:

FINAL REPORT Approach 2: Optimizati

- Page 42 and 43:

FINAL REPORT Evaluation and Screeni

- Page 44 and 45:

FINAL REPORT • All performance in

- Page 46 and 47:

FINAL REPORT 5. During the Seaway n

- Page 48 and 49:

FINAL REPORT The programmed Plan 19

- Page 50 and 51:

FINAL REPORT Other efforts showed t

- Page 52 and 53:

FINAL REPORT Plan E generally produ

- Page 54 and 55:

FINAL REPORT An early version of Pl

- Page 56 and 57:

FINAL REPORT Plan Evaluations and C

- Page 58 and 59:

FINAL REPORT Table 3: Differences i

- Page 60 and 61:

Lake Ontario FINAL REPORT Figure 13

- Page 62 and 63:

St. Lawrence River at Lac St. Louis

- Page 64 and 65:

FINAL REPORT Figures 29, 30, 32 and

- Page 66 and 67:

Discharge (m 3 /s) Discharge (tcfs)

- Page 68 and 69:

Level (m IGLD 1985) Level (ft. IGLD

- Page 70 and 71:

FINAL REPORT Economic Results All p

- Page 72 and 73:

FINAL REPORT Disproportionate Loss

- Page 74 and 75:

FINAL REPORT Table 7: Percent Damag

- Page 76 and 77:

FINAL REPORT Table 8: Environmental

- Page 78 and 79:

FINAL REPORT Beyond the Summary Num

- Page 80 and 81:

FINAL REPORT Figure 36: Net economi

- Page 82 and 83:

FINAL REPORT On Lake Ontario, lakeb

- Page 84 and 85:

FINAL REPORT Coastal damages occur

- Page 86 and 87:

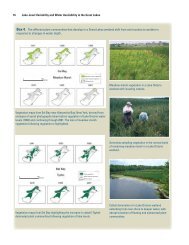

FINAL REPORT Figure 39: Wetland pla

- Page 88 and 89:

FINAL REPORT Sensitivity Analyses D

- Page 90 and 91:

FINAL REPORT Table 11: Summary of E

- Page 92 and 93:

FINAL REPORT Figure 43: Lake Ontari

- Page 94 and 95:

FINAL REPORT Climate Change Analysi

- Page 96 and 97:

FINAL REPORT Table 13: Summary of E

- Page 98 and 99:

FINAL REPORT Validation The Plan Fo

- Page 100 and 101:

FINAL REPORT Municipal and Industri

- Page 102 and 103:

FINAL REPORT Interest-specific shor

- Page 104 and 105:

FINAL REPORT Change the Criteria an

- Page 106 and 107:

FINAL REPORT Through the advocacy o

- Page 108 and 109:

FINAL REPORT 5. People living along

- Page 110 and 111:

FINAL REPORT The Study Board consid

- Page 112 and 113:

FINAL REPORT • Ecohydrology is th

- Page 114 and 115:

FINAL REPORT Institutional issues d

- Page 116 and 117:

FINAL REPORT Environmental Data and

- Page 118 and 119:

FINAL REPORT The point of access to

- Page 120 and 121:

FINAL REPORT Possible Changes in th

- Page 122 and 123:

FINAL REPORT 106 Options for Managi

- Page 124 and 125:

FINAL REPORT People and Organizatio

- Page 126 and 127:

FINAL REPORT Environmental Technica

- Page 128 and 129:

FINAL REPORT Common Data and Inform

- Page 130 and 131:

FINAL REPORT 114 Options for Managi

- Page 132 and 133:

FINAL REPORT BASIN; WATERSHED - The

- Page 134 and 135:

FINAL REPORT EROSION - The wearing

- Page 136 and 137:

FINAL REPORT INTEGRATED ECOLOGICAL

- Page 138 and 139:

FINAL REPORT PHYSIOGRAPHY - A descr

- Page 140 and 141:

FINAL REPORT TECHNICAL WORK GROUP (

- Page 142 and 143:

FINAL REPORT Pacific International

- Page 144 and 145:

FINAL REPORT Savage, C. Lake Ontari

- Page 146 and 147:

FINAL REPORT Doyon, B., et al. (200

- Page 148 and 149:

FINAL REPORT Planning and Managemen

- Page 150 and 151:

FINAL REPORT h. Information Managem

- Page 152 and 153:

FINAL REPORT 136 Options for Managi

- Page 154 and 155:

FINAL REPORT 138 Options for Managi

- Page 156 and 157:

FINAL REPORT 140 Options for Managi

- Page 158 and 159:

FINAL REPORT 142 Options for Managi

- Page 160 and 161:

FINAL REPORT 144 Options for Managi

- Page 162 and 163:

FINAL REPORT 146 Options for Managi

- Page 164:

ANNEXES Options for Managing Lake O

- Page 167 and 168:

ANNEXES Annex 3 - Plan Descriptions

- Page 170 and 171: ANNEX 1 Annex 1 Pertinent Documents

- Page 172 and 173: The Study Board shall provide optio

- Page 174 and 175: Pertinent Document 2 Plan of Study

- Page 176 and 177: trial regulation plans will need to

- Page 178 and 179: WHEREAS pursuant to the said Applic

- Page 180 and 181: (c) (d) (e) (f) (g) The works shall

- Page 182 and 183: (i) (j) (k) Under regulation, the f

- Page 184 and 185: (b) Control Facilities Adequate con

- Page 186 and 187: ANNEX 2 2 Annex2 Technical Work Gro

- Page 188 and 189: Hydrology, supplies Historical and

- Page 190 and 191: Performance Indicators As noted ear

- Page 192 and 193: Table A-2: Lower St. Lawrence River

- Page 194 and 195: Table A-3: Weighting Scheme for Eco

- Page 196 and 197: In the St. Lawrence River, high spr

- Page 198 and 199: References Armellin, A., Mingelbier

- Page 200 and 201: A. Environmental Contextual Narrati

- Page 202 and 203: types. Analyses of historical aeria

- Page 204 and 205: 9. References Listed in text Baedke

- Page 206 and 207: B. Recreational Boating and Tourism

- Page 208 and 209: In addition to recreational boating

- Page 210 and 211: Summary of Key Findings Based on it

- Page 212 and 213: ANNEX 2 Figure B-3: Alexandria Bay

- Page 214 and 215: Participants Recreational Boating a

- Page 216 and 217: Communities along New York waters v

- Page 218 and 219: On the Canadian side, a telephone s

- Page 222 and 223: The average horsepower of motor boa

- Page 224 and 225: Noden, D. and Brown, T. (1975) The

- Page 226 and 227: The Lower St. Lawrence River In com

- Page 228 and 229: Table C-1: Unit Costs for the Const

- Page 230 and 231: Beach Access The beach access perfo

- Page 232 and 233: Since the value of shore protection

- Page 234 and 235: ANNEX 2 Figure C-6: Map of percent

- Page 236 and 237: ANNEX 2 Figure C-8: Map of downstre

- Page 238 and 239: References Baird, W.F. and Associat

- Page 240 and 241: C. Coastal Processes Contextual Nar

- Page 242 and 243: Given the current land use policies

- Page 244 and 245: . In the case of the shore protecti

- Page 246 and 247: e. With the ever increasing urban d

- Page 248 and 249: 8. Risk Assessment/Sensitivity Anal

- Page 250 and 251: C. Coastal Processes Contextual Nar

- Page 252 and 253: This interest suffered badly during

- Page 254 and 255: 5. Key Trends Construction along ri

- Page 256 and 257: Finally, from a computational stand

- Page 258 and 259: D. Commercial Navigation Technical

- Page 260 and 261: More information on the socio-econo

- Page 262 and 263: Participants Commercial Navigation

- Page 264 and 265: . Number of stakeholders The St. La

- Page 266 and 267: g. Trade flows and current market c

- Page 268 and 269: Commercial navigation costs actuall

- Page 270 and 271:

5. Key Trends Provided below are hi

- Page 272 and 273:

Another adaptive measure to falling

- Page 274 and 275:

f. In Montreal, water levels impact

- Page 276 and 277:

U.S. Dollars ANNEX 2 Figure E-1: Sh

- Page 278 and 279:

Ice formation Ice cover stability i

- Page 280 and 281:

Hydroelectric Power Generation Tech

- Page 282 and 283:

Regionally, hydropower is seen main

- Page 284 and 285:

NYISO administers the Day Ahead Mar

- Page 286 and 287:

(b) The hydropower performance indi

- Page 288 and 289:

Synapse Energy Economics Inc. devel

- Page 290 and 291:

9. References The Hydroelectric Pow

- Page 292 and 293:

F. Municipal, Industrial and Domest

- Page 294 and 295:

Taste and odours performance indica

- Page 296 and 297:

Determining a critical elevation fo

- Page 298 and 299:

Water level in Pointe-Claire (m) Fi

- Page 300 and 301:

F. Municipal, Industrial and Domest

- Page 302 and 303:

7. Adaptive Behaviours The evaluati

- Page 304 and 305:

(d) History of the interest The Akw

- Page 306 and 307:

Under this project, the H&H TWG pro

- Page 308 and 309:

increases throughout the year. Mixi

- Page 310 and 311:

• build operational hydrology for

- Page 312 and 313:

Fan, Y. and Fay, D. (2001) Variatio

- Page 314 and 315:

I. Common Data Needs Technical Work

- Page 316 and 317:

Collection of detailed bathymetric

- Page 318 and 319:

• Metadata requirements Metadata

- Page 320 and 321:

FTP Support The first component of

- Page 322 and 323:

ANNEX 2 Figure J-3: Typical product

- Page 324 and 325:

ANNEX 3 Annex 3 Plan Descriptions a

- Page 326 and 327:

After discussions, the Plan Formula

- Page 328 and 329:

Table A-1: Constraints Applied to E

- Page 330 and 331:

Deviations The outflow calculated a

- Page 332 and 333:

The following list summarizes the a

- Page 334 and 335:

ANNEX 3 Figure B-3: Lake Ontario Av

- Page 336 and 337:

Lake Ontario level (m) 1.9 1.8 1.7

- Page 338 and 339:

ANNEX 3 Figure B-8: Cumulative Freq

- Page 340 and 341:

Total winter flow (10 m 3 /s - quar

- Page 342 and 343:

Plan 1958-DD - Appendix Detailed de

- Page 344 and 345:

SELECT CASE adjusted supply indicat

- Page 346 and 347:

If the Lake Ontario level is greate

- Page 348 and 349:

The inflow category (e.g., wet, dry

- Page 350 and 351:

Step 5 - Ice limit: Exactly the sam

- Page 352 and 353:

ANNEX 3 Figure B-18: Plan A + rule

- Page 354 and 355:

Other rules Plan B + has two additi

- Page 356 and 357:

Plan D + : Blended Benefits Objecti

- Page 358 and 359:

ANNEX 3 Figure B-19A: Lake Ontario

- Page 360 and 361:

ANNEX 3 Figure B-20: Lake Ontario s

- Page 362 and 363:

ANNEX 3 Figure B-21F: Long Sault Da

- Page 364 and 365:

Figure B-23 shows the three benefit

- Page 366 and 367:

Score Figure B-25: Score based on t

- Page 368 and 369:

Flow Constraints In addition to the

- Page 370 and 371:

This procedure is repeated until th

- Page 372 and 373:

Reference and Interest Specific Reg

- Page 374 and 375:

Plan 1958-D Regulation of Lake Onta

- Page 376 and 377:

4. The “I” limits, or ice limit

- Page 378 and 379:

Figure B-31 compares the scoring re

- Page 380 and 381:

Experimental variations In simpler

- Page 382 and 383:

C. Summary Tables of Plan Results T

- Page 384 and 385:

Historical Time Series (1900-2000)

- Page 386 and 387:

Environmental Results (Historical)

- Page 388 and 389:

Stochastic Supply Sequences Economi

- Page 390 and 391:

Table C-8: Economic results for can

- Page 392 and 393:

Table C-10: Economic results for ca

- Page 394 and 395:

Table C-12: Environmental results f

- Page 396 and 397:

Table C-14: Environmental results f

- Page 398 and 399:

Table C-16: Economic results for ca

- Page 400 and 401:

Table C-18: Economic results for ca

- Page 402 and 403:

ANNEX 4 Introduction Annex 4 Mitiga

- Page 404 and 405:

The great majority of potential act

- Page 406 and 407:

Great Lakes Advance Emergency Manag

- Page 408 and 409:

“(b) General Plan. (1) The Secret

- Page 410 and 411:

Adaptive Management Action Plan (AM

- Page 412 and 413:

difference in evaluations. If, for

- Page 414 and 415:

Coastal Monitoring Purpose: Monitor

- Page 416 and 417:

Adaptive Management Program Summary

- Page 418 and 419:

GLOSSARY OF TERMS ABIOTIC - Non-liv

- Page 420 and 421:

COASTAL EROSION - The wearing away

- Page 422 and 423:

EROSION - The wearing away of land

- Page 424 and 425:

HYDROLOGIC MODELING - The use of ph

- Page 426 and 427:

MEASURE, STRUCTURAL - Any measure t

- Page 428 and 429:

PUBLIC INFORMATION - Activities whe

- Page 430 and 431:

SUBSTRATE COMPOSITION - Categorical