Doing Business in the Netherlands 2012 - American Chamber of ...

Doing Business in the Netherlands 2012 - American Chamber of ...

Doing Business in the Netherlands 2012 - American Chamber of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18.9 Tax Incentives<br />

<strong>Do<strong>in</strong>g</strong> <strong>Bus<strong>in</strong>ess</strong> <strong>in</strong> <strong>the</strong> Ne<strong>the</strong>rlands <strong>2012</strong><br />

The follow<strong>in</strong>g measures provide tax relief to taxpayers:<br />

18.9.1 Investment Allowance<br />

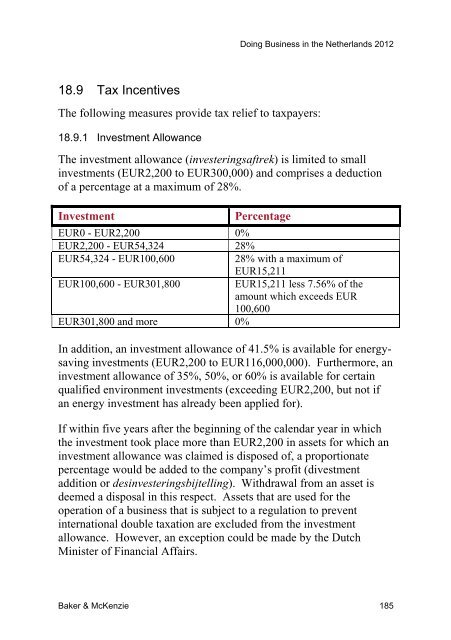

The <strong>in</strong>vestment allowance (<strong>in</strong>vester<strong>in</strong>gsaftrek) is limited to small<br />

<strong>in</strong>vestments (EUR2,200 to EUR300,000) and comprises a deduction<br />

<strong>of</strong> a percentage at a maximum <strong>of</strong> 28%.<br />

Investment Percentage<br />

EUR0 - EUR2,200 0%<br />

EUR2,200 - EUR54,324 28%<br />

EUR54,324 - EUR100,600 28% with a maximum <strong>of</strong><br />

EUR15,211<br />

EUR100,600 - EUR301,800 EUR15,211 less 7.56% <strong>of</strong> <strong>the</strong><br />

amount which exceeds EUR<br />

100,600<br />

EUR301,800 and more 0%<br />

In addition, an <strong>in</strong>vestment allowance <strong>of</strong> 41.5% is available for energysav<strong>in</strong>g<br />

<strong>in</strong>vestments (EUR2,200 to EUR116,000,000). Fur<strong>the</strong>rmore, an<br />

<strong>in</strong>vestment allowance <strong>of</strong> 35%, 50%, or 60% is available for certa<strong>in</strong><br />

qualified environment <strong>in</strong>vestments (exceed<strong>in</strong>g EUR2,200, but not if<br />

an energy <strong>in</strong>vestment has already been applied for).<br />

If with<strong>in</strong> five years after <strong>the</strong> beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> <strong>the</strong> calendar year <strong>in</strong> which<br />

<strong>the</strong> <strong>in</strong>vestment took place more than EUR2,200 <strong>in</strong> assets for which an<br />

<strong>in</strong>vestment allowance was claimed is disposed <strong>of</strong>, a proportionate<br />

percentage would be added to <strong>the</strong> company’s pr<strong>of</strong>it (divestment<br />

addition or des<strong>in</strong>vester<strong>in</strong>gsbijtell<strong>in</strong>g). Withdrawal from an asset is<br />

deemed a disposal <strong>in</strong> this respect. Assets that are used for <strong>the</strong><br />

operation <strong>of</strong> a bus<strong>in</strong>ess that is subject to a regulation to prevent<br />

<strong>in</strong>ternational double taxation are excluded from <strong>the</strong> <strong>in</strong>vestment<br />

allowance. However, an exception could be made by <strong>the</strong> Dutch<br />

M<strong>in</strong>ister <strong>of</strong> F<strong>in</strong>ancial Affairs.<br />

Baker & McKenzie 185

![912.025 AmCham News [1] - American Chamber of Commerce in ...](https://img.yumpu.com/9328612/1/190x127/912025-amcham-news-1-american-chamber-of-commerce-in-.jpg?quality=85)