í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

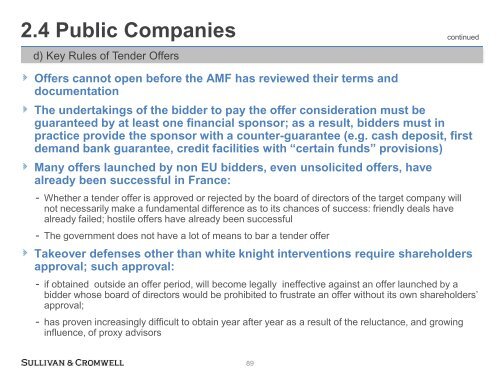

2.4 Public Companies<br />

continued<br />

d) Key Rules of Tender Offers<br />

Offers cannot open before the AMF has reviewed their terms and<br />

documentation<br />

The undertakings of the bidder to pay the offer consideration must be<br />

guaranteed by at least one financial sponsor; as a result, bidders must in<br />

practice provide the sponsor with a counter-guarantee (e.g. cash deposit, first<br />

demand bank guarantee, credit facilities with “certain funds” provisions)<br />

Many offers launched by non EU bidders, even unsolicited offers, have<br />

already been successful in France:<br />

- Whether a tender offer is approved or rejected by the board of directors of the target company will<br />

not necessarily make a fundamental difference as to its chances of success: friendly deals have<br />

already failed; hostile offers have already been successful<br />

- The government does not have a lot of means to bar a tender offer<br />

Takeover defenses other than white knight interventions require shareholders<br />

approval; such approval:<br />

- if obtained outside an offer period, will become legally ineffective against an offer launched by a<br />

bidder whose board of directors would be prohibited to frustrate an offer without its own shareholders‘<br />

approval;<br />

- has proven increasingly difficult to obtain year after year as a result of the reluctance, and growing<br />

influence, of proxy advisors<br />

89