í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

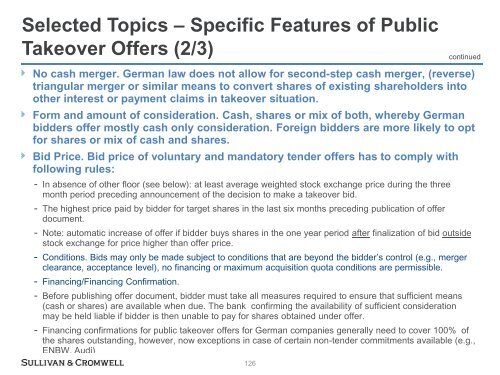

Selected Topics – Specific Features of Public<br />

Takeover Offers (2/3)<br />

continued<br />

No cash merger. German law does not allow for second-step cash merger, (reverse)<br />

triangular merger or similar means to convert shares of existing shareholders into<br />

other interest or payment claims in takeover situation.<br />

Form and amount of consideration. Cash, shares or mix of both, whereby German<br />

bidders offer mostly cash only consideration. Foreign bidders are more likely to opt<br />

for shares or mix of cash and shares.<br />

Bid Price. Bid price of voluntary and mandatory tender offers has to comply with<br />

following rules:<br />

- In absence of other floor (see below): at least average weighted stock exchange price during the three<br />

month period preceding announcement of the decision to make a takeover bid.<br />

- The highest price paid by bidder for target shares in the last six months preceding publication of offer<br />

document.<br />

- Note: automatic increase of offer if bidder buys shares in the one year period after finalization of bid outside<br />

stock exchange for price higher than offer price.<br />

- Conditions. Bids may only be made subject to conditions that are beyond the bidder‘s control (e.g., merger<br />

clearance, acceptance level), no financing or maximum acquisition quota conditions are permissible.<br />

- Financing/Financing Confirmation.<br />

- Before publishing offer document, bidder must take all measures required to ensure that sufficient means<br />

(cash or shares) are available when due. The bank confirming the availability of sufficient consideration<br />

may be held liable if bidder is then unable to pay for shares obtained under offer.<br />

- Financing confirmations for public takeover offers for German companies generally need to cover 100% of<br />

the shares outstanding, however, now exceptions in case of certain non-tender commitments available (e.g.,<br />

ENBW, Audi)<br />

126