í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

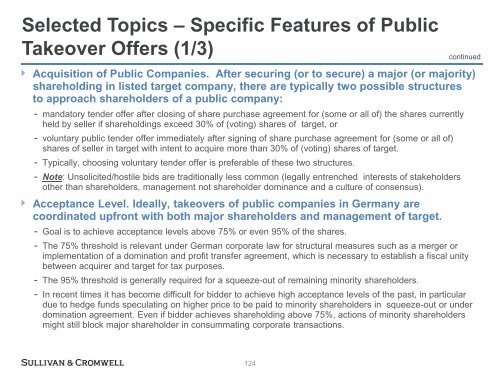

Selected Topics – Specific Features of Public<br />

Takeover Offers (1/3)<br />

continued<br />

Acquisition of Public Companies. After securing (or to secure) a major (or majority)<br />

shareholding in listed target company, there are typically two possible structures<br />

to approach shareholders of a public company:<br />

- mandatory tender offer after closing of share purchase agreement for (some or all of) the shares currently<br />

held by seller if shareholdings exceed 30% of (voting) shares of target, or<br />

- voluntary public tender offer immediately after signing of share purchase agreement for (some or all of)<br />

shares of seller in target with intent to acquire more than 30% of (voting) shares of target.<br />

- Typically, choosing voluntary tender offer is preferable of these two structures.<br />

- Note: Unsolicited/hostile bids are traditionally less common (legally entrenched interests of stakeholders<br />

other than shareholders, management not shareholder dominance and a culture of consensus).<br />

Acceptance Level. Ideally, takeovers of public companies in Germany are<br />

coordinated upfront with both major shareholders and management of target.<br />

- Goal is to achieve acceptance levels above 75% or even 95% of the shares.<br />

- The 75% threshold is relevant under German corporate law for structural measures such as a merger or<br />

implementation of a domination and profit transfer agreement, which is necessary to establish a fiscal unity<br />

between acquirer and target for tax purposes.<br />

- The 95% threshold is generally required for a squeeze-out of remaining minority shareholders.<br />

- In recent times it has become difficult for bidder to achieve high acceptance levels of the past, in particular<br />

due to hedge funds speculating on higher price to be paid to minority shareholders in squeeze-out or under<br />

domination agreement. Even if bidder achieves shareholding above 75%, actions of minority shareholders<br />

might still block major shareholder in consummating corporate transactions.<br />

124