í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

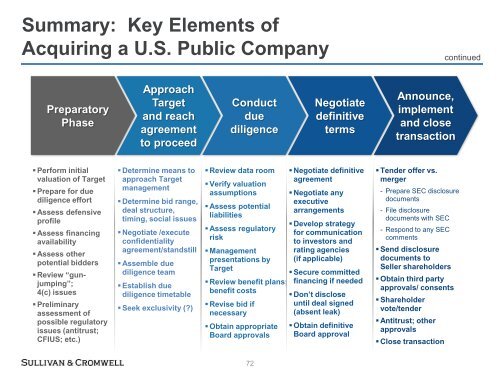

Summary: Key Elements of<br />

Acquiring a U.S. Public Company<br />

continued<br />

Preparatory<br />

Phase<br />

Approach<br />

Target<br />

and reach<br />

agreement<br />

to proceed<br />

Conduct<br />

due<br />

diligence<br />

Negotiate<br />

definitive<br />

terms<br />

Announce,<br />

implement<br />

and close<br />

transaction<br />

• Perform initial<br />

valuation of Target<br />

• Prepare for due<br />

diligence effort<br />

• Assess defensive<br />

profile<br />

• Assess financing<br />

availability<br />

• Assess other<br />

potential bidders<br />

• Review ―gunjumping‖;<br />

4(c) issues<br />

• Preliminary<br />

assessment of<br />

possible regulatory<br />

issues (antitrust;<br />

CFIUS; etc.)<br />

• Determine means to<br />

approach Target<br />

management<br />

• Determine bid range,<br />

deal structure,<br />

timing, social issues<br />

• Negotiate /execute<br />

confidentiality<br />

agreement/standstill<br />

• Assemble due<br />

diligence team<br />

• Establish due<br />

diligence timetable<br />

• Seek exclusivity (?)<br />

• Review data room<br />

• Verify valuation<br />

assumptions<br />

• Assess potential<br />

liabilities<br />

• Assess regulatory<br />

risk<br />

• Management<br />

presentations by<br />

Target<br />

• Review benefit plans;<br />

benefit costs<br />

• Revise bid if<br />

necessary<br />

• Obtain appropriate<br />

Board approvals<br />

• Negotiate definitive<br />

agreement<br />

• Negotiate any<br />

executive<br />

arrangements<br />

• Develop strategy<br />

for communication<br />

to investors and<br />

rating agencies<br />

(if applicable)<br />

• Secure committed<br />

financing if needed<br />

• Don‘t disclose<br />

until deal signed<br />

(absent leak)<br />

• Obtain definitive<br />

Board approval<br />

• Tender offer vs.<br />

merger<br />

- Prepare SEC disclosure<br />

documents<br />

- File disclosure<br />

documents with SEC<br />

- Respond to any SEC<br />

comments<br />

• Send disclosure<br />

documents to<br />

Seller shareholders<br />

• Obtain third party<br />

approvals/ consents<br />

• Shareholder<br />

vote/tender<br />

• Antitrust; other<br />

approvals<br />

• Close transaction<br />

72